Fed pivot? Not quite

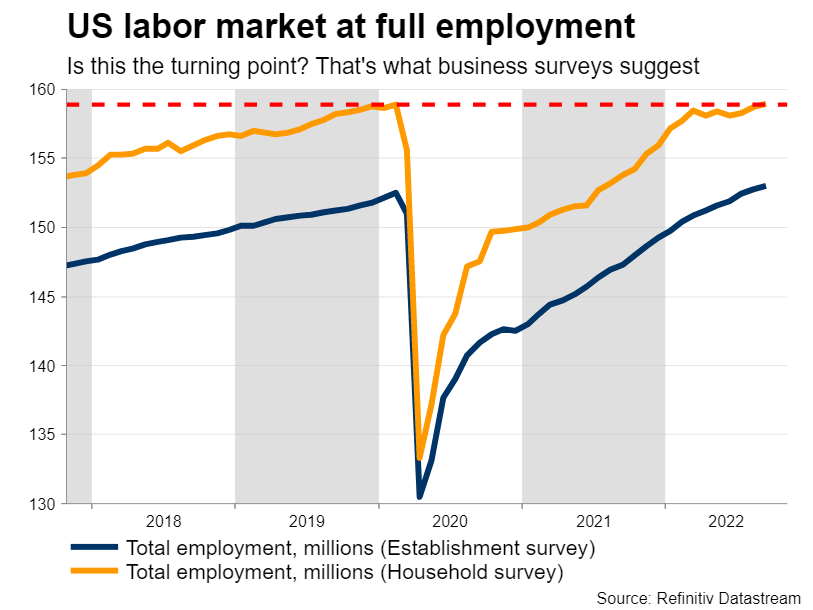

A three-quarter percentage point rate increase from the Federal Reserve on Wednesday is fully baked into the markets, as inflation remains uncomfortably high and the labor market has not absorbed any serious damage yet.

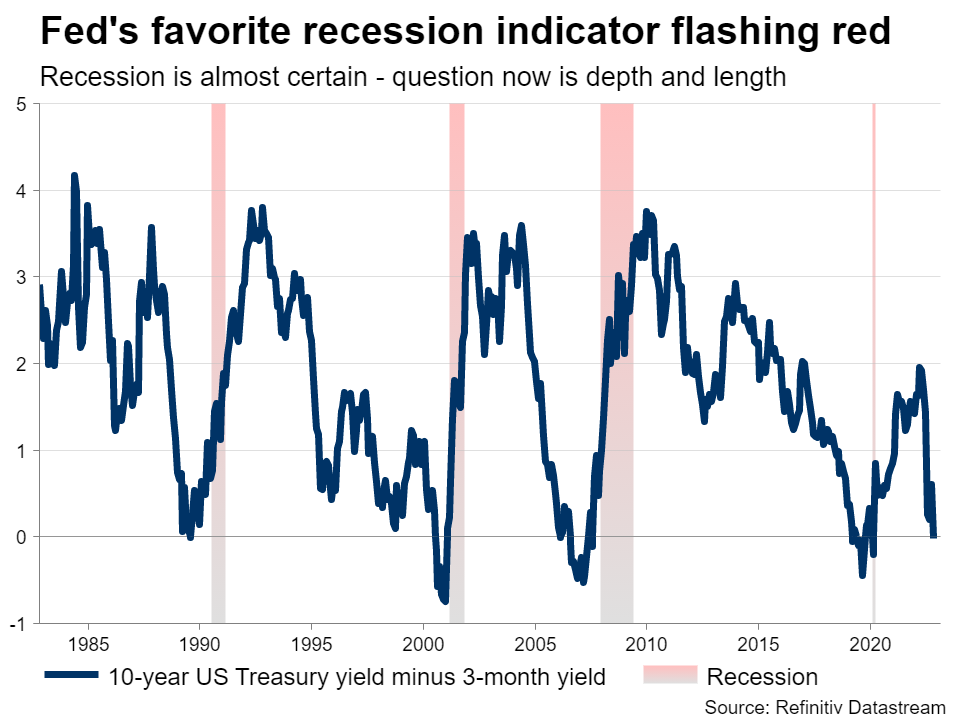

Nevertheless, the Fed has started to get cold feet. With business surveys, the yield curve, and various other leading indicators warning that a recession is just around the corner, Fed officials have signaled they might slow down the pace of tightening come December.

After all, monetary policy works with long lags and the true impact of all the rate increases they have already rolled out won’t be fully reflected in economic data until next year. They are worried that if they keep smashing the rate hike button too hard, that might cause unnecessary harm to the economy.

Hence, the challenge of this meeting will be how to open the door for slower rate hikes without making it seem like a surrender, since that could spark a stock market rally and a sharp drop in bond yields, adding fuel to inflation. It will be a difficult communications exercise, with Powell likely to stress that rates are still headed higher from here.

There is a flurry of crucial data releases on the schedule too, kicking off with the ISM manufacturing survey on Tuesday. Then on Wednesday, the ADP jobs report will hit the markets, ahead of the ISM services print on Thursday and the official employment report on Friday.

