After a barrage of US data hurt the dollar this week, with investors having second thoughts as to whether another Fed hike may be needed, the US agenda will become lighter next week with the spotlight turning to the ISM non-manufacturing PMI. Elsewhere, the RBA and the BoC are holding their interest rate decisions, kick-starting a round of pivotal meetings by major central banks, which could well impact forthcoming directions of major currency pairs.

Light US agenda, focus on ISM non-mfg PMI

The US dollar pulled back this week as several US data forced investors to reconsider the likelihood of another hike by the Fed before the end credits of this tightening crusade roll, and to add more basis points worth of rate cuts for next year.

Just after Fed Chair Powell kept the prospect of more rate increases alive at Jackson Hole, investors lifted slightly their implied path, but on Tuesday, job openings for July hit their lowest since March 2021 and consumer sentiment for August deteriorated, while on Wednesday, the ADP employment report revealed that the US private sector added less jobs than expected during August.

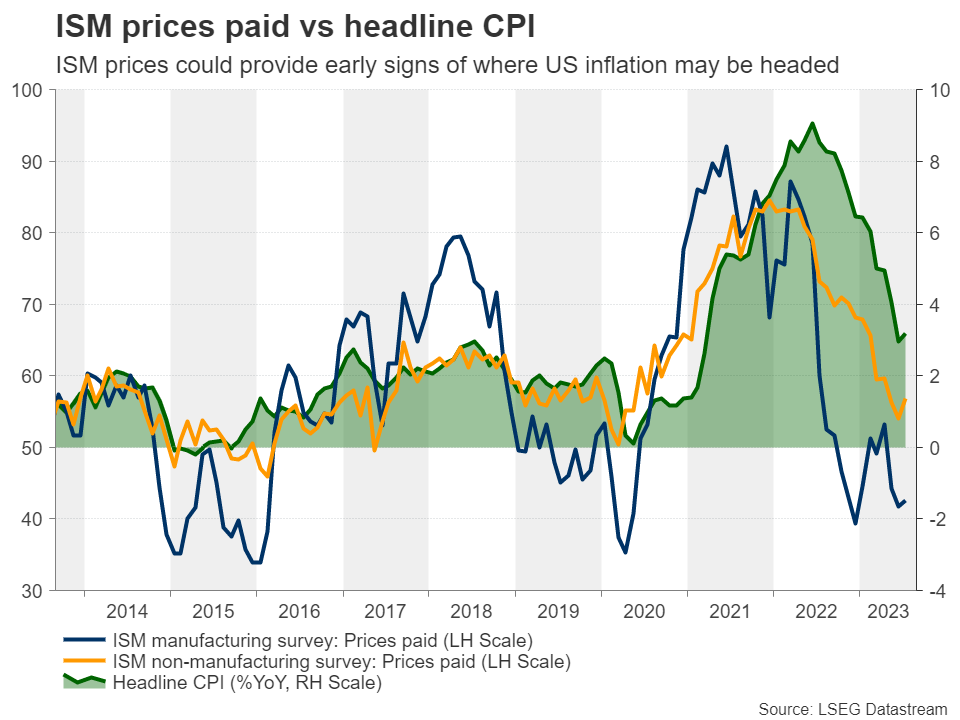

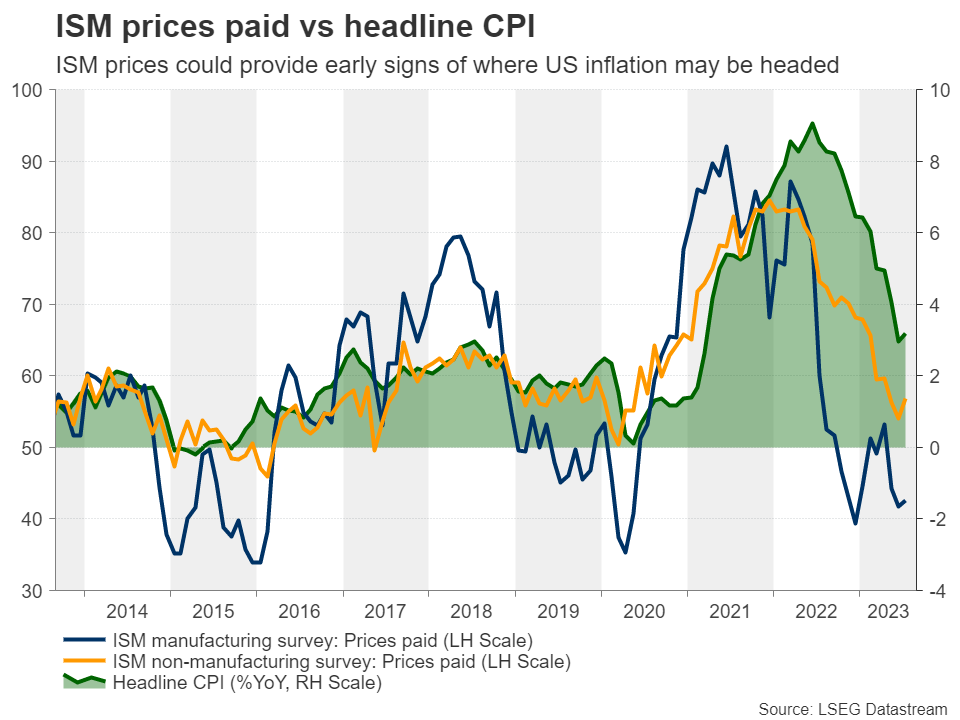

Investors had second thoughts after the data and currently, they are evenly split on whether another hike by November is warranted. The US agenda will be light in the coming week, with Monday being a holiday due to Labor Day, but there is a data point that could well impact expectations regarding the Fed’s plans, and this is the ISM non-manufacturing PMI on Wednesday.

The preliminary manufacturing and services PMIs from S&P Global both confounded market expectations of largely unchanged points and instead declined in August. With that in mind, the risks surrounding the ISM index may be tilted to the downside. That said, whether the probability of another Fed hike will further decline may also depend on the new orders and prices subindices. If there are declines there as well, the dollar and Treasury yields could stay under pressure and equities may continue drifting higher as expectations of lower interest rates could keep the net present value (NPV) of high-growth firms elevated.

