- Germany goes to the polls, but far-right AfD is unlikely to form a government.

- German CPI data might be a bigger driver for the euro.

- US inflation is also in the spotlight as the PCE report is awaited.

Will German elections change the outlook much?

When Germany’s chancellor, Olaf Scholz, called a snap general election back in December, there was hope that a new government would inject much life into the flagging economy. With the February 23 election day almost here, it’s unclear how consequential Sunday’s vote will be, if at all.

Looking at the latest polls, the conservative CDU/CSU bloc is likely to be the biggest party in the Bundestag. But they will need the support of at least one other party to be able to form a majority government. This is where incumbent Chancellor Scholz’s SPD party comes in. Although the two are not natural partners, a grand coalition may be necessary to keep the far-right AfD out of power.

However, this may be difficult to do if the AfD or far-left parties like The Left get more votes than expected, shrinking the main parties’ shares even more than what the polls currently indicate. The Greens and the FDP have already lost significant votes so any coalition that doesn’t include both the CDU/CSU and SPD may not be very stable.

And with all the main parties having ruled out an alliance with the AfD, Scholz and CDU/CSU leader Friedrich Merz will have no choice but to find enough common ground to steer the country for the next four years. One area where the two parties might struggle, but which is the most crucial for the markets, is the debate about whether to relax Germany’s strict debt brake rule. The German government is obliged constitutionally to keep the structural deficit of the budget at no more than 0.35% of GDP.

Loosening this rule could go a long way in boosting spending to lift the economy out of the doldrums. But the CDU/CSU isn’t too keen on tweaking it and is likely to attach conditions to any agreement to raise the borrowing limit.

Nevertheless, if on Monday morning the election results point to a CDU/CSU and SPD coalition, the euro could enjoy a modest rally, and if in the coming days, the party leaders decide to prioritize reforming the debt brake, there could be further gains for the single currency.

However, if the AfD comes a close second, the euro could face some selling pressure as the government may require the party’s votes to pass some legislation even if it’s not included in the new coalition, allowing it to push through some of its far-right agenda.

Data also Matters for the Euro

In the event that the German elections don’t bring about much of a political shift in Europe’s largest economy, traders may turn their attention to the incoming data. The Ifo survey is out on Monday and will shed some light on German business sentiment in February, while on Friday, the preliminary CPI numbers are due to be published.

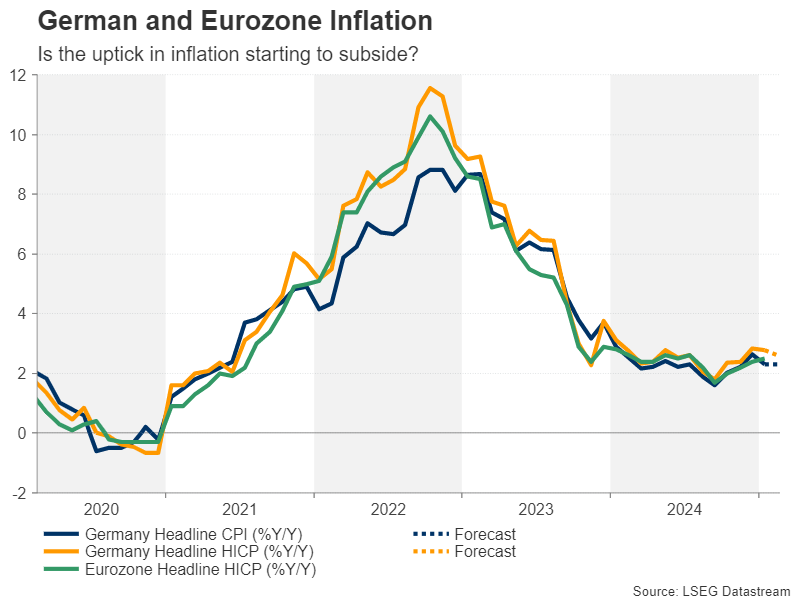

Eurozone inflation has been creeping higher since October so a further uptick in Germany’s prints could cast doubt on expectations of three more 25-bps rate cuts by the ECB this year.

As for the euro area, the final CPI estimates for January are out on Monday. Investors will also be keeping an eye on the minutes of the ECB’s January meeting due on Thursday. Any worries among policymakers about inflation not coming back down to 2% quickly enough could provide some upside to the euro, although on the whole, it’s unlikely that either the German CPI or ECB minutes will significantly move the needle for rate cut bets.