It seems the labor market finally felt the heat of the rapid-fire rate hikes in October. Economists expect another solid report with nonfarm payrolls seen at 200k, but the ‘tea leaves’ point to disappointment. The composite S&P Global survey revealed a slight contraction in employment, while applications for unemployment benefits rose during the month.

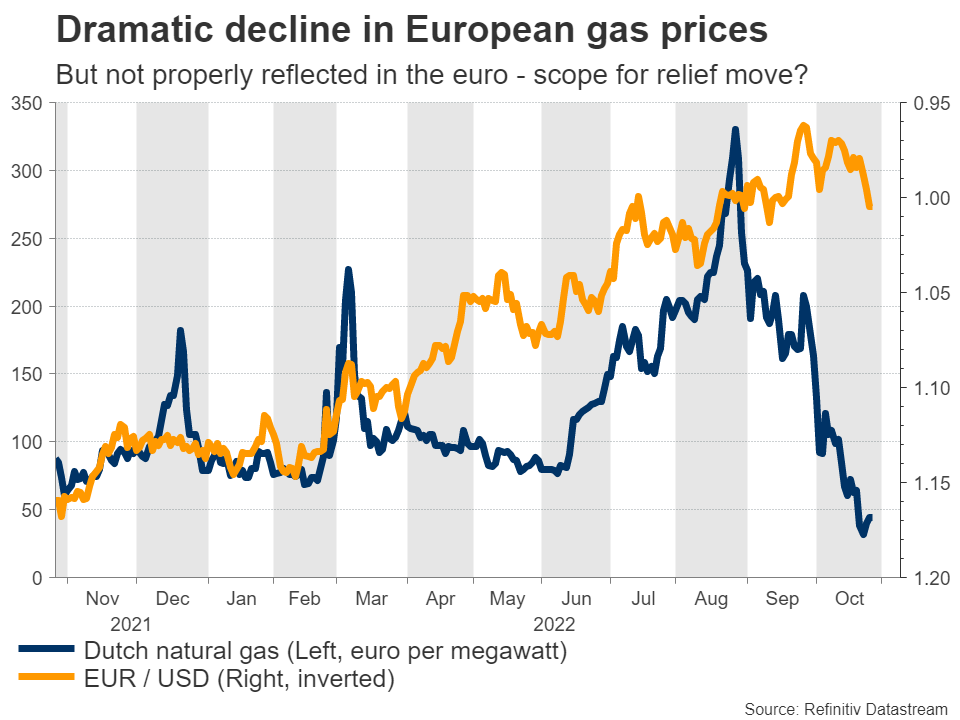

As for the dollar, while the broader picture is still positive, there is scope for a substantial retracement in this rally. The Fed is shifting into lower gear, the market is already flush with long-dollar bets, and the prospects for the euro have started to improve after the huge decline in European energy prices. Indeed, euro/dollar violated a crucial downtrend line this week, adding credence to this view.

BoE - Playing it safe

Over in the UK, with Rishi Sunak taking over as prime minister, order has been restored in FX and bond markets. The budget crisis seems to be fading into the rear view mirror, allowing sterling to realign with its classic drivers - monetary policy and risk sentiment.

Bank of England officials will announce their latest decision on Thursday, and money markets have fully priced in a three-quarter point rate increase. Speculation for an even bigger move evaporated recently, as deficit nerves calmed down and other central banks adopted a more cautious stance.

With the rate increase locked in, the market reaction will boil down to the meeting minutes, Governor Bailey’s press conference, and the updated economic forecasts.

