ECB to hike by 25 bps but what will follow?

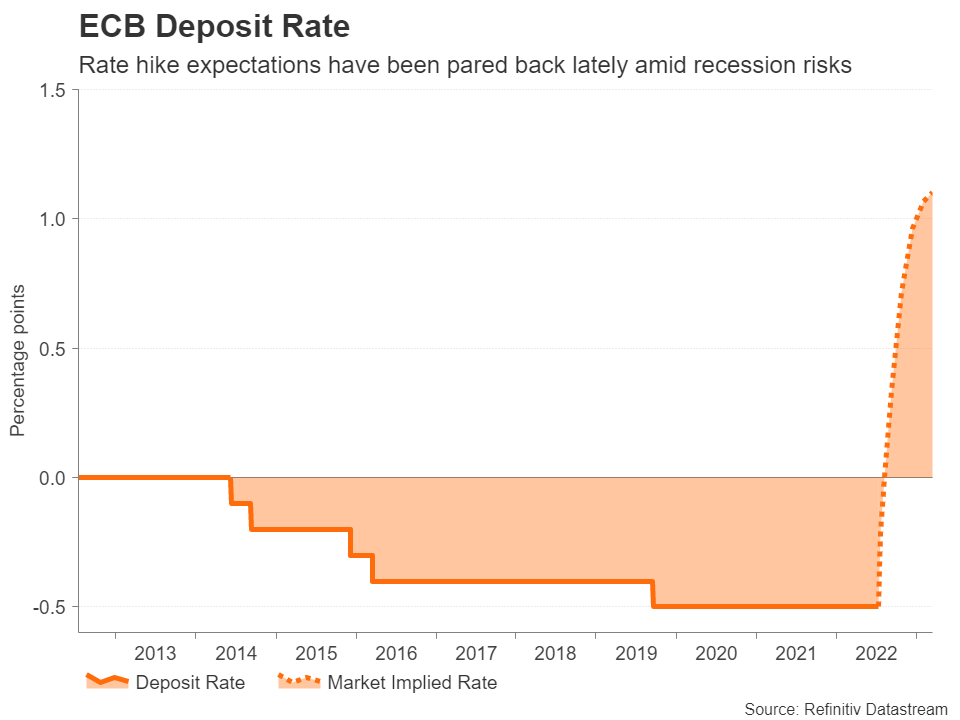

There can be no doubt that the ECB is late to the game when it comes to the tightening race, but policymakers will be hoping to send the right message when they hike rates for the first time in more than a decade on Thursday, by 25 basis point.

Eurozone inflation reached 8.6% y/y in June according to the flash reading and that figure is expected to be confirmed on Tuesday. The ECB’s decision to outline its plan for a series of rate increases rather than just a couple at the last meeting was seen as very hawkish and the bank will want to underscore its intentions by possibly flagging a 50-bps hike for September.

But the euro, which has been flirting with parity with the dollar all week, is unlikely to get much of a lift even if policymakers make another hawkish pivot as worries about the growth outlook are weighing on the currency, while the US dollar is being jointly boosted by an even more hawkish Fed and safe-haven flows.

If the ECB finalizes the details on how it intends to tackle fragmentation risks in Eurozone bond markets, that could turn out to be a bigger positive driver for the euro than hints that large rate hikes are on the way.

