BoC to ponder one last rate hike

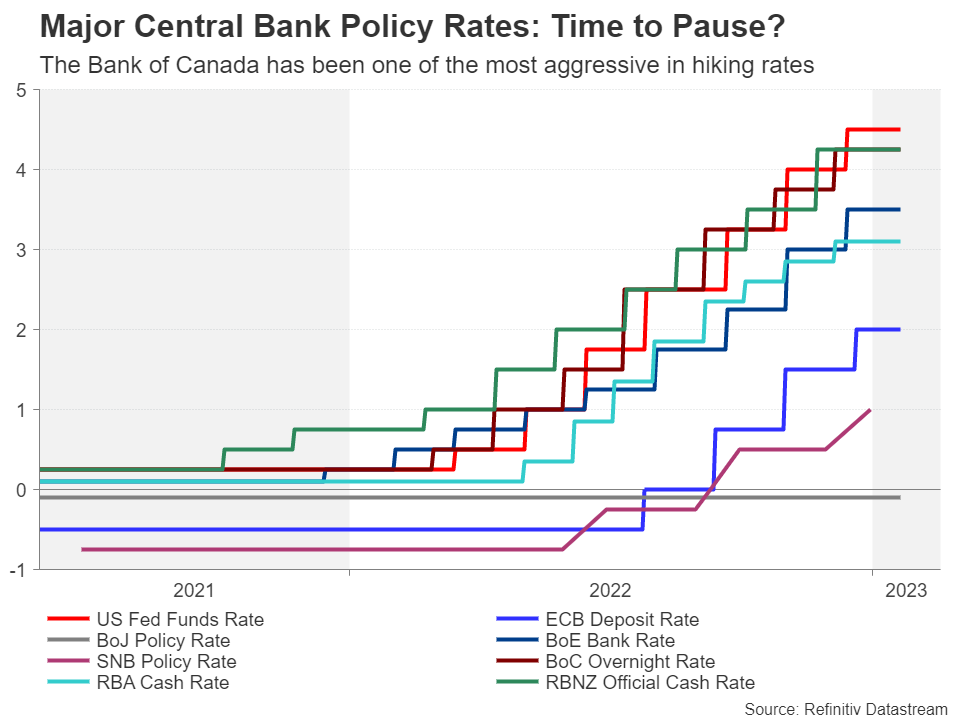

After having spent much of the last year front loading rate hikes, many central banks are now nearing the end of their tightening cycle and this theme is likely to dominate at least the first half of 2023. The Bank of Canada could take the lead in pausing rate hikes when it meets on Wednesday, but in all probability, it will raise its overnight rate by 25 basis points to 4.50% in one final tightening round.

Inflation in Canada peaked back in June but then stubbornly hovered slightly below 7%. There was better news from the December data as the retreat in CPI gathered pace, sliding to 6.3% y/y. However, underlying measures of inflation haven’t budged much in the last few months. What’s more, employment surged in December, making a pause appear somewhat questionable.

Markets have assigned about a 60% probability of a 25-bps rate rise, with the remaining bets placed on no change. This gives the Canadian dollar some scope for gains should the BoC lift rates in line with expectations. However, if the Bank maintains the same language as last time that it “will be considering whether the policy interest rate needs to rise further”, the loonie is more likely to slip after the decision.

US data could be a mixed bag for the dollar