Aussie awaits RBA and Chinese data

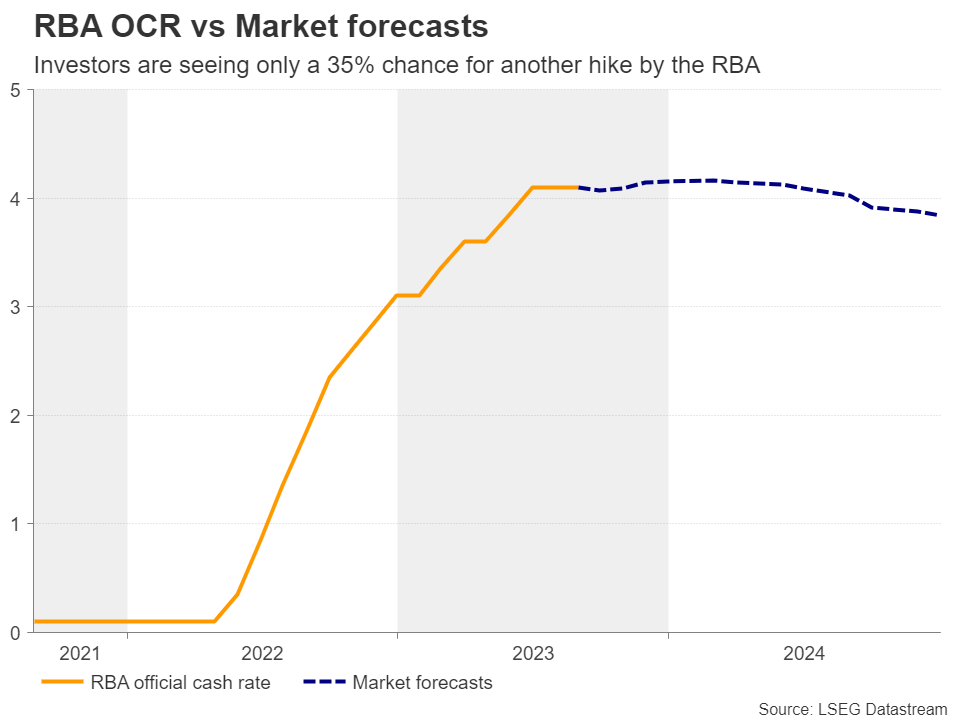

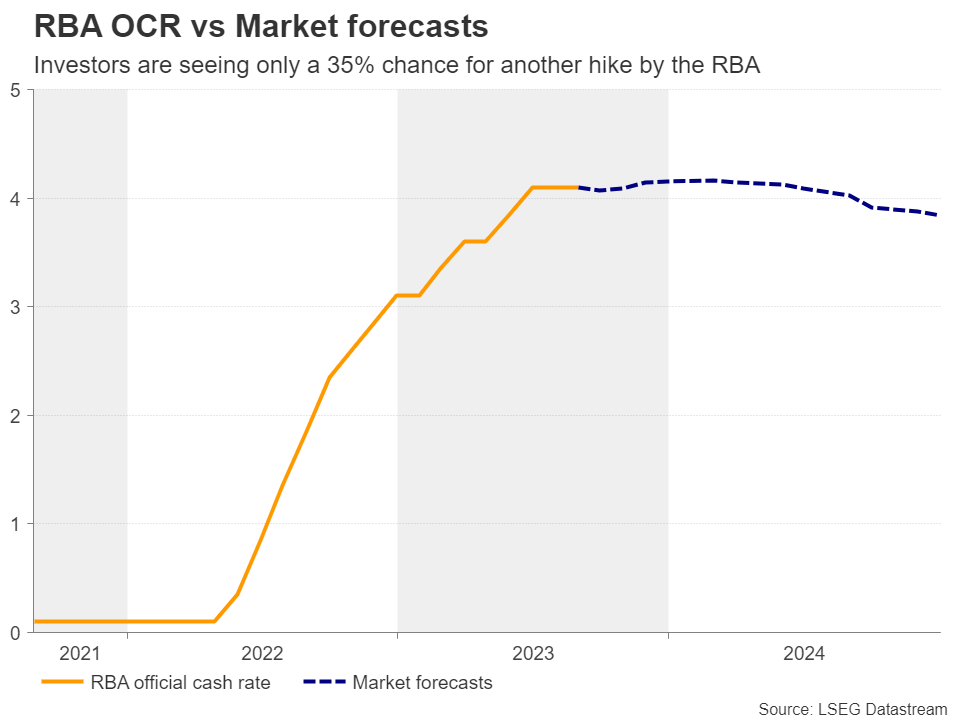

On Tuesday, the Reserve Bank of Australia begins a series of central bank meetings that could prove very important in guiding market expectations regarding the future of monetary policy in the major economies. At their last meeting, officials stood pat, disappointing expectations of a rate hike, but leaving the door open to more action by saying that some further tightening of monetary policy may be required, but also that this will depend upon the data and the evolving assessment of risk.

Since then, the employment data for July revealed that the economy has lost jobs instead of gaining, with the unemployment rate rising to 3.7% from 3.5%. On top of that, CPI numbers for the month of July showed that headline inflation in Australia dropped to 4.9% y/y from 5.4%, which eliminated any speculation with regards to a potential hike at this gathering.

Currently, investors are nearly certain that policymakers will keep their hands off the hike button at this meeting, while they are assigning around only a 35% probability for another quarter-point increase to be delivered by the end of the year.

Having said that though, with the core monthly CPI rate sliding only to 5.8% y/y from 6.1%, still well above the Bank’s inflation target range of 2-3%, closing the door to more hikes may be an unwise choice. Therefore, if policymakers reiterate the guidance that some further tightening may be required, even if they stand pat at this meeting, the probability for another hike before the end of this year could rise, helping the aussie extend its latest recovery.

