- Nonfarm payrolls report and European flash CPI to shape rate cut bets

- ISM PMIs to also be important for Fed expectations and US dollar

- Canadian employment and Chinese PMIs also on the agenda

Fed hawks rear their ugly heads

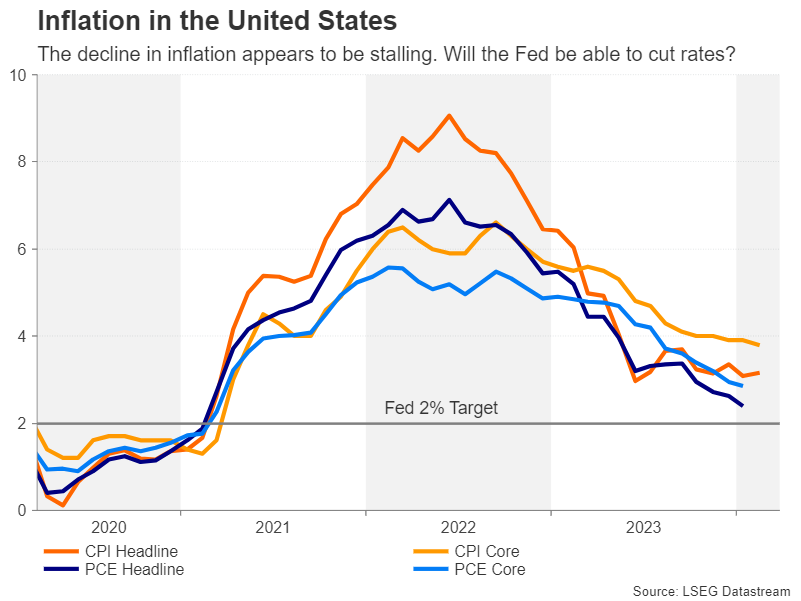

The March round of policy meetings reinforced June as the likely date when most central banks will begin cutting rates. Yet, doubts remain about whether or not inflation is on a sustainable path downwards, especially in the United States.

Although FOMC members maintained their projection of three rate reductions this year, they appear to have become more reluctant to commit to a specific timeframe for cutting rates. Inflation in the US has stalled around 3.0%, while the labour market remains very tight.

The worry is that cutting rates pre-emptively under such settings could refuel inflationary pressures. From the Fed’s perspective, the damage to its credibility would be greater in such a scenario than if it were to keep policy restrictive for longer than necessary.

But for the markets, the base case of a soft landing is imperative to feeding risk appetite so any change to that outlook risks putting an end to the rally on Wall Street and possibly giving the US dollar a leg up. The best hope for investors therefore is that the incoming data will be neither too hot, nor too cold.

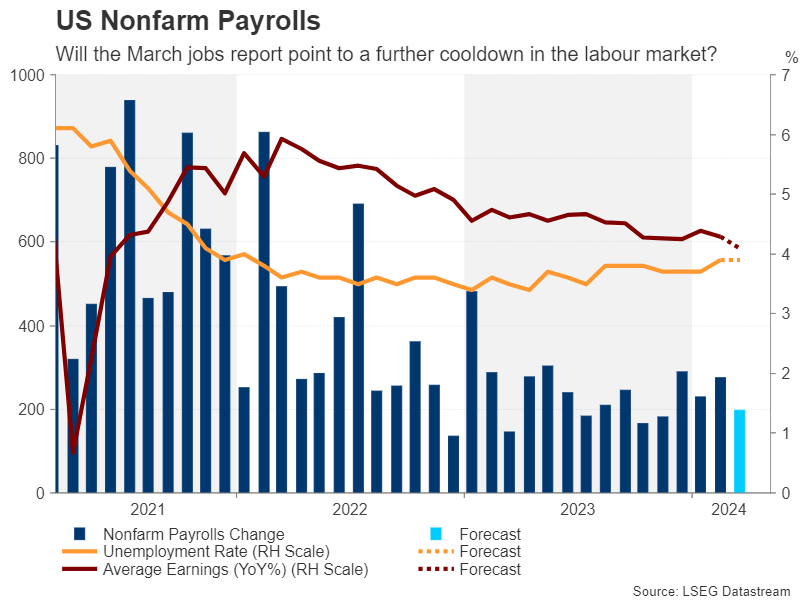

Is the US labour market really cooling?

