- Investors are split between a 25 and 50bps Fed rate cut

- BoE is expected to stand pat, but resume cuts in November

- BoJ to also stay on hold, focus to fall on future hike signals

Let the Fed Cuts Begin

Since the July US employment report, which sparked fears of recession, investors have been trying to figure out the size of the potential rate cut the Fed will deliver at its September gathering, and the moment of truth has finally come.

On Wednesday, the Fed will announce its decision, and it seems that it is not a matter of whether officials will press the rate cut button, but how strongly. In other words, by how many basis points will they lower the Fed funds target rate.

Following Chair Powell’s speech at Jackson Hole, where he noted that they will not tolerate further weakness in the labor market, investors locked their gaze on employment-related data, adding to their rate-cut bets on any sign of softness. Even the NFP report for August was not as encouraging as expected, with investors seeing then a 30% chance of a 50bps rate cut at next week’s gathering.

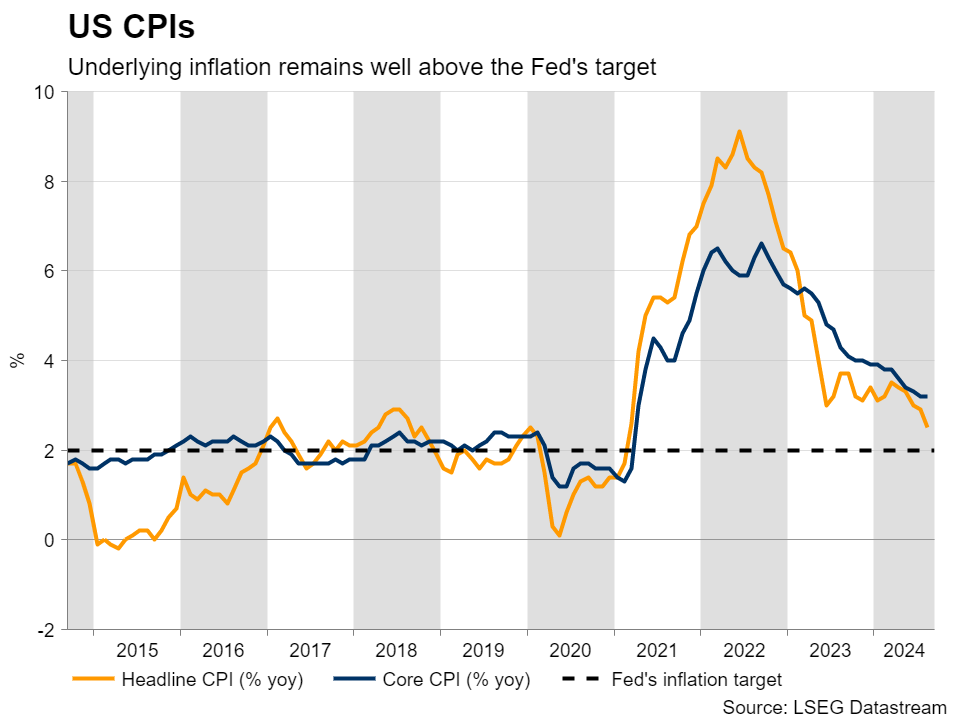

That percentage came down to around 15% after the CPI data for August revealed that underlying inflation remained elevated well above the Fed’s objective of 2%, but it climbed back to 45% after media reports from the Financial Times and the Wall Street Journal said that next week’s decision would be a close call.

Having said all that though, with the Atlanta Fed GDPNow model projecting a solid 2.5% growth rate for Q3, it seems that there is no concrete reason for policymakers to start this easing cycle with an aggressive move. A 25bps cut seems the more sensible move.