That said, monetary policy developments on their own may not be enough to save the risk-linked currency, which has been sensitive also to developments and expectations surrounding China, Australia’s main trading partner.

China has been in the spotlight lately, with data pointing to deepening economic wounds and responses by authorities not convincing market participants that they could have the desired effect. With that in mind, China’s trade data on Thursday, as well as the CPI and PPI numbers on Friday, could attract special attention. Further weakness in Chinese exports and imports, as well as another month of deflation could prompt traders to sell the aussie, which could erase any RBA decision-related gains.

Australia’s own trade data are also due to be released on Thursday, while the day before, the nation releases its GDP numbers for Q2.

BoC seen holding fire, guidance and jobs data in focus

Besides the aussie, another risk-linked currency will enter the limelight next week and that’s the loonie, with the Bank of Canada holding its own interest rate decision on Wednesday.

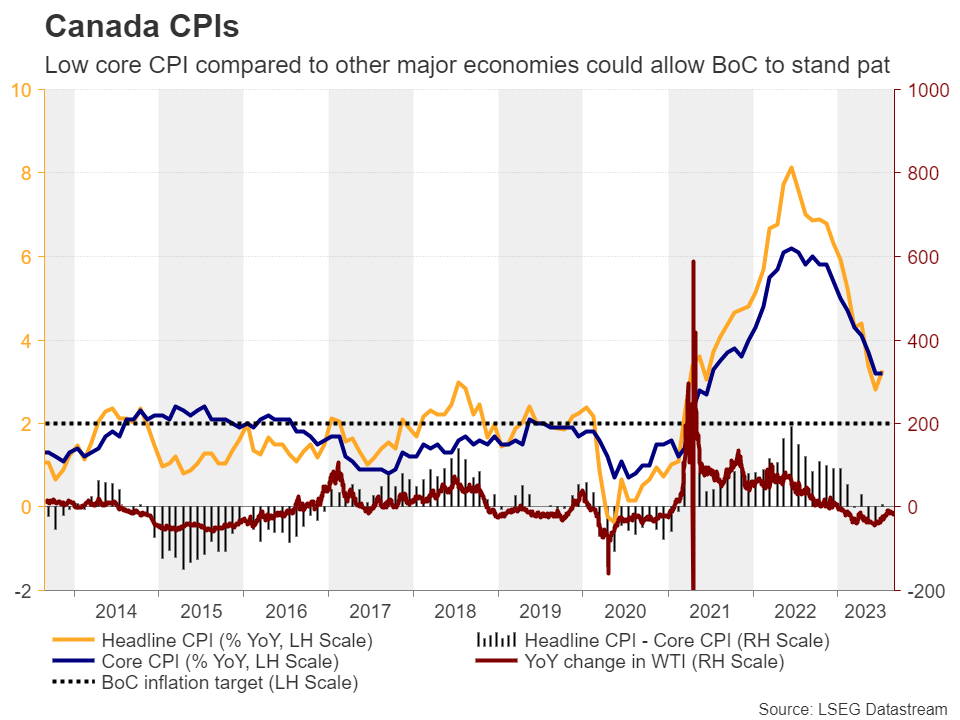

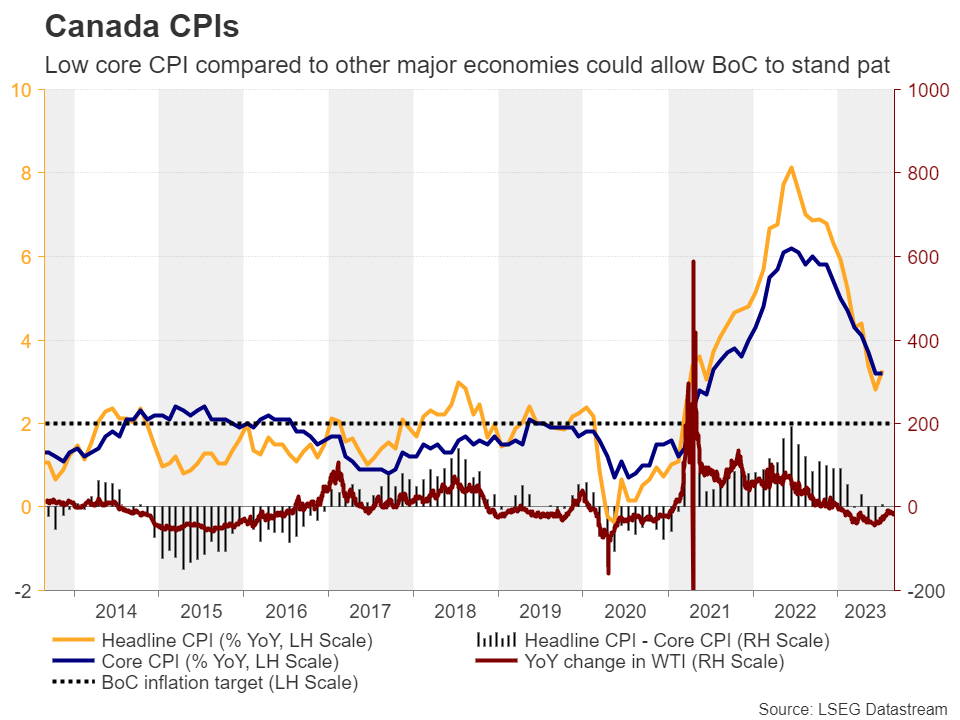

At the July gathering, this Bank decided to push the hike button, lifting interest rates by 25bps, but refrained from clearly telegraphing future moves. Officials just noted that they will continue to assess the dynamics and the outlook for inflation and that they remain committed to restoring price stability.

Inflation data for June revealed a notable slowdown in both headline and core terms, but the July numbers pointed to some stickiness, with the headline rate rebounding to 3.3% y/y from 2.8%, and the core one holding steady at 3.2%.

This may have prompted market participants to keep the option of another hike by the end of the year firmly on the table. Although they see only a 20% chance for action next week, they are assigning around a 50% probability for another 25bps hike by December.

Yes, inflation is above the Bank’s 2% objective, but with Canada’s core rate being closer to that number than underlying inflation rates in other major economies, and with the BoC maintaining a flexibility range around that target between 1-3%, officials may have the luxury to stay sidelined now and wait to see whether past hikes are still exerting downside pressure on prices.