That’s mostly been the case for the labour market, although it has been cooling down so gradually that it has kept the Fed on edge about overheating concerns. But the slowdown became more apparent in February when the unemployment rate ticked up to 3.9% and wage growth moderated to 4.3% y/y.

Jobs growth has stayed solid, however, with nonfarm payrolls increasing by 275k. The forecast for March is that the economy added 198k new jobs and the jobless rate held steady at 3.9%, while average hourly earnings growth is expected to have eased to 4.1% y/y.

Friday’s data will be preceded by the ISM PMIs. The manufacturing PMI is due on Monday and the services one on Wednesday. The former is anticipated to have improved slightly in March, but the latter is projected to have ticked lower.

If there’s a broadly positive set of figures, particularly if there’s a hotter-than-expected NFP print, this would likely deal a further blow to rate cut bets, providing another boost to the dollar.

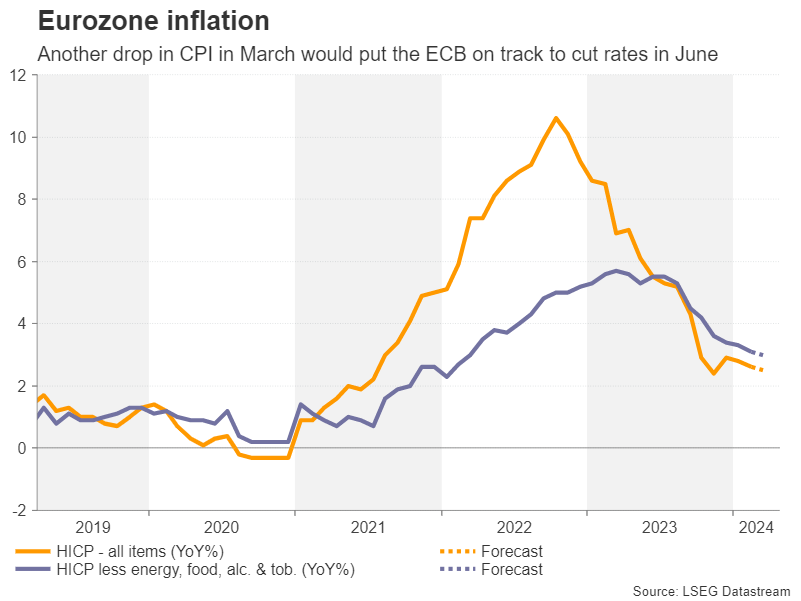

Eurozone CPI eyed as June rate cut moves closer

As the Fed gets jittery about inflation persisting above the 2% target, there’s been better progress for the European Central Bank. Headline CPI declined to 2.6% in February and is forecast to fall further to 2.5% in March. Core CPI that excludes food, energy, alcohol and tobacco prices is expected to edge down to 3.0%.

ECB policymakers have been out in droves lately, all calling for a rate cut at the June meeting. A downside surprise would endorse such a move, pressuring the euro, but stronger-than-expected readings could lessen the odds for a June cut.

However, any boost to the euro from stronger numbers would likely be limited and short-lived as one month’s data would not be seen as shifting expectations very significantly when there is such a strong consensus within the ECB for a summer cut.