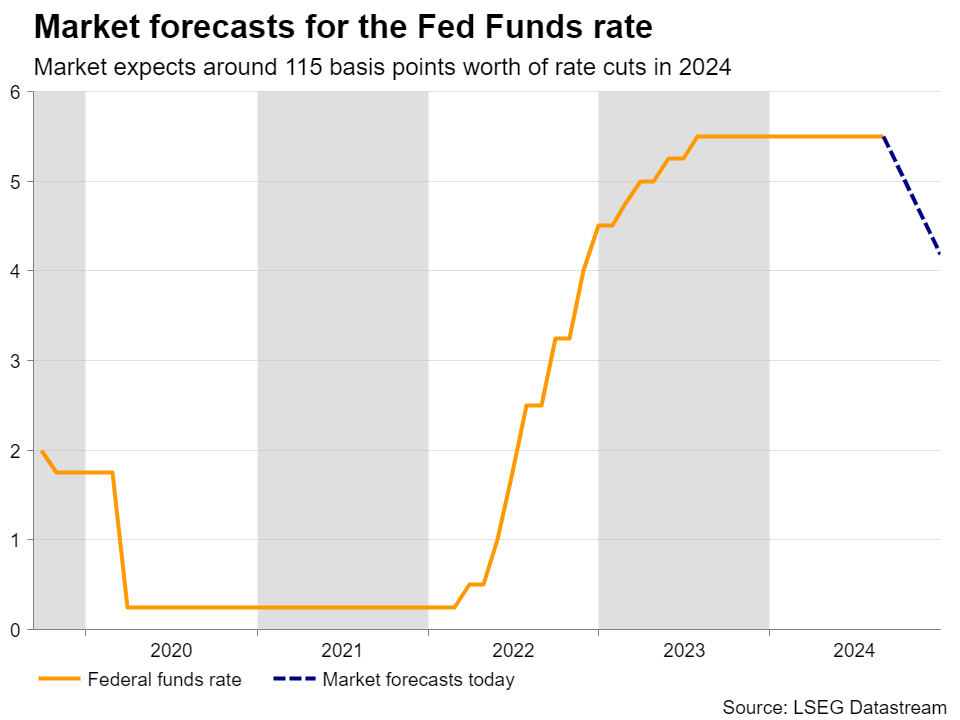

If this is the case, the dollar could gain as those expecting a bigger one may get disappointed, but whether it could hold onto its gains may depend on the updated dot plot and Powell’s remarks about the Committee’s future course of action.

If the dot plot and Powell suggest fewer basis points worth of reductions this year than the 115 currently expected by the market, the dollar’s engines may receive more fuel. As for Wall Street, confidence that the world’s largest economy is not headed for a recession may keep risk appetite elevated, even if this means fewer-than-expected rate cuts.

US retail sales are due out on Tuesday, but given the importance of the Fed meeting, they are unlikely to hugely impact investors’ positioning.

Will the BoE Confirm November Cut Bets?

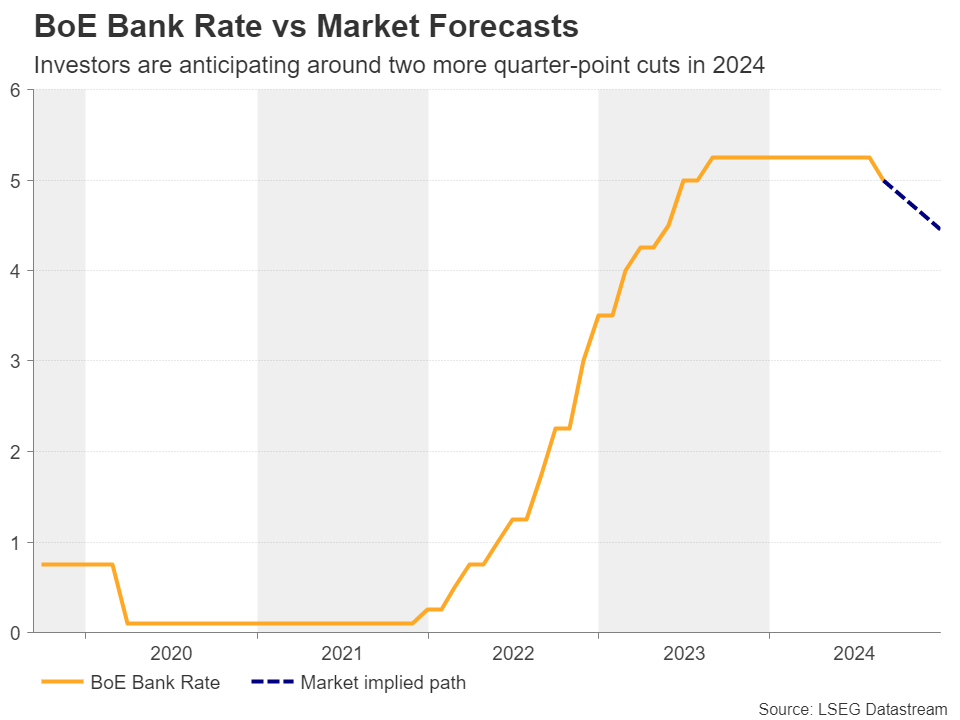

On Thursday, the central bank torch will be passed to the BoE. At its latest decision, this Bank cut interest rates by 25bps, but the decision was a close call, with officials signaling that they will be careful about future reductions.

