I’ve been thinking that at some point in the future I want to buy the snot out of pot stocks.

Did I say in the future?

Let me explain by taking you back to the 2000’s.

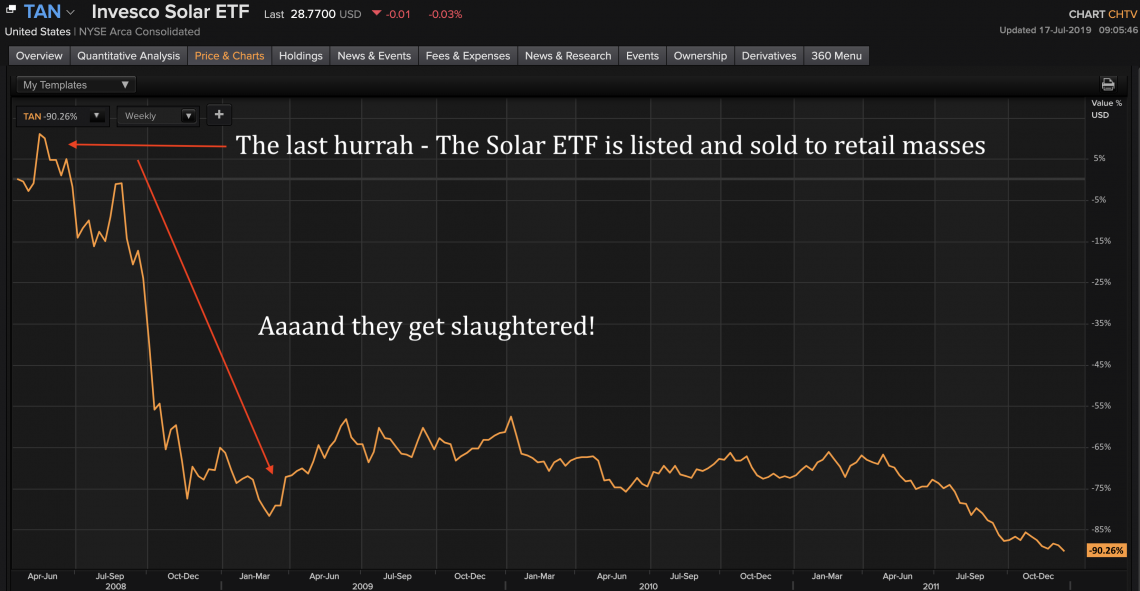

Remember the mid 2000’s? Nokia (HE:NOKIA) was still “the bomb”, wearing bandanas was cool, and alternative energy was “en fuego”. Solar, wind, you name it. 2008 was the peak. It was also when the solar ETF (NYSE:TAN) was launched.

Remember, investment bankers sell product, and they’ll sell what the market wants.

And so they packaged up solar into an ETF and sold it. Not their fault the companies in that particular package were unprofitable cash incinerating and overhyped.

Fast forward to today and we’re down around 80% from the highs. The companies left in this ETF (about 90% in the entire sector went bankrupt) now make money while they were all unprofitable in 2008. And you know what? Nobody cares. Weird, huh?

One of the things that’s happening in the solar space is that the Pareto distribution is taking hold.

Those who were fit enough to stay alive now command the greatest market share. In the speculative boom most were garbage and almost none of them ever made money.

As always happens, it ended and debt holders became equity holders, equity holders got wiped out, and all that capex invested ultimately got sold for cents on the dollar.

In short, the new winners in the solar energy space have now been forged on the anvil of market discipline.

The reason I point to solar is because I think today we’re in the same place solar was in 2008 for pot stocks.

I’ve mentioned Tilray (NASDAQ:TLRY) before as it’s one of the most egregious examples of completely crazy valuations and a sign of investors having lost their minds.

But to top it off, the other day the funniest thing happened.

I was chatting with my buddy (more on that shortly below) when I received a message from a publisher who is interested in working as an affiliate for our research publications.

He lamented the fact that I had “almost nothing that his readers would get excited about”. And I quote, “If you could promote a pot stock for me, I could sell it all day long.“

I laughed so hard I think my breath went into labor.

That, of course, will be the day, but rest assured we do intend to buy pot stocks. But when we do, nobody will want to go anywhere near them. They’ll be selling at less than book, paying healthy dividends, and the market leaders will be emerging having been forged on that same anvil of market discipline.

But for now we’re a long ways of that. Which brings me to my buddy I mentioned above.

Below are Kuppy’s latest thoughts on the topic. An article he was penning while we chatted and laughed heartily at the absurdity of it all.

These Shareholders Must All Be Stoned…

I have watched the publicly traded Canadian cannabis sector in stunned awe for the past few years. I really cannot think of a worse place to be invested. You have the basic economics of growing celery, with all the government regulation of an HMO, complete with the regulatory risk of manufacturing pharmaceuticals, with a two-tier system of legal and illegal producers—where legal prices are dramatically more expensive, with hundreds of entrants, funded with billions in equity capital who don’t care about near-term economics, all locked in a vicious price war, focused on gaining marketing share. If it sounds like an insane place to invest—that’s because it is—particularly as demand is stagnating. You’d have to be stoned out of your mind, to want to own any of these companies.