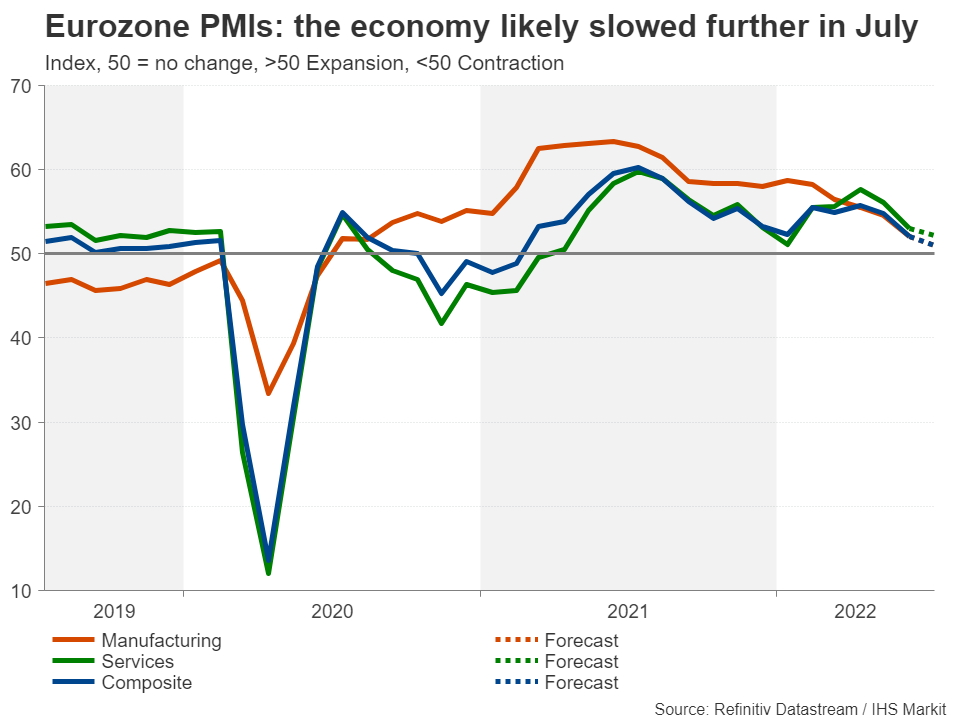

However, the euro will face more danger on Friday from S&P Global’s flash PMI data for July. Economic activity slowed markedly in June as businesses were impacted from soaring input costs and energy prices, as well as easing demand. A further slowdown is expected in July, with the composite PMI forecast to edge down from 52.0 to 51.0.

Bank of Japan is a wildcard

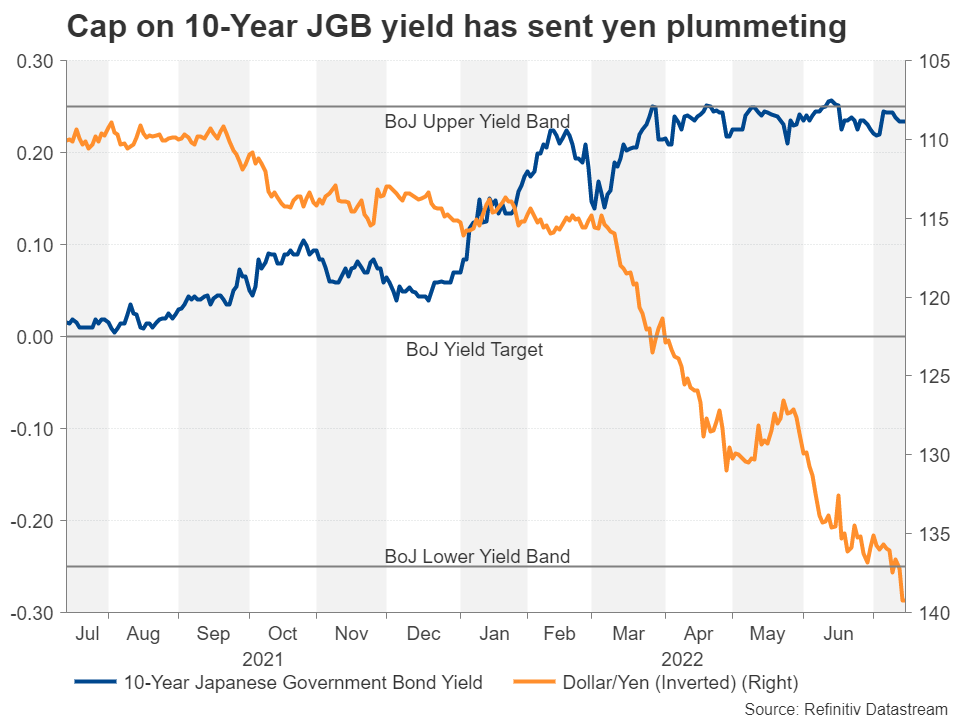

Another currency that has come under the wrath of the mighty dollar is the Japanese yen. The Bank of Japan’s refusal to abandon its controversial yield curve control policy at a time when all other central banks are aggressively raising interest rates has pushed the yen on the verge of hitting the 140 per dollar barrier for the first time in 24 years.

It can be argued that under the circumstances, the BoJ has been fairly successful in defending the 0.25% upper limit of its zero percent target on the 10-year yield. However, it may only be a matter of time before market forces take over and the BoJ suffers a humiliating U-turn. Hence, policymakers might decide that tweaking the policy now of their own accord when they meet on Thursday would save them a lot of headache later on.

On Friday, policymakers will be keeping a close eye on the June CPI figures. The core consumer price index, which only excludes food prices and is targeted by the BoJ, stood at 2.1% y/y in May and is projected to edge up to 2.2% in June. But other underlying measures that additionally strip out energy prices remain below 1%. This is why Governor Haruhiko Kuroda has stuck to his guns, insisting that there is no sign yet of inflation meeting the 2% goal sustainably.