PCE Inflation May Keep Rate Cut Optimism Alive

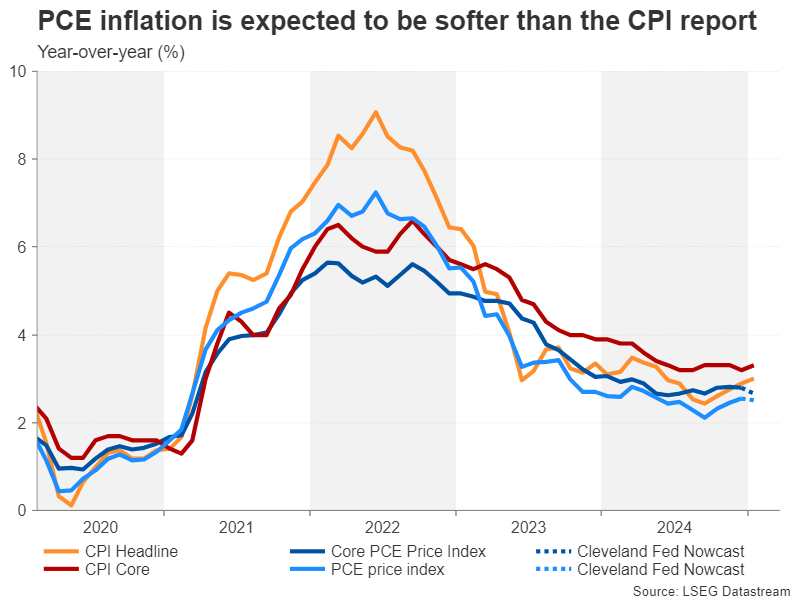

Over in the United States, sticky inflation has been an even bigger problem for the Federal Reserve. The headline rate of CPI inched up to 3.0% in January, dashing hopes for two rate cuts in 2025. But the market reaction wasn’t as negative as one would have expected, partly because investors predicted that the PCE measure of inflation, which the Fed attaches more importance to, would not be as hot as the CPI readings.

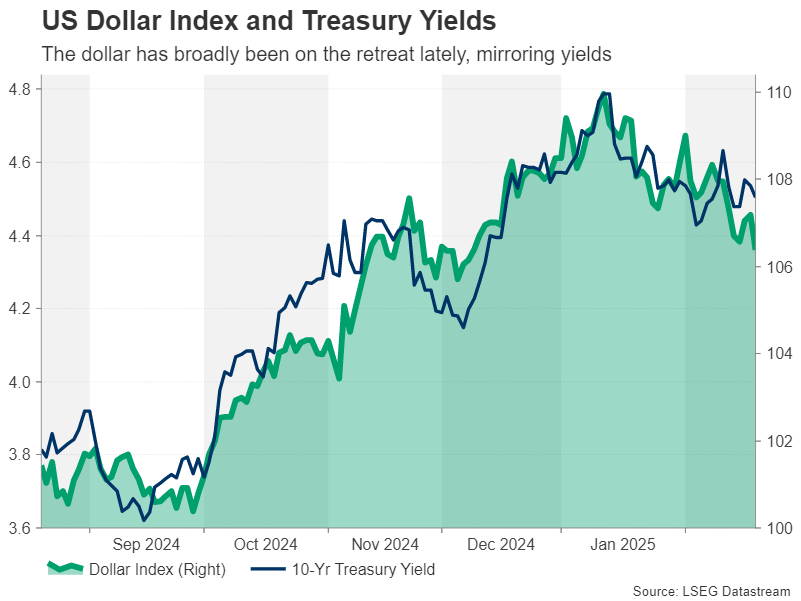

According to the Cleveland Fed’s Nowcast model, the core PCE price index eased to 2.7% in January from 2.8%, and headline PCE edged down to 2.5%. If those estimates turn out to be correct when the actual numbers are released on Friday and there are no upside surprises in the month-on-month figures, expectations for two 25-bps rate reductions could continue to recover, weighing on the US Dollar.

The PCE report will also include the latest stats on personal income and consumption, while earlier in the week, there’s a slew of other releases. The Conference Board’s closely watched consumer confidence gauge is out on Tuesday, to be followed by new home sales on Wednesday. There’s a barrage of indicators on Thursday, including durable goods orders and pending home sales for January, as well as the second estimate of Q4 GDP growth.

Geopolitical Risks Could Support the US Dollar

With risk appetite remaining resilient in the face of elevated geopolitical uncertainty following President Trump’s exchange of insults with Ukraine’s President Zelensky, any signs of weakness in the US economy could again encourage investors to ratchet up their rate-cut bets even if the inflation numbers don’t back it.

But the US dollar, which is trading near two-month lows against a basket of currencies, still stands a chance of rebounding if the geopolitical headlines worsen. Specifically, a further deterioration in the relations between Trump and Zelensky and vis-à-vis with the EU, or new tariff announcements, could redirect some flows back to the US dollar.