Dollar Ignores Powell’s Dovish Soundbites

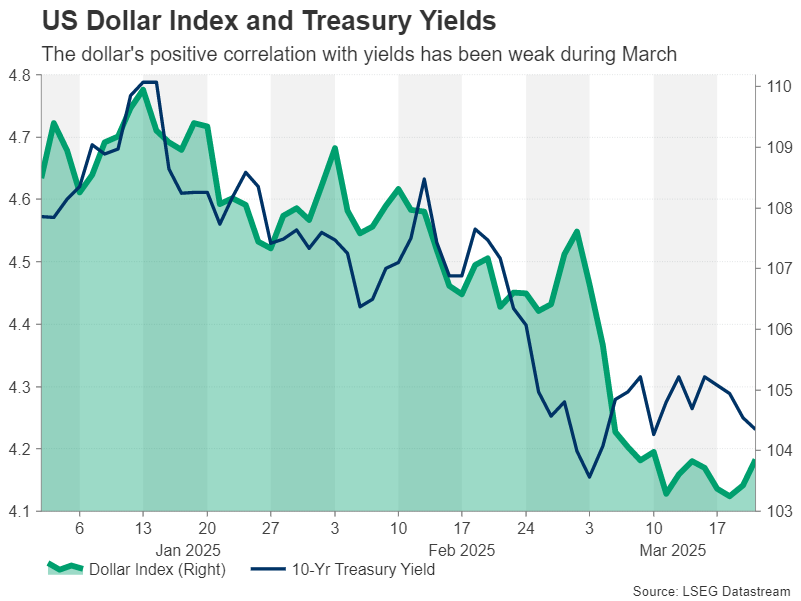

The US dollar has been on a positive footing since the March FOMC meeting, as Fed Chair Jerome Powell downplayed the risk of a recession while maintaining caution over the inflation outlook. Treasury yields, in contrast, dipped after the meeting, and stocks on Wall Street rose, backing the notion of a dovish surprise by the Fed.

The dollar’s contradictory response could be explained by the fact that it hadn’t been tracking the recovery in yields from earlier this month, so this was just catchup. However, it’s debatable how dovish Powell really was. Yes, he soothed market nerves by suggesting that any inflationary effect from higher tariffs would likely be transitory, but he wasn’t particularly upbeat about the Fed hitting its 2% target anytime soon either.

The fact that FOMC members maintained their prediction of just two 25-basis-point-cuts this year and signalled gradual easing over the course of the forecast period indicates the Fed is still in inflation fighting mode. Markets, on the other hand, think there’s a strong likelihood of a third cut this year, as many investors are betting that the US economy will slow more than what the Fed is projecting.

Is The US Consumer Still Spending?

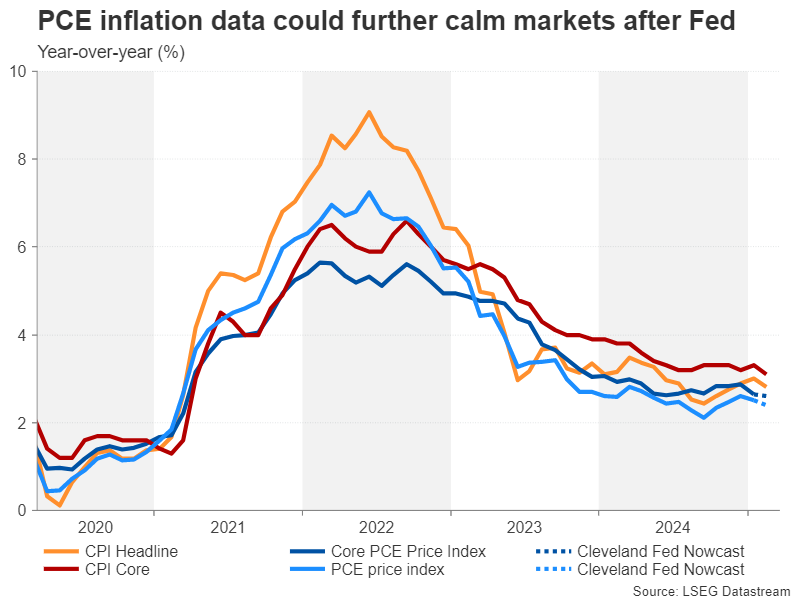

Hence, growth data could climb to the top of investors’ minds over the coming months, if it hasn’t already, with inflation metrics attracting somewhat less attention. The highlight next week will be Friday’s personal income and outlays report, which includes the PCE inflation readings.