Pound doesn’t have a lot to cheer about

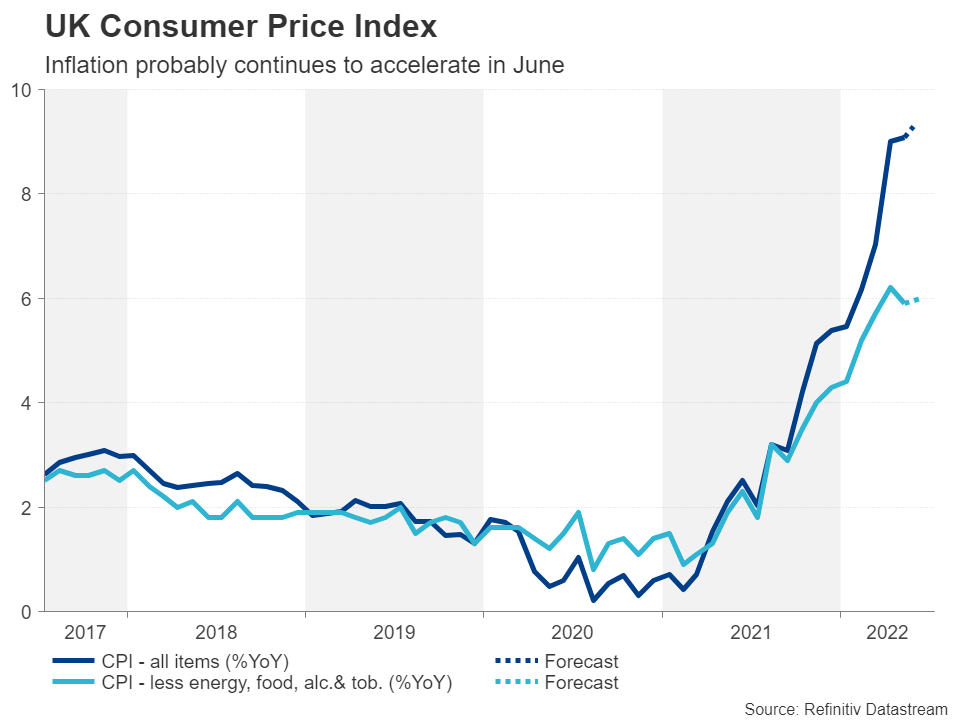

Over in the UK, the pound could hit some turbulence amid a flurry of data releases. Kicking things off on Tuesday is the employment report, followed by CPI numbers on Wednesday and retail sales and the flash PMIs on Friday.

The British economy eked out a surprise growth in May and GDP was revised higher in the prior two months. This puts the Bank of England in a much more comfortable position to speed up its rate increases in August. Yet, sterling has kept on slipping against the dollar.

Like the euro area, the UK is highly exposed to the energy crisis and the latest political developments in Westminster have cast a further shadow over the country’s economic prospects.

Headline inflation jumped to 9.1% y/y in May and another acceleration would boost the odds of the Bank of England raising rates by 50 bps at its next meeting.

However, it’s unlikely that this would halt the pound’s slide as it may only add to stagflation fears. But there could be some support from any upbeat readings in the other data points.

Rising inflation is adding to recession bets

CPI and retail sales numbers are due in Canada too next week and the loonie may similarly not benefit from a further rise in inflation. The Bank of Canada shocked markets when it hiked rates by a whopping 100 bps. But the Canadian dollar has instead nosedived to the lowest since November 2020 versus the greenback.

Investors are clearly nervous that frontloading rate increases will only heighten the risk of a recession, even in Canada whose economy currently is among the strongest in the G20.