I’m willing to admit that early entrants made fortunes as they navigated Byzantine legal structures and capitalized on the initial gold rush phase. However, the boom is rapidly collapsing. Let’s face it, cannabis is a commodity product, it is priced based on supply and demand. With a lag, you can build endless production facilities and produce unlimited quantities of cannabis. It’s called “weed” for a reason. When this happens, what do you think happens to pricing? This is why, despite billions in subsidies, there aren’t many rich farmers. Agriculture is a terrible business.

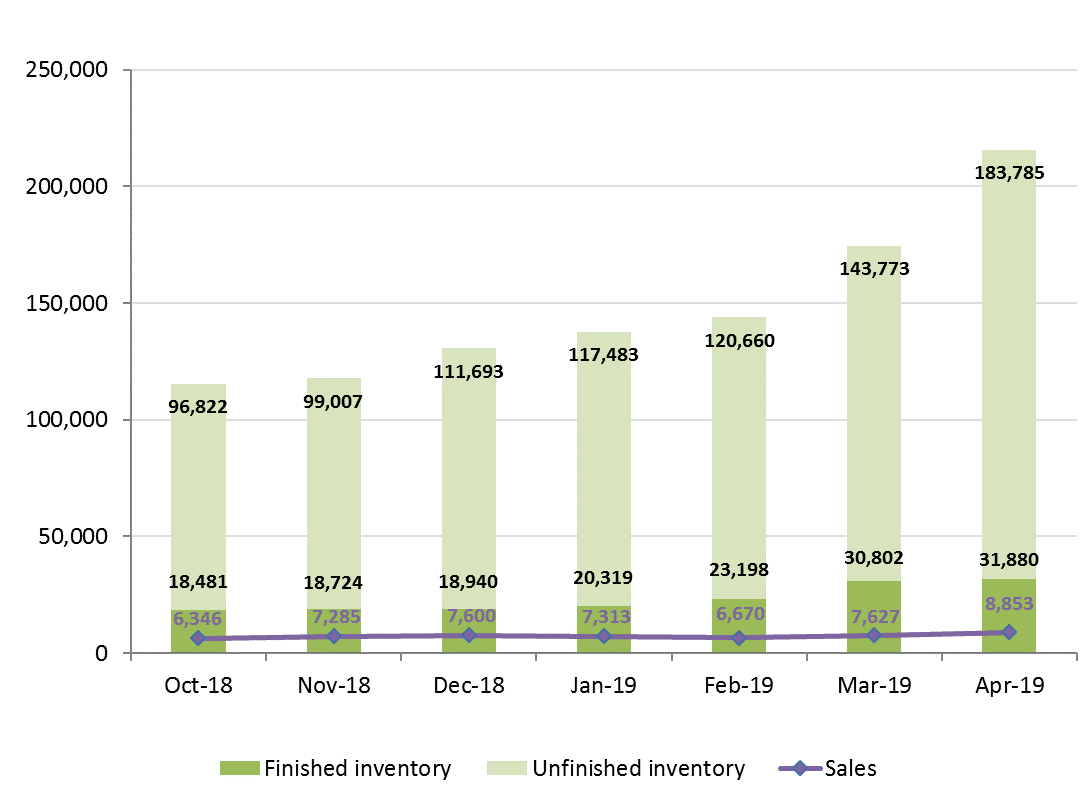

Total Inventory and Sales – Dried Cannabis (kilograms)

