- US CPI inflation is the next big test for the US dollar

- Yen traders turn to Tokyo CPIs and wages for BoJ exit hints

- China’s inflation and trade numbers to impact broader sentiment

- UK monthly GDP on tap amid recession fears Will the US CPIs corroborate the market’s implied Fed rate path?

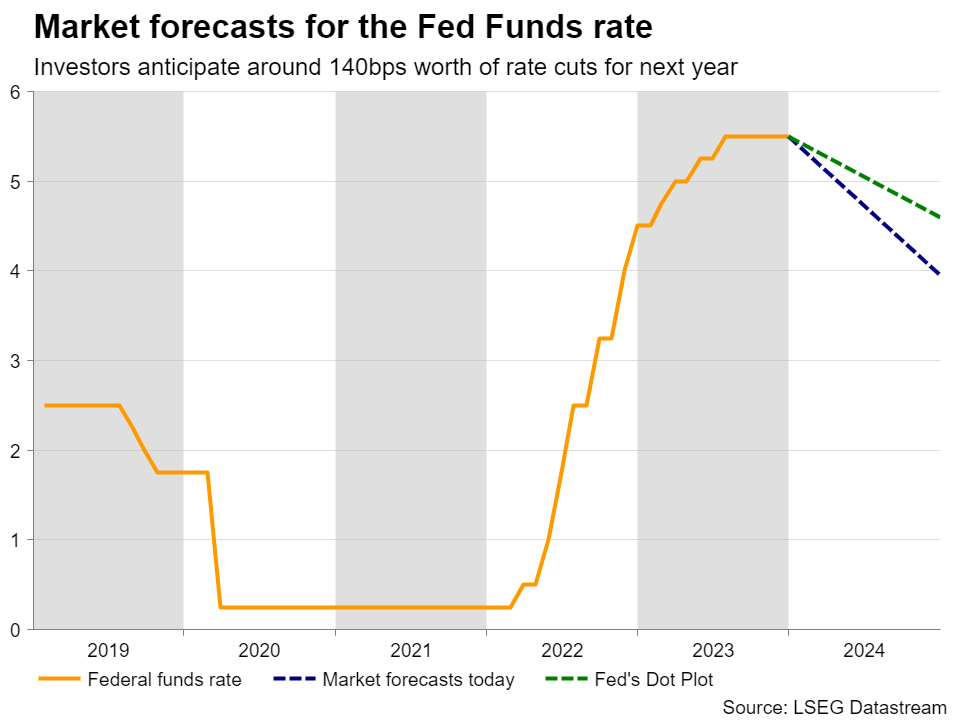

The US dollar staged a decent recovery during the first week of the year, with market participants scaling back some basis points worth of rate reductions expected by December, although the total number of rate cuts anticipated by investors is still way larger than the amount of rate cuts indicated by the Fed’s December dot plot.

At that gathering, the median dot for 2024 was revised down to 4.6% from 5.1% and Fed Chair Jerome Powell appeared more dovish than anticipated at the press conference following the decision. He said that rate increases are not the base case anymore and that the question now is “when will it become appropriate to begin dialing back?”

With that in mind, at some point last week, investors were nearly fully convinced that a 25bps cut will be delivered in March and that interest rates should be lowered by 160bps by December. Now that number stands at around 140 and the probability of a March cut is down to around 70%.