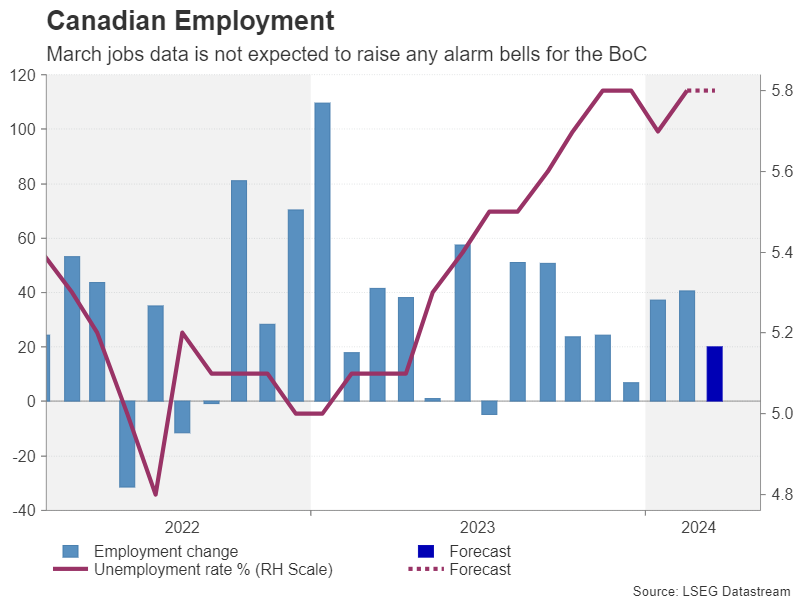

Loonie might shrug off Canadian jobs data

In Canada, employment stats for March will be the highlight, which are released on Friday along with the Ivey PMI. The Bank of Canada is another central bank that’s headed for starting its easing cycle in June. A cut became more certain after inflation fell more than expected in February, dropping below 3.0%. The labour market has also been slowing in recent months, with the jobless rate climbing to 5.8%.

Employment likely rose slightly, by 20k, in March, which probably won’t have a huge impact on rate cut odds, unless there’s a big miss or a beat.

The Canadian dollar has been on a shallow downtrend versus the greenback in 2024 as US data has been mostly strong. Hence, much of the reaction on Friday will be driven more by US dollar dynamics when the NFP is also due.

BoJ’s Tankan survey and Chinese PMIs on the way too

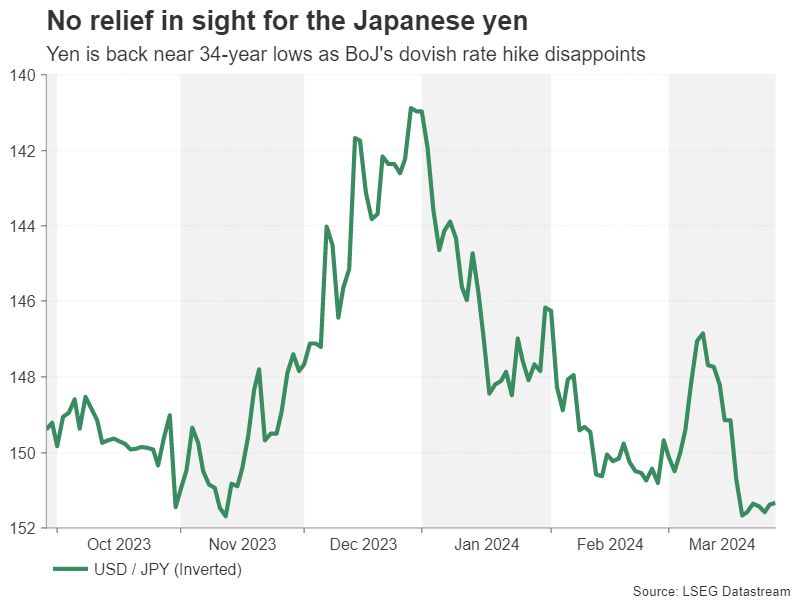

Fed rate cut expectations will be crucial for the Japanese yen as well, which has come under attack following the Bank of Japan’s dovish rate hike and speculation about a possible intervention.

Investors are not convinced that the BoJ will be in a position to tighten policy again anytime soon after the massive steps taken at the March meeting. Accommodative policy may be required for a while longer to support the economy and ensure that inflation doesn’t fall back below 2%. But Monday’s quarterly Tankan survey may offer some support to the battered yen if it points to growing optimism by Japanese businesses. Household spending figures out on Friday will also be watched.

Elsewhere, Chinese PMI numbers will likely attract some attention on Monday. The official manufacturing PMI is expected to rise to 49.9 and the alternative Caixin PMI is forecast to improve marginally to 51.0.

Indications that the recovery in the world’s industrial powerhouse is gathering pace could lift sentiment at the start of the week when volumes are expected to be light due to the long Easter holiday weekend in many markets.