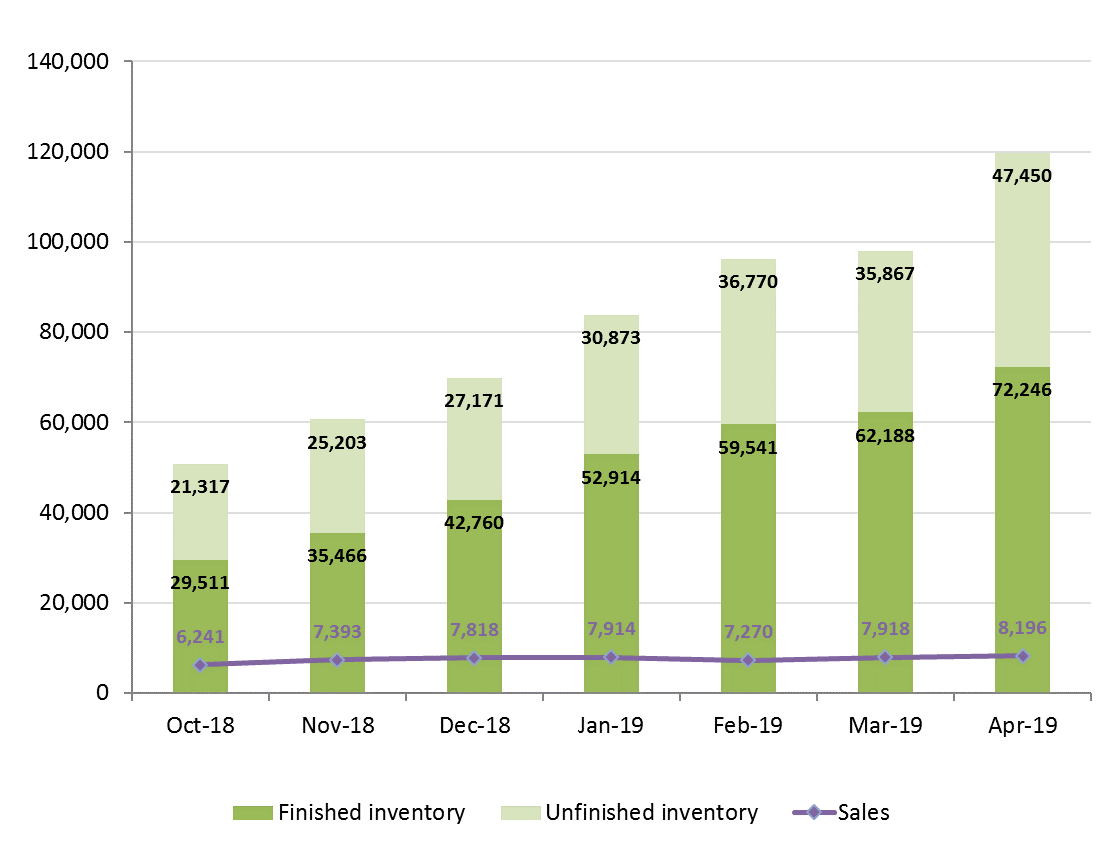

Total Inventories and Sales – Cannabis Oil (Liters)

Above are some charts from Health Canada. As you can see, recreational legalization has done little for overall demand as most “recreational demand” was previously considered “medical demand” and it was easy to get a doctor to prescribe cannabis. Meanwhile, supply is growing dramatically faster. In fact, there are now 24 months of supply of dried cannabis and 15 months of supply of cannabis oil. This is while every publicly traded cannabis company is talking about dramatically increasing production.

As we have learned with every commodity product from; solar panels to rare earths to lithium to vanadium to bandwidth capacity to shale oil to natural gas, when supply swamps demand, pricing deteriorates, fixed costs stay constant and operating losses explode. Cannabis is no different—except the valuations are even nuttier and most producers are flush with cash, focused on ramping production and gaining market share. Did I mention how nutty the valuations are?

Now, I know the counterpoint here;

“Kuppy, they’re building brands. The barley and hops in a beer are worth less than the aluminum can. If you have a brand, you no longer have a commodity product.”

I’m not going to dispute that fact. However, thousands of beer brands co-exist, while only a few leaders actually make much money at it. The difference is that most of the cannabis companies are losing money during the peak margin phase as they’re all equity funded and focused on market share—not profits. When pricing inevitably collapses, the operating losses will astound people. Even worse, the legal sector is fighting against a black market that has dramatically cheaper product. Besides, most consumers are not branded consumers—yet. That part will come, but much later. After the shake-out, winners can be chosen. By that point, these companies will trade at fractions of current valuations.

What is happening in Canada will happen one by one to the individual US states. A weed will always out-grow its demand if you throw unlimited capital at it. The idea that you can dump excess product from one place to another is silly because the current patchwork of laws was created to protect local producers and jobs—meanwhile black-market players will continue to arbitrage cheap supply into protected demand regions and undercut legal producers. That said, I feel that we are a year or three too early to talk about the collapse in US cannabis companies. That will come—don’t worry. For now, I’m focused on Canadian names.

I have been wanting to write this article for some time, but the timing didn’t feel right. There were too many people chasing cannabis and too few stocks to play. Now, the capital markets have done what they always do—separate idiots from their money. There are hundreds of these things. Most won’t make it. Even the winners will likely see their share prices collapse. I wanted to see cannabis supply swamp demand. I wanted to see revenues start to comp negative, even though volumes were still increasing. I think we’ll see all of these in Q3 or at worst Q4. Most importantly, I wanted to see the charts break. I don’t short much, but I sometimes buy puts. Calling tops is hard. Shorting unprofitable businesses with high debt levels, after the charts have “broken,” is easier. These charts look “broken” to me. I am no great chartist, so I’m going to call this the “head and shoulders; about to collapse” pattern. Yea, I invented that (deal with it). There has been a lot of volatility in the sector before, but never before has it occurred while fundamentals were also rolling over. I think this is the real deal.

In the end, I’m an economic historian. Every new sector always has a similar arc of revenue growth, market share gains, un-profitability, collapse, bankruptcy and consolidation. Cannabis will follow a similar arc. We’re at the cusp of the collapse phase. In a few years, maybe we can pick through the wreckage and find a few winners to own for the recovery phase. Until then, I own a collection of puts, put spreads and even some ITM calls I sold on a basket of these companies. Please don’t ask me which ones. I purposely didn’t name names. Just assume that if it’s Canadian, liquid, has liquid options, is unprofitable and has high debt, it’s probably in my basket. (Besides, I need some Ponzi-Sector shorts as this whole thing is about to blow…)