- Fed rate-cut speculators rest hopes on US inflation data

- After dovish BoE, pound traders turn to UK job numbers

- Will a strong labor market convince the RBA to hike?

- More Chinese data on tap amid signs of slow Q2 start

Spotlight turns to US CPI numbers

At last week’s meeting, the Fed appeared less hawkish than expected, with Chair Powell ruling out rate hikes and hinting that they are still leaning towards cuts. The softer-than-expected jobs report for April corroborated that view, which was echoed by more policymakers this week.

The only official expressing a different view was Minneapolis Fed President Neel Kashkari, who said that interest rates may need to stay at current levels all year and that the bar for a rate hike, although quite high, is not infinite.

With all that in mind, next week, traders will turn their attention to the US CPIs for April, due out on Wednesday. According to the S&P Global PMIs, output prices increased again at a solid but slower pace during April compared to March, suggesting that the risks surrounding Wednesday’s numbers may be titled somewhat to the downside. On top of that, the y/y change in oil prices declined and got closer to zero, which adds to the downside risks of the headline rate.

Therefore, if the data suggests that the latest stickiness in consumer prices was just temporary and that inflation has started to cool again, traders may lower their implied path a bit more, which could thereby prove negative for Treasury yields and the US dollar.

That said, market participants may get an earlier glimpse of where inflation headed in April on Tuesday, when the PPIs for the month are scheduled to be released. The US retail sales are also coming out at the same time as the CPI numbers, and they could also impact the market’s perspective on where the Fed may be headed.

Will UK jobs data seal the deal for a summer BoE cut?The Bank of England (BoE) appeared more dovish than expected yesterday, leaving interest rates unchanged but with two members voting for a 25bps cut. In the statement accompanying the decision there was an addition saying that they will consider forthcoming data releases and how these inform the assessment that the risks from inflation are receding.

Combined with the downward revisions in the inflation projections, this suggested that officials believe inflation will continue softening. The pound slid somewhat at the time of the release as investors became more convinced that the first 25bps reduction will be delivered in August.

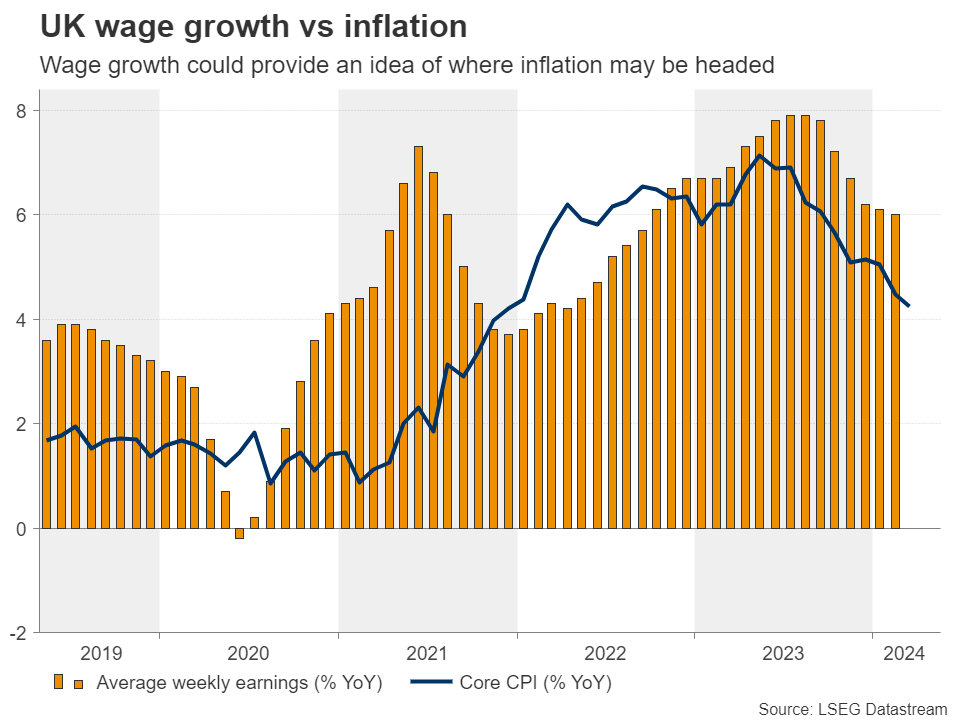

On Tuesday, the UK releases employment data for March, where investors may pay extra attention to wage growth to see whether it further softened, something that may allow inflation to slow as the Bank has projected. Thus, if wages decelerate, the pound may extend its BoE-related slide as traders may start examining whether a June cut is a better option.