That said, similarly to the RBA, closing the door to future hikes before the objective is met may be a premature choice. Thus, even if they stand pat, Canadian policymakers could keep alive the possibility of more action if deemed necessary. This will confirm the view of those assigning decent chances for another move in the coming months and thus, it may allow the loonie to gain some ground.

However, whether the currency could have a sustained and decent post-meeting recovery may largely depend on Friday’s employment report for August. The July numbers pointed to some weakness, with the economy losing some jobs and the unemployment rate rising further. Should next week’s data reveal deeper wounds, those expecting another BoC rate increase may start having second thoughts. For the probability of further action to keep rising and take the loonie higher, improving labor-market conditions may be required.

Light US agenda, focus on ISM non-mfg PMI

The US dollar pulled back this week as several US data forced investors to reconsider the likelihood of another hike by the Fed before the end credits of this tightening crusade roll, and to add more basis points worth of rate cuts for next year.

Just after Fed Chair Powell kept the prospect of more rate increases alive at Jackson Hole, investors lifted slightly their implied path, but on Tuesday, job openings for July hit their lowest since March 2021 and consumer sentiment for August deteriorated, while on Wednesday, the ADP employment report revealed that the US private sector added less jobs than expected during August.

Investors had second thoughts after the data and currently, they are evenly split on whether another hike by November is warranted. The US agenda will be light in the coming week, with Monday being a holiday due to Labor Day, but there is a data point that could well impact expectations regarding the Fed’s plans, and this is the ISM non-manufacturing PMI on Wednesday.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

The preliminary manufacturing and services PMIs from S&P Global both confounded market expectations of largely unchanged points and instead declined in August. With that in mind, the risks surrounding the ISM index may be tilted to the downside. That said, whether the probability of another Fed hike will further decline may also depend on the new orders and prices subindices. If there are declines there as well, the dollar and Treasury yields could stay under pressure and equities may continue drifting higher as expectations of lower interest rates could keep the net present value (NPV) of high-growth firms elevated.