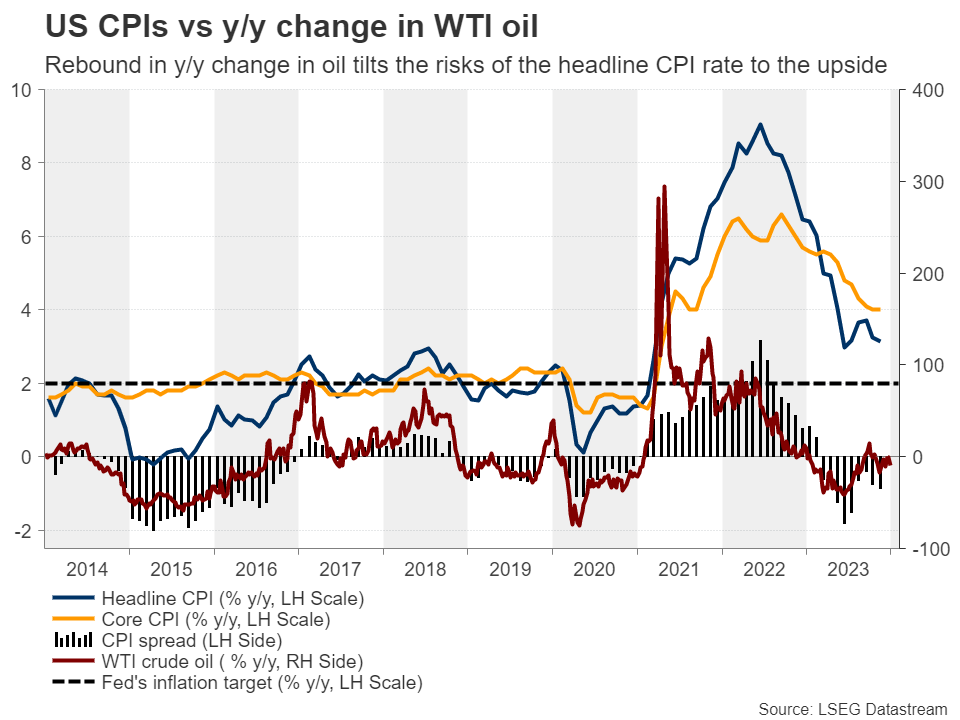

Next week, investors will stay locked in front of their screens in anticipation of the US CPI numbers for December, due out on Thursday. Inflation has come down quickly in recent months due to weaker goods prices and moderating costs of services, including travel, even as rent increases remained elevated. Headline inflation saw a faster slowdown than underlying price pressures as energy prices began drifting south in September, erasing nearly all the gains posted during the summer months.

However, with the 2022 downtrend now dropping out of the year-on-year calculation, oil prices are close to their opening levels for 2023, which means that the y/y change has moved from well into negative territory close to zero. And with the headline CPI rate resting well below the core one, even if the latter softens a bit more, this means that there are risks for a rebound in headline inflation.

Should this be the case, investors may further reconsider whether March is the appropriate time for a first rate reduction by the Fed, lowering the probability for that happening even further and scaling back more basis points worth of cuts for the whole year. Consequently, the US dollar could extend its recovery as Treasury yields edge higher.

When will the BoJ take rates out of negative territory?