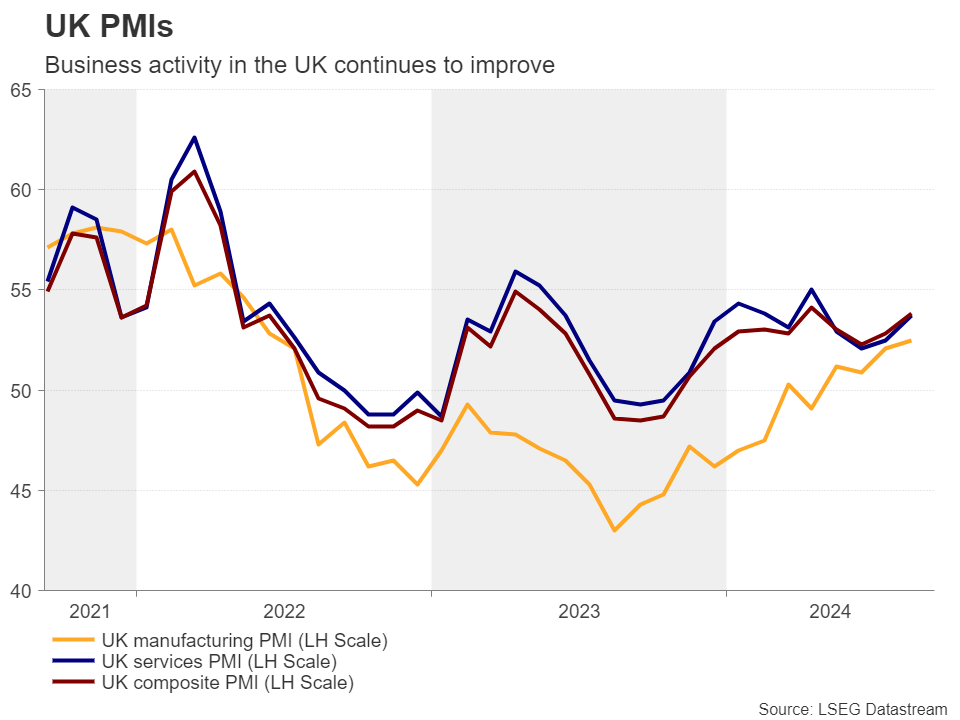

Since then, data has been mostly corroborating the officials’ stance. The PMIs beat expectations in both July and August, while the labor market continued to improve. Although average weekly earnings continued to slow, they’ve been proving stickier than expected, with the y/y rate for July resting at an elevated 5.1%.

What’s more, the headline CPI rebounded somewhat in July, with services inflation remaining stubbornly high. The August inflation numbers are coming out on Wednesday, while on Friday, retail sales are scheduled to be released.

Even BoE Governor Bailey himself said at Jackson Hole that they are not in a rush to cut again, prompting market participants to factor in a strong 80% chance for no action at this meeting.

The remaining 20% favoring a rate cut may be the result of some concerns after the monthly GDP for July pointed to stagnation.

Should officials indeed keep their hands off the rate cut button, investors will turn their attention to the Bank’s communication about their future plans. According to the UK Overnight Index Swaps (OIS), investors expect another two quarter-point reductions at the November and December gatherings. Thus, if policymakers maintain a no-rush mindset, the pound may extend its latest rebound.