The Cleveland Fed’s own Nowcast model is estimating that the headline PCE price index moderated from 2.5% to 2.4% y/y in February but that the core PCE price index stayed unchanged at 2.6% y/y.

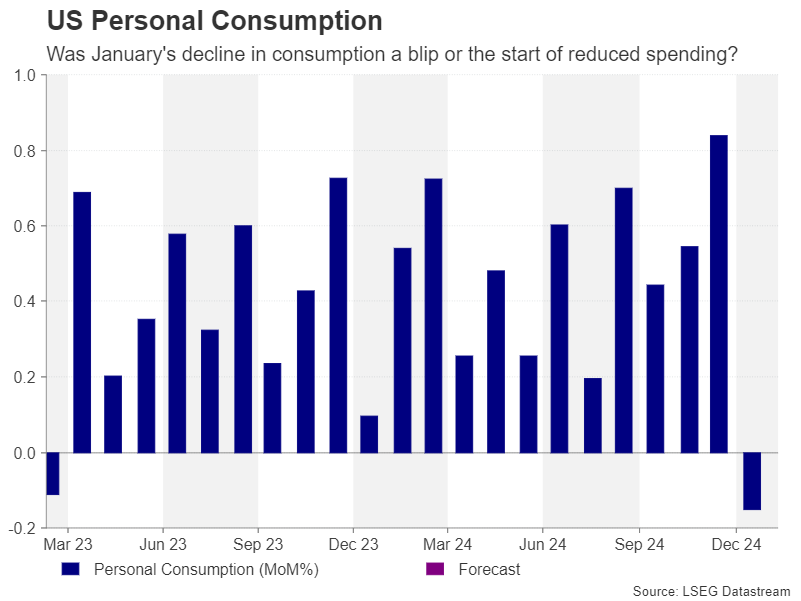

Such numbers are likely to neither please nor upset the markets, and so the personal income and spending component of the report could take the spotlight. Personal consumption fell by 0.2% m/m in January. But this was after several months of strong increases. Analysts are forecasting a rebound of 0.6% m/m in February. Therefore, any unexpected weakness could revive slowdown fears, putting the dollar on the backfoot again.

Recession Angst Could Return

It’s possible, though, that recession concerns could resurface much earlier in the week, as the March flash PMI survey by S&P Global is out on Monday. The Conference Board’s consumer confidence index will be watched on Tuesday along with new home sales. Durable goods orders for February will follow on Wednesday, with pending home sales and the final estimate for Q4 GDP drawing some interest on Thursday.

Any unforeseen softness in the upcoming releases could have a devastating impact on risk appetite if they are accompanied by fresh tariff headlines. The April 2 deadline for the Trump administration’s reciprocal tariffs is fast approaching and the President may decide to ratchet up the rhetoric ahead of it.

Pound on Stagflation Watch

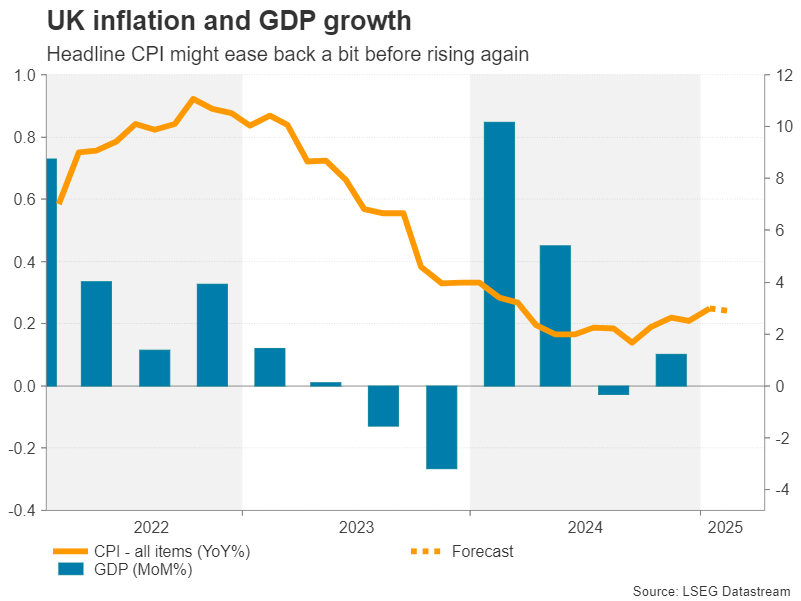

March has been a strong month for sterling, as it’s surged by about 3% against the US dollar. Much of that is attributed to the dollar’s dramatic pullback. But another factor is that UK economic indicators over the past couple of months have been somewhat better than expected. More importantly, inflation is on the rise again.