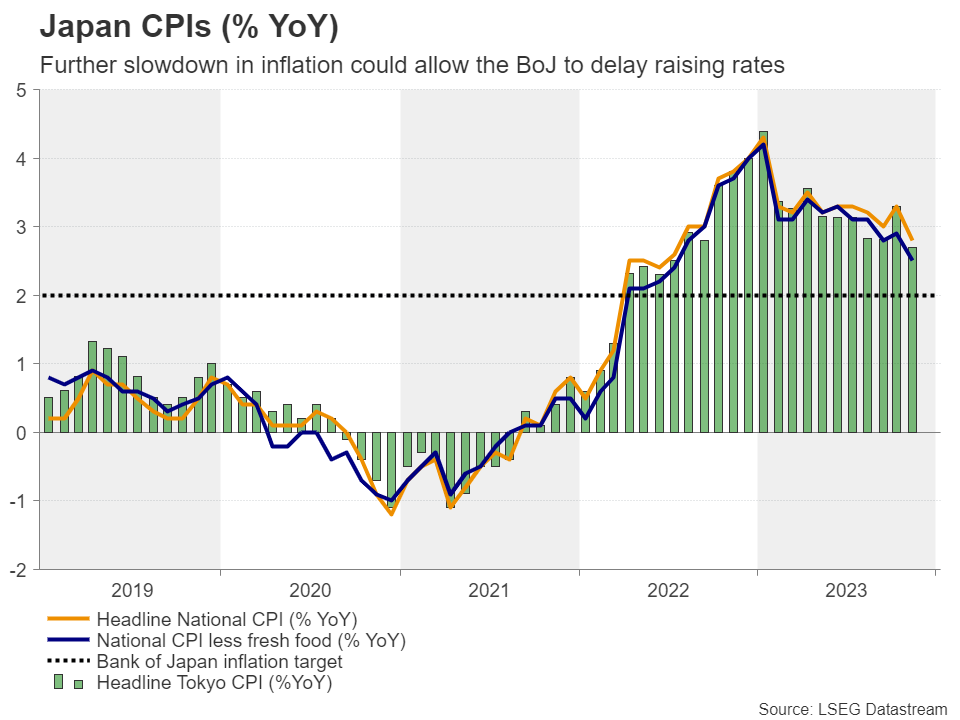

Japan’s Tokyo CPI and wage data, due out on Tuesday and Wednesday respectively, may also attract special attention next week. At its December gathering, this Bank decided unanimously to keep interest rates untouched at -0.1% and to stick to its yield curve control policy framework that places an upper bound of 1% for the 10-year Japanese government bond yield as reference.

With the Bank giving no signals that the era of ultra-loose policy conditions is nearing its end, next week’s releases can very well upset opinions on that front. The Tokyo CPI data for November revealed notable slowdowns in both headline and core consumer prices, with the latter rate hitting 2.3% y/y, slightly above the Bank’s objective of 2%. Therefore, further cooling could point to a similar reaction in the national CPI data for the month and may suggest that Japanese policymakers are not in a rush to take interest rates out of negative territory, thereby further hurting the recently wounded yen.

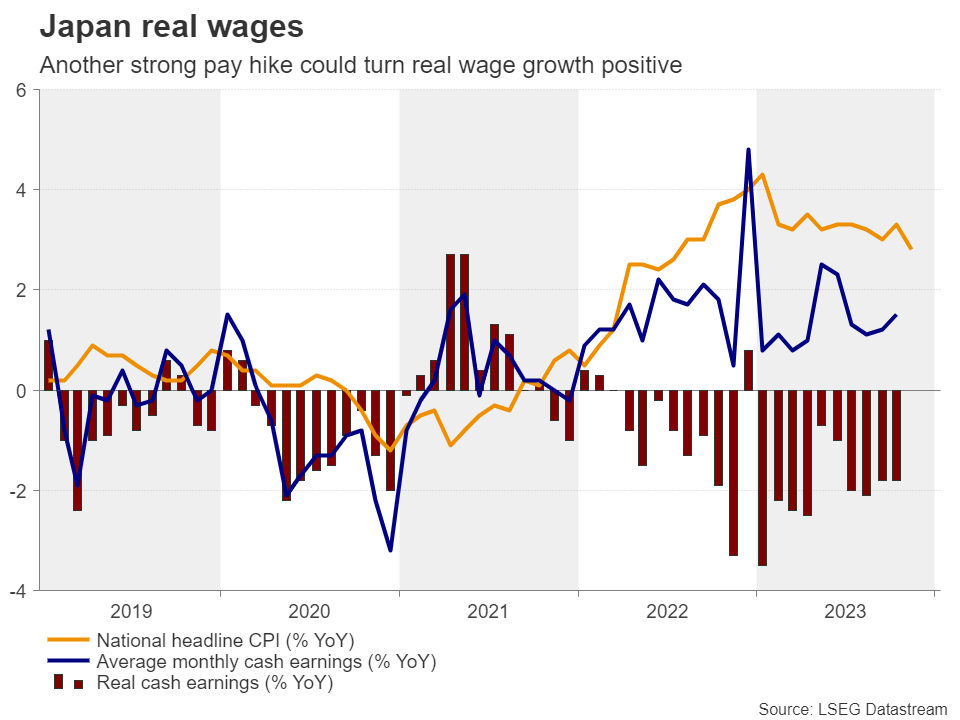

As for wages, they have accelerated to 1.5% y/y in October from 0.6%, but even if next week’s data reveals that the positive trend continued in November, the Bank may prefer to wait for the outcome of the spring wage negotiations before ending the negative-rate era. In October, Japan’s umbrella labor union, Rengo, said that they will demand hikes of at least 5%, which could take real wage growth into positive territory. Therefore, April seems a better choice for the BoJ to raise interest rates.