Strong yen awaits BoJ decision

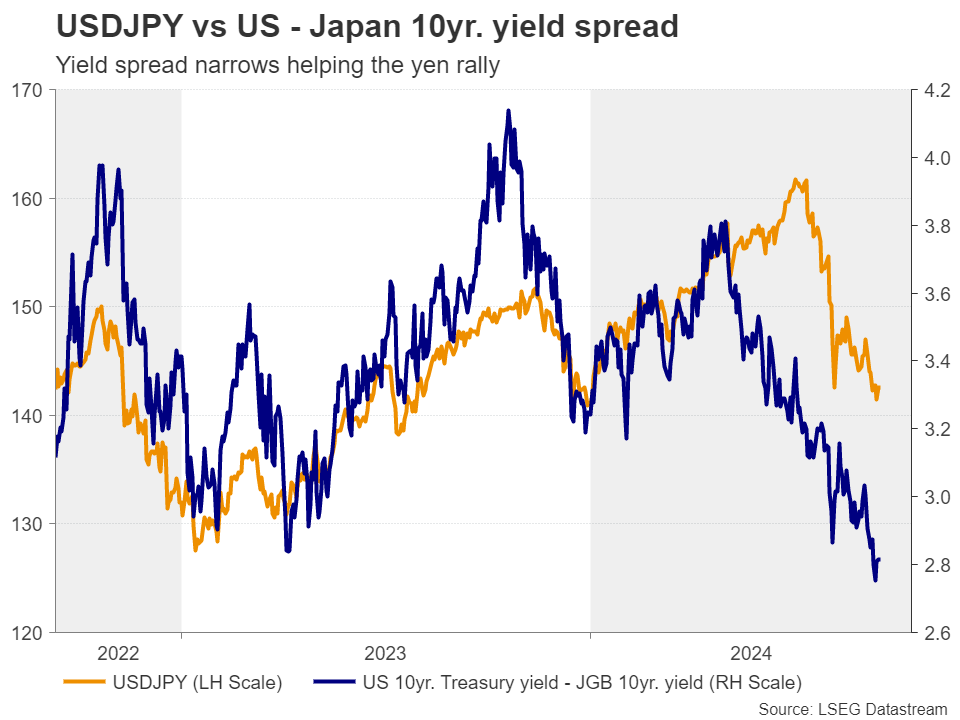

On Friday, it will be the turn of the BoJ. In July, Japanese policymakers raised interest rates by 15bps and have been since signaling that more hikes are looming. This allowed investors to pencil in an 85% chance for another 10bps worth of increase by the end of the year.

Although BoJ officials have been repeatedly noting that the pace of rate hikes will be slow, the divergence in monetary policy strategies between this Bank and the rest of the world has led to a surging Japanese yen as traders decided to abandon a previously overcrowded carry trade.

Yet, no policy action is expected at this gathering and thus, the focus will be on whether Ueda and his colleagues will continue to signal more hikes down the road. Anything corroborating the market’s view that another increase could be delivered before year-end, may allow the yen to continue marching north.

A few hours ahead of the decision, the Nationwide CPI numbers for August will be published.

Canadian Inflation and BoC Summary of Deliberations

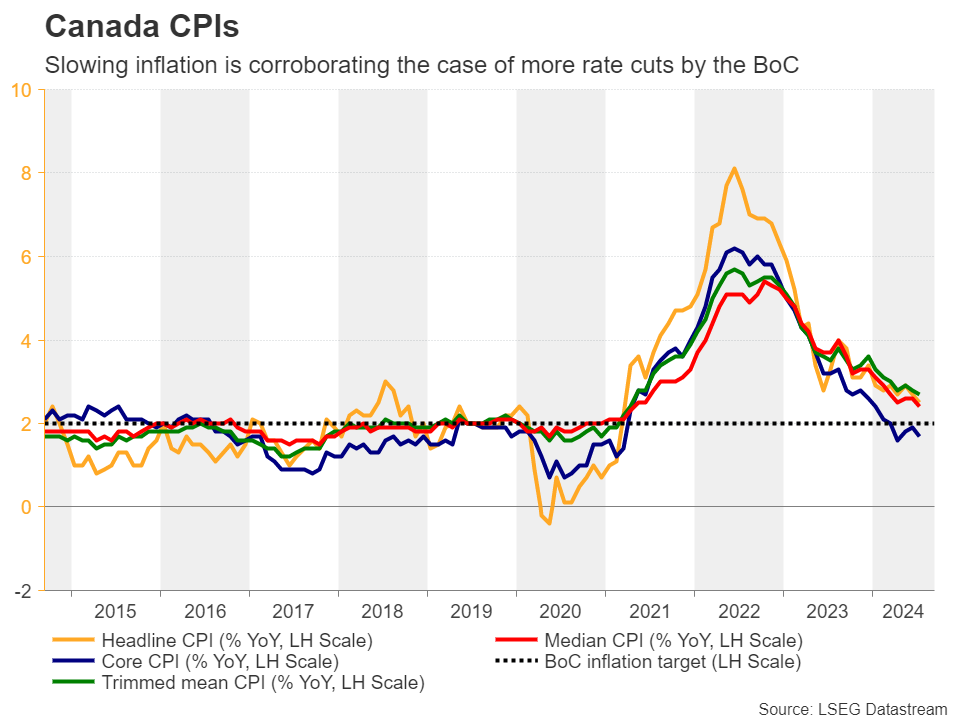

Canada is also releasing its CPI inflation data for August on Tuesday. At last week’s meeting, the BoC cut interest rates for a third time in a row, opening the door to bigger cuts if the economy slows more sharply ahead. On Wednesday, the Bank’s Summary of Deliberations may provide more clarity on that front, but further cooling in consumer prices the day before could very well encourage market participants to add to their rate-cut bets. Currently, they are expecting another 60bps worth of cuts by the end of the year. The nation’s retail sales are on Friday’s agenda.

In Australia, the employment report for August is due out on Thursday.