The US dollar is lower against the major pairs after the political uncertainty in Washington and mixed economic fundamentals took their toll on the greenback. The first week of August will be full of economic releases with major central banks on the agenda as well as the week wrapping up with the biggest economic indicator in the market, the United States Non-farm payrolls report.

The Reserve Bank of Australia (RBA) will release their August rate statement on Tuesday, August 1 at 12:30 am EDT. The cash rate is not expected to change despite the AUD trading at two year highs versus the USD and RBA policy makers arguing for a lower Aussie.

The Bank of England will host another Super Thursday on August 3 at 7:00 am EDT with the release of the Quarterly Inflation Report, the Monetary Policy Summary, and Minutes of the meeting. The rate is expected to remain unchanged despite the narrow vote in June. The rate setting committee is mixed on when to hike rates but the exit of a prominent hawk has pushed back the timing.

US employment has been the biggest driver in the economic recovery narrative and could be called once again to spark USD strength. Jobs week kicks off on Wednesday, August 2 with the publication of the ADP nonfarm employment report at 8:15 am EDT. Unemployment claims will be released on Thursday, August 3 at 8:30 am EDT and the week will close with the NonFarm Payrolls report on Friday, August 4 at 8:30 am EDT. Job gains are forecasted to be above 180,000 and wages could gain 0.3 percent pushing the unemployment rate down to 4.3 percent.

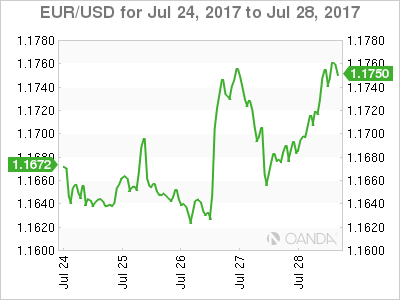

The EUR/USD gained 0.716 percent in the last five days. The single currency is trading at 1.1761 as the US dollar has weakened following a period of political uncertainty in Washington as well as economic growth meeting but not exceeding expectations after the release of the first estimate of gross domestic product (GDP) for the second quarter.

The highlights of the week were the Federal Open Market Committee (FOMC) rate statement and the US GDP first estimate for the second quarter. Both were more dovish than expected. The Fed did as expected by not raising rates and keeping the balance sheet timing in plain view without talking about actual dates but the downgrade on inflation could mean a more patient approach to rate hikes going forward. That decision to remove the “somewhat” language is the Fed admitting inflation is running below its 2 percent target.

The GDP release met expectations with a 2.6 percent gain. The first estimate will be followed by two more revisions, but this one is the one that has the most impact as it sets the basis for Fed forecasts. The euro gained more from the softness of the dollar rather than by improving conditions in the EU. This week the mix of political and fundamental releases did not make the case for a strong dollar. The USD will look ahead to employment data, where once again inflationary data in the form of wage growth will be heavily anticipated.

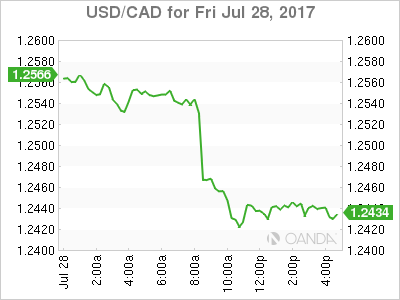

The USD/CAD lost 0.734 percent in the last 24 hours. The currency is trading at 1.2446 after a strong monthly GDP figure in Canada boosting the loony ahead of the dollar. The US GDP released at the same time met the forecast but the lack of wage growth is putting more pressure on the Fed to rethink its third interest rate hike of the year. The Federal Reserve has already raised interest rates twice in 2017 and is expected to begin shrinking the balance sheet it accumulated from its QE program in the fall.

Political uncertainty has sapped the momentum out of the USD. The rally at the beginning of the year is gone after the debacle that has been the attempts to pass healthcare reform. The Trump administration is now focusing on tax reform, but it remains to be seen if they have the political capital left after a very contentious period to repeal Obamacare.

Pro-growth policies were also one of the factors behind the dollar rally earlier in the year, but as they got reprioritized that shift also hurt the greenback against majors. A back to basics approach with tax reform learning the lessons from the failure to pass healthcare policies could end up boosting the dollar before the end of the year.

The loonie continues to gain versus the dollar in a rally that started when the Bank of Canada policy makers made hawkish comments back in June and compounding rhetoric changed market expectations on Canadian monetary policy. The BoC hiked interest rates in July and given the pace of growth could do so again in October. Another 25 basis points would bring the Canadian interest rate to 1 percent, where it sat prior to the 2015 cuts and a significant drop in oil prices.

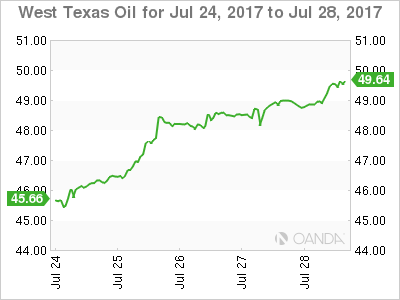

The price of energy gained 1.242 percent on Friday. West Texas Intermediate is trading at $49.48 as the price of crude continues to rise. Bigger than expected drawdowns for the past three weeks and comments from US producers hinting at less output has driven prices higher. The OPEC and other major producers had so far limited output but with the US, Brazil and Canada out of the agreement the global supply glut was not being drained fast enough.

Citing a cutback in capital expenditure US operations will take a step back. At the same time Saudi Arabia has said that it will cut its production further and warned members of the production cut agreement that compliance will be more stringent to make sure stability returns to oil prices.

Oil has gained 8.41 percent in the last five days as the US dollar retreat has also made crude more expensive. Large financial institutions have cut forecasts for this year to a range around $60 per barrel. The two month high that WTI is currently sitting in is a good start, but not enough to convince investors the levels are sustainable. The biggest risk to oil prices remains the continued support from OPEC and other major producers. Infighting inside the OPEC could escalate and tear the organization apart as Saudi Arabia and Iran could take their ideological disputes a step further.

Market events to watch this week:

Tuesday, August 1

12:30 am AUD Cash Rate

12:30 am AUD RBA Rate Statement

4:30 am GBP Manufacturing PMI

10:00 am USD ISM Manufacturing PMI

6:45 pm NZD Employment Change q/q

Wednesday, August 2

4:30 am GBP Construction PMI

8:15 am USD ADP Non-Farm Employment Change

10:30 am USD Crude Oil Inventories

9:30pm AUD Trade Balance

Thursday, August 3

4:30 am GBP Services PMI

7:00 am GBP BOE Inflation Report

7:00 am GBP MPC Official Bank Rate Votes

7:00 am GBP Monetary Policy Summary

7:00 am GBP Official Bank Rate

7:30 am GBP BOE Gov Carney Speaks

8:30 am USD Unemployment Claims

10:00 am USD ISM Non-Manufacturing PMI

9:30 pm AUD RBA Monetary Policy Statement

9:30 pm AUD Retail Sales m/m

Friday, August 4

8:30 am CAD Employment Change

8:30 am CAD Trade Balance

8:30 am USD Average Hourly Earnings m/m

8:30 am USD Non-Farm Employment Change