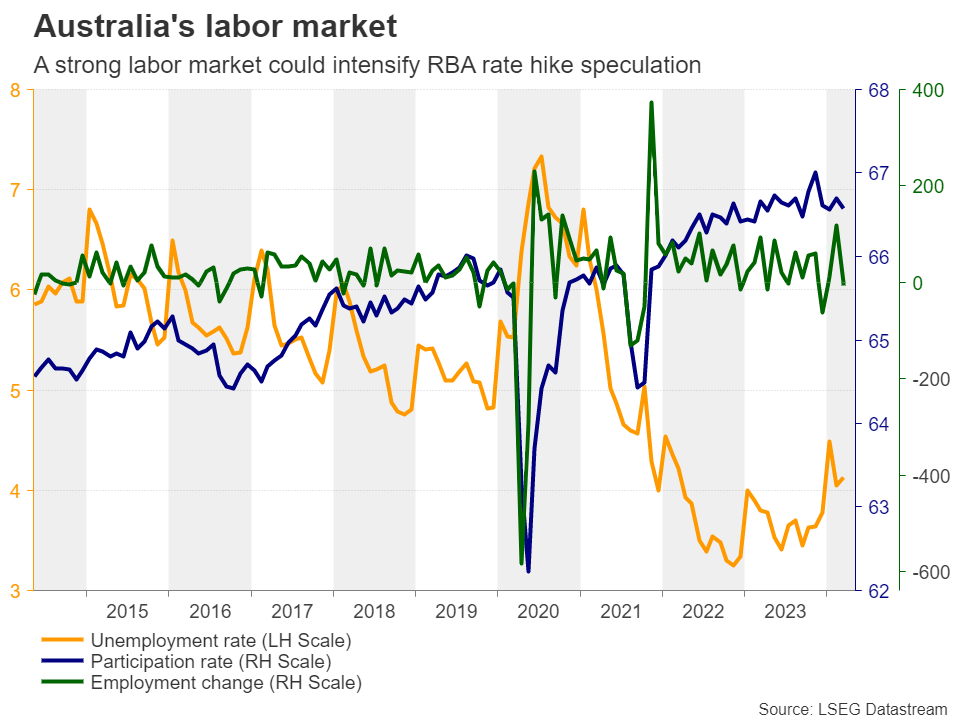

Aussie may benefit from increasing RBA hike betsAfter being disappointed by the RBA’s decision to maintain a neutral stance, aussie traders will now turn their gaze to Australia’s wage price index on Wednesday and the nation’s employment report on Thursday.

With inflation proving stickier than expected in Q1, they are not expecting rate cuts by the RBA anymore. On the contrary, they are assigning a decent 20% chance for a quarter-point hike by September.

Although the Bank reiterated that they “not ruling anything in or out” at this week’s decision, further acceleration in wages, which have been trending north since Q3 2020 and a strong rebound in employment could well enhance the probability for a September hike at a time when other central banks are thinking when to start lowering rates. This could prove positive for the aussie, which may also benefit from further improvement in risk appetite if the US inflation data on Wednesday encourage investors to add to their Fed rate cut bets.

How did the Chinese economy begin Q2?Speaking about the aussie and the broader market sentiment, another variable in this equation next week will be China. On Friday, the world’s second-largest economy will release its industrial production, retail sales, and fixed asset investment data for April.

The nation’s official PMIs showed that growth slowed in both the manufacturing and services sectors, suggesting that activity cooled at the start of the second quarter after sizable gains in March. However, China’s exports and imports grew in April after contracting in March, pointing to improving domestic and overseas demand.

Having said all that, even though a solid GDP growth for Q1 lowered the need for Chinese policymakers to urgently ramp up stimulus measures, if next week’s data adds to the notion of a slow start of Q2, concerns about the stability of the economic recovery may resurface. This may weigh on the aussie and kiwi, with the former giving back some of any employment-related gains.

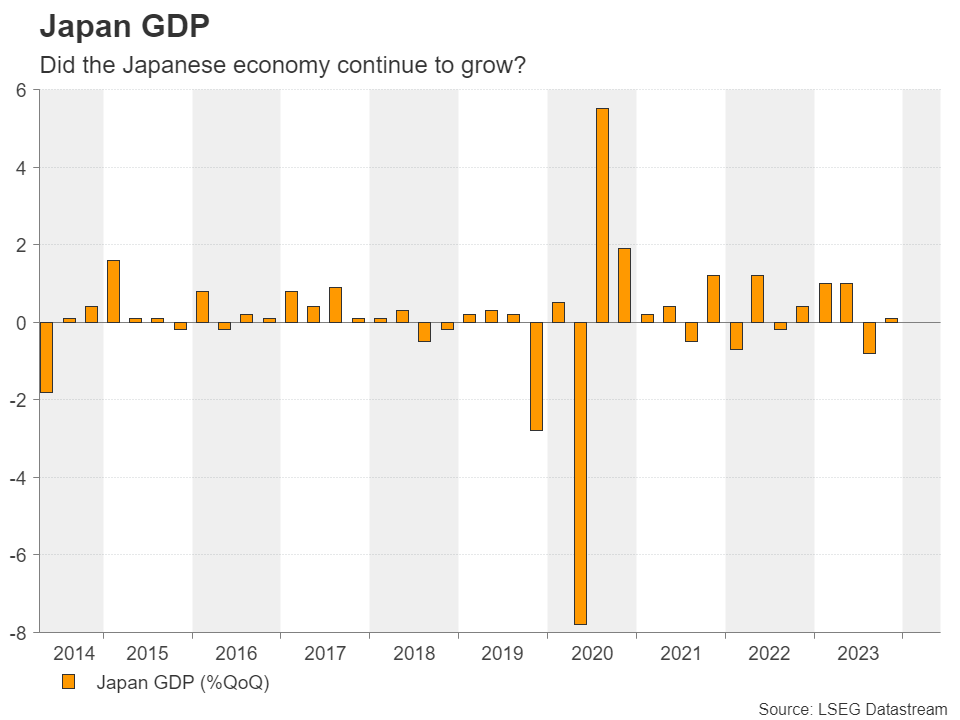

Japan’s GDP also on tapOn Thursday, during the Asian morning, Japan will publish the first estimate of its GDP for Q1, and it will be interesting to see whether the economy remained in growth or whether it slipped back into contraction. If the latter is the case, the yen is likely to continue falling and get closer to the 160-per-dollar zone that triggered last week’s first round of intervention.

Nonetheless, even if Japanese authorities step in again near that zone, a trend reversal would still be unlikely as another quarter of contraction could raise speculation that the next hike by the BoJ would be delayed even more. For the yen to stage a decent recovery, GDP data may need to reveal accelerating growth, encouraging market participants to ramp up their summer hike bets.