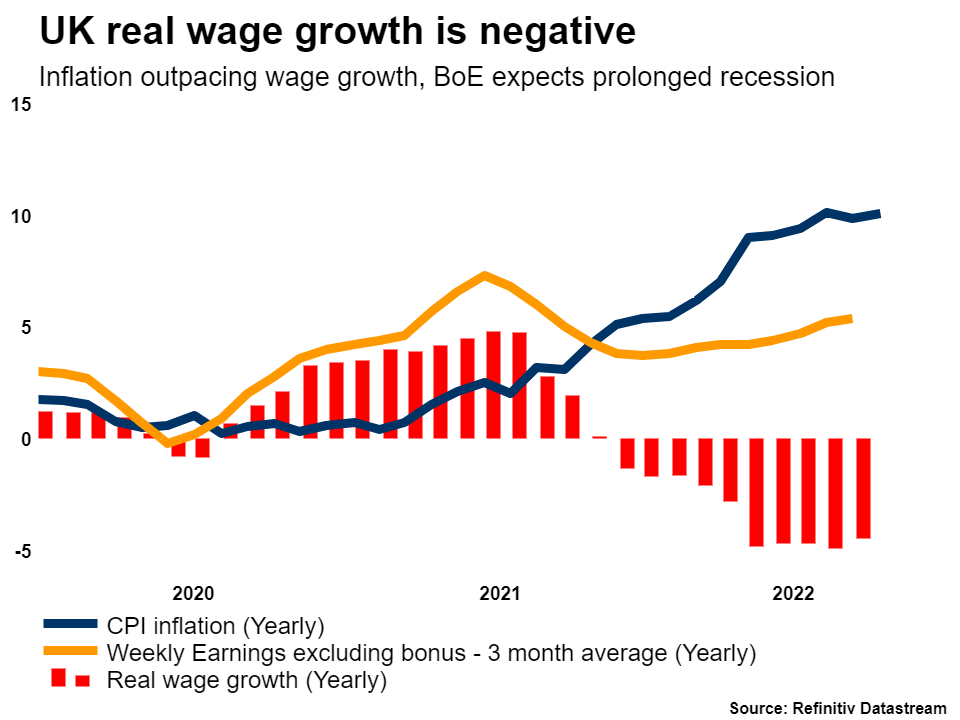

From a risk management perspective, this is not the time for the BoE to be a hero. Inflation is running above 10%, necessitating heavy action, but the central bank already expects a recession to begin this quarter and the latest business surveys confirm as much.

As such, the BoE might be inclined to strike a cautious tone overall. Signals of more shock-and-awe moves would risk causing further damage to an already-nervous bond market, which policymakers surely want to avoid. If so, sterling could slide on the news.

Beyond that, the currency’s fate will remain tied to global risk sentiment and stock market performance, as it has been all year.

Eurozone data deluge

In euro land, the ball will get rolling on Monday with inflation numbers for October and the first estimate of GDP growth for the third quarter. Unemployment data will follow on Thursday.

European business surveys point to an economy that is on the verge of recession, but following the massive decline in energy prices lately, it seems that the winter won’t be Armageddon after all.

With Fed/ECB policy starting to converge too, the outlook for the euro is not horrendous anymore. It is still premature to discuss a trend reversal, as that would likely require a ceasefire in Ukraine and brighter economic skies globally, but the worst seems to be behind the euro.

RBA and the commodity complex

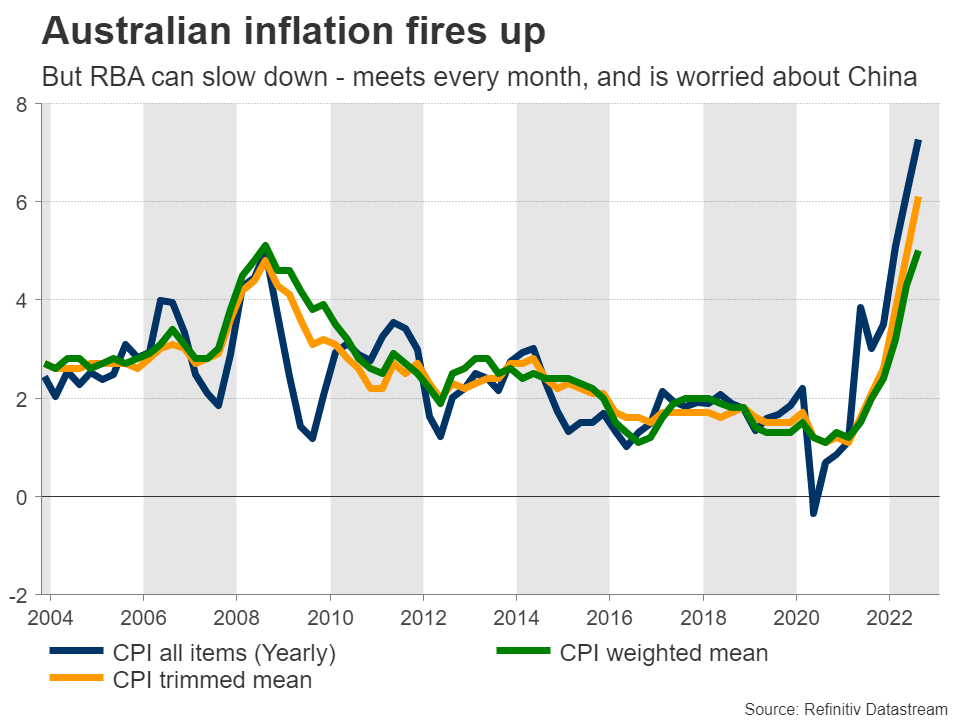

In Australia, the Reserve Bank will conclude its own meeting on Tuesday, and investors expect a cautious quarter-point rate hike. Despite a sharp acceleration in inflation, the RBA is worried about the global outlook, placing more emphasis on the rapid slowdown in China - Australia’s largest trading partner.

This decision is unlikely to change much for the aussie, which recovered lately alongside equity markets, albeit not convincingly. As long as the outlook for China remains so gloomy and the property market is in freefall, any relief rallies might remain shallow.

It’s a similar story for neighboring New Zealand, an economy that also relies heavily on Chinese demand to absorb its commodity exports. The nation’s employment report for Q3 is out on Wednesday.

In China, the business surveys for October will be released over the weekend. While the latest GDP growth print was solid, unemployment is on the rise and the offshore yuan is falling apart as foreign investors grow increasingly concerned that the political, regulatory, and economic trends of recent years will persist.

Finally in Canada, the jobs report for October will take center stage on Friday.