Considering that the market expects the Fed to cut interest rates by around 140bps next year, this may allow the yen to stay in an uptrend mode against its US counterpart, even if the latest slide continues for a while longer.

Will the outlook for the Chinese economy get gloomier?

With China’s official manufacturing PMI for December signaling contraction for the third straight month, investors who are concerned about the state of the world’s second largest economy may now turn their attention to China’s CPI and trade data for the last month of 2023. In November, China slipped further into deflation and although its exports improved, its imports slowed notably, suggesting weak demand.

Therefore, should this week’s data corroborate the gloomy outlook, risk aversion may intensify and pressure on Chinese authorities to adopt bolder stimulus measures may grow. With Australia and New Zealand being China’s main trading partners, aussie and kiwi may also correct lower. That said, a bearish reversal in those currencies may be premature as the market is currently anticipating fewer basis points worth of rate reductions by the RBA and the RBNZ than the Fed. Australia’s monthly CPI for November is also due to be released on Wednesday.

Is the UK heading for a recession?

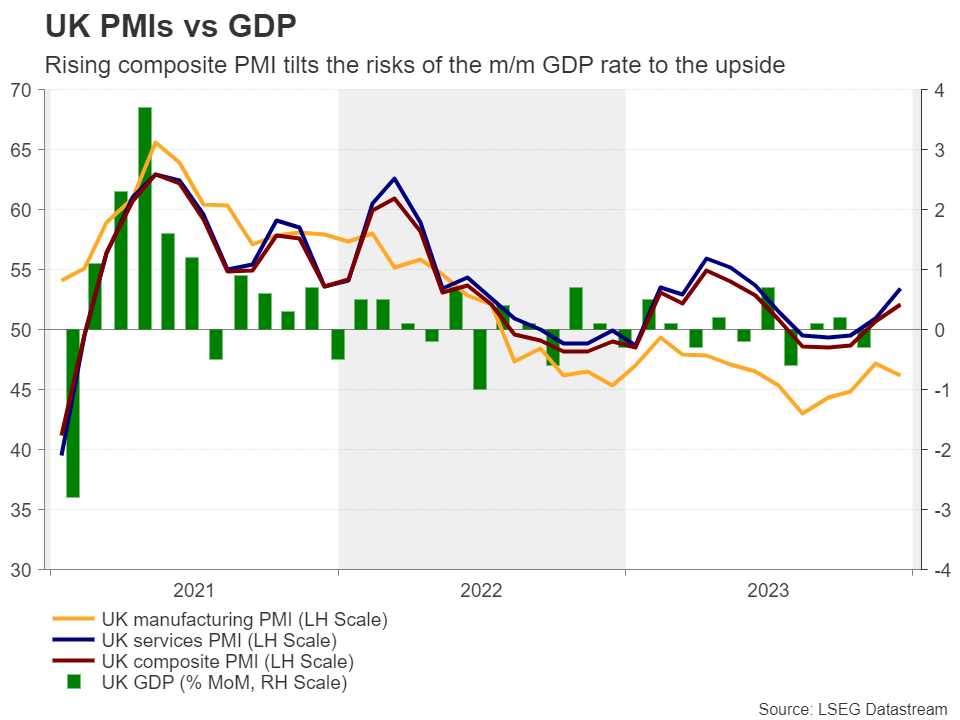

The UK agenda was very light during the first week of the new year, but there are some items for pound traders to consider next week. The monthly GDP rate for November is due to be released on Friday alongside the industrial and manufacturing production prints for the same month.

In October, the UK economy contracted 0.3% m/m, taking the quarterly rate down to -0.1%, thereby ringing the recession alarm bells. Taking that into account, investors have added to their BoE rate cut bets, currently penciling in around 125bps worth of reductions by the end of the year, despite Governor Bailey and his colleagues sticking to their “higher for longer” mantra when they last met.

Thus, should the November data suggest that the economy entered the last quarter of the year on a weak note, market participants could sell some pounds on speculation that the BoE may indeed start lowering borrowing costs sooner than it currently believes. Nonetheless, considering the rising composite PMI for that month, the risks surrounding the monthly GDP rate may be tilted to the upside.