Aussie awaits RBA and Chinese data

On Tuesday, the Reserve Bank of Australia begins a series of central bank meetings that could prove very important in guiding market expectations regarding the future of monetary policy in the major economies. At their last meeting, officials stood pat, disappointing expectations of a rate hike, but leaving the door open to more action by saying that some further tightening of monetary policy may be required, but also that this will depend upon the data and the evolving assessment of risk.

Since then, the employment data for July revealed that the economy has lost jobs instead of gaining, with the unemployment rate rising to 3.7% from 3.5%. On top of that, CPI numbers for the month of July showed that headline inflation in Australia dropped to 4.9% y/y from 5.4%, which eliminated any speculation with regards to a potential hike at this gathering.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Currently, investors are nearly certain that policymakers will keep their hands off the hike button at this meeting, while they are assigning around only a 35% probability for another quarter-point increase to be delivered by the end of the year.

Having said that though, with the core monthly CPI rate sliding only to 5.8% y/y from 6.1%, still well above the Bank’s inflation target range of 2-3%, closing the door to more hikes may be an unwise choice. Therefore, if policymakers reiterate the guidance that some further tightening may be required, even if they stand pat at this meeting, the probability for another hike before the end of this year could rise, helping the aussie extend its latest recovery.

That said, monetary policy developments on their own may not be enough to save the risk-linked currency, which has been sensitive also to developments and expectations surrounding China, Australia’s main trading partner.

China has been in the spotlight lately, with data pointing to deepening economic wounds and responses by authorities not convincing market participants that they could have the desired effect. With that in mind, China’s trade data on Thursday, as well as the CPI and PPI numbers on Friday, could attract special attention. Further weakness in Chinese exports and imports, as well as another month of deflation could prompt traders to sell the aussie, which could erase any RBA decision-related gains.

Australia’s own trade data are also due to be released on Thursday, while the day before, the nation releases its GDP numbers for Q2.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

BoC seen holding fire, guidance and jobs data in focus

Besides the aussie, another risk-linked currency will enter the limelight next week and that’s the loonie, with the Bank of Canada holding its own interest rate decision on Wednesday.

At the July gathering, this Bank decided to push the hike button, lifting interest rates by 25bps, but refrained from clearly telegraphing future moves. Officials just noted that they will continue to assess the dynamics and the outlook for inflation and that they remain committed to restoring price stability.

Inflation data for June revealed a notable slowdown in both headline and core terms, but the July numbers pointed to some stickiness, with the headline rate rebounding to 3.3% y/y from 2.8%, and the core one holding steady at 3.2%.

This may have prompted market participants to keep the option of another hike by the end of the year firmly on the table. Although they see only a 20% chance for action next week, they are assigning around a 50% probability for another 25bps hike by December.

Yes, inflation is above the Bank’s 2% objective, but with Canada’s core rate being closer to that number than underlying inflation rates in other major economies, and with the BoC maintaining a flexibility range around that target between 1-3%, officials may have the luxury to stay sidelined now and wait to see whether past hikes are still exerting downside pressure on prices.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

That said, similarly to the RBA, closing the door to future hikes before the objective is met may be a premature choice. Thus, even if they stand pat, Canadian policymakers could keep alive the possibility of more action if deemed necessary. This will confirm the view of those assigning decent chances for another move in the coming months and thus, it may allow the loonie to gain some ground.

However, whether the currency could have a sustained and decent post-meeting recovery may largely depend on Friday’s employment report for August. The July numbers pointed to some weakness, with the economy losing some jobs and the unemployment rate rising further. Should next week’s data reveal deeper wounds, those expecting another BoC rate increase may start having second thoughts. For the probability of further action to keep rising and take the loonie higher, improving labor-market conditions may be required.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.