The Bank of England is facing a difficult dilemma, as it’s worried about a possible rise in both unemployment and inflation in the months ahead. The high risk of stagflation could cap further gains for the pound, although the UK’s exclusion from Trump’s trade war is a significant source of support for the time being.

The March PMI numbers due Monday will provide a crucial update as to whether British businesses are being affected by the global trade uncertainty, if any of them are planning to reduce their workforce and if prices pressures are easing or not. But investors will probably be focusing more on Wednesday’s CPI report for February.

The headline CPI rate jumped to 3.0% y/y in January, which is at the top of the Bank of England’s 1.0%-3.0% inflation buffer. The Bank expects CPI to reach 3.75% in Q3, so another reading above 3.0% is unlikely to alarm markets. Instead, investors will be looking underneath the surface, to see whether core and services CPI are accelerating at a similar rapid pace.

Last Chance for Reeves?

Any upside surprises could cast a dark cloud over the UK’s embattled finance minister Rachel Reeves’ Spring Statement later in the day where she is expected to outline big spending cuts. The bulk of the reductions will likely come from the welfare system – something that’s bound to be greeted more positively by the market than by voters.

A cut in spending would not only be taken as a sign that the government is not keen on any further tax increases to close the budget hole, but it’s also disinflationary, potentially making it easier for the BoE to resume rate cuts later in the year. For the pound, however, there could be an immediate boost from the budget update if Reeves also announces some new measures aimed at kickstarting the stagnant economy.

The run of data will continue on Friday with February retail sales and revised Q4 GDP figures.

Euro Bulls PIN Hopes on Pmis as Uptrend Stalls

The euroeuro’s incredible rally on the back of the German government’s substantial fiscal package and reform to borrowing rules appears to be petering out. The single currency is still the best performing major against the dollar in the year to date, but for investors to take the uptrend to the next level, they will probably need some fresh incentives.

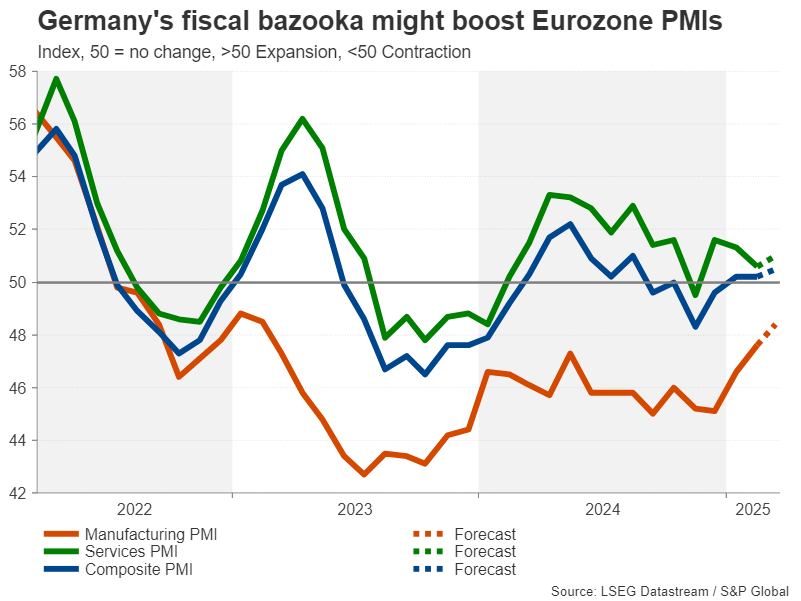

That could come in the form of Monday’s flash PMI figures, but the odds aren’t looking good as business confidence has deteriorated in the face of US tariffs and Trump’s fury at the European Union’s retaliatory levies.

The Eurozone composite PMI was flat in February, as an improvement in manufacturing activity was offset by a weaker services PMI. A pickup in the latter, however, can’t be ruled out as the services sector is less exposed to the immediate effects of higher tariffs, and so the euro stands some chance of receiving a lift from the data.

Traders will also be keeping an eye on Germany’s Ifo business climate gauge on Tuesday for signs that the new coalition’s spending plans are boosting optimism.