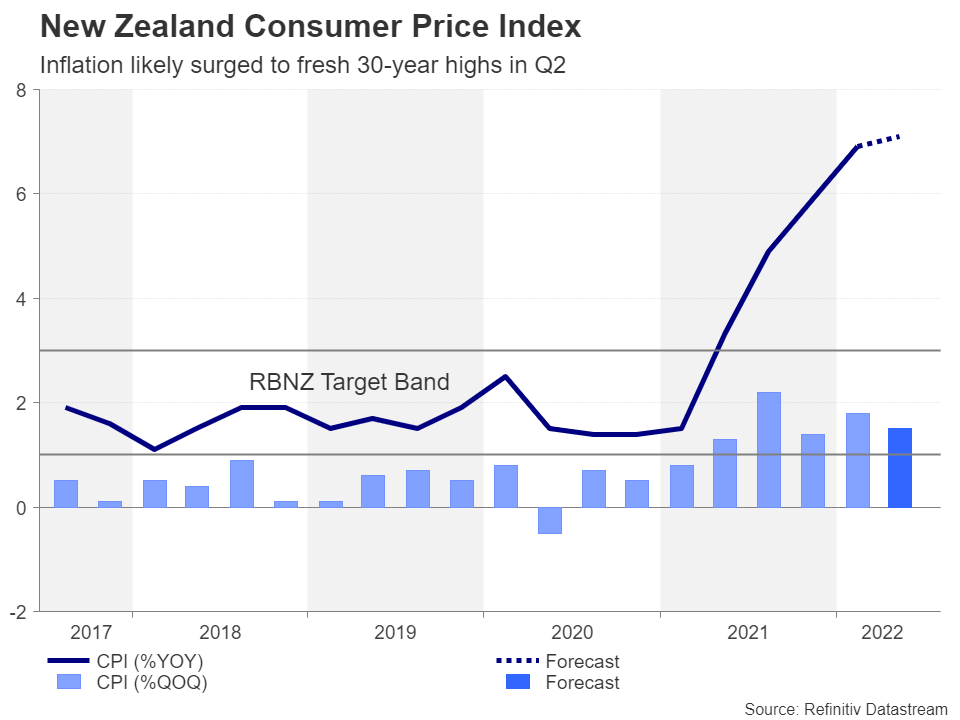

The Reserve Bank of New Zealand is in the same predicament and Q2 CPI data out on Monday might guide markets as to whether the pace of tightening is more likely to slow down or speed up.

Overall, however, domestic tightening speculation will play second fiddle to bets about the Fed and general risk sentiment as far as the commodity-linked dollars are concerned.

Some downtime for USD bulls?

Expectations that the Fed could raise rates by 100 bps skyrocketed after US inflation hit a fresh four-decade high of 9.1% y/y in June, fuelling the dollar rally. The dollar index soared to 20-year highs above the 109 level in the aftermath.

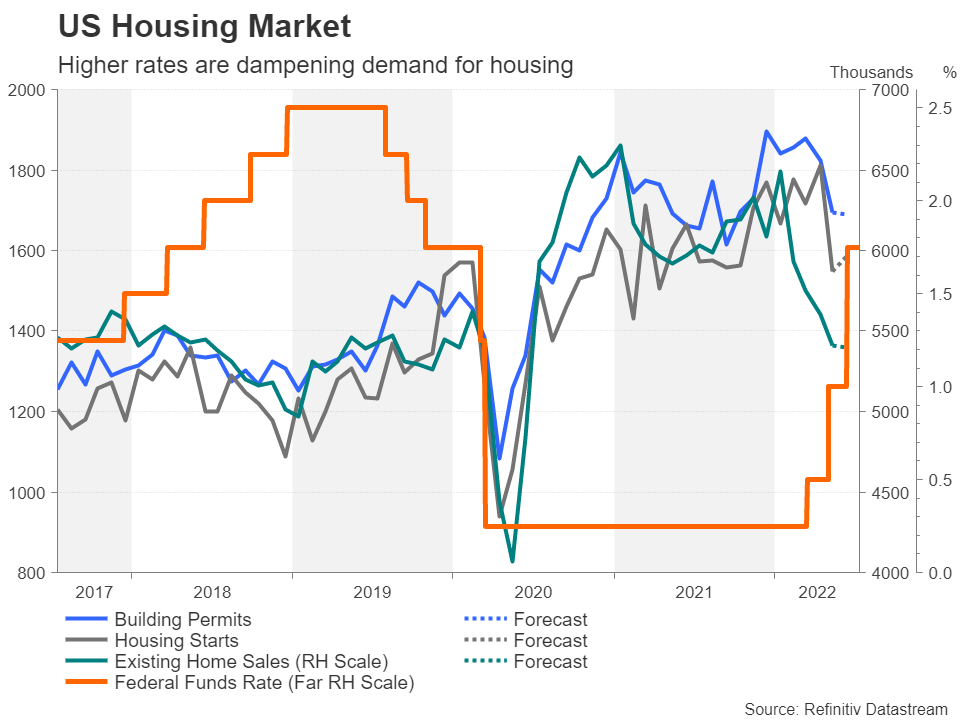

But a batch of housing data for June next week pose some downside risks. Building permits are due on Tuesday along with housing starts, and existing home sales follow on Wednesday.

Also important will be the Philly Fed manufacturing index on Thursday and the flash July PMIs on Friday.In a relatively quieter week, investors may sit on the sidelines as they await the next FOMC decision on July 27, unless of course there are fresh risk-off episodes that drive more funds into the world’s number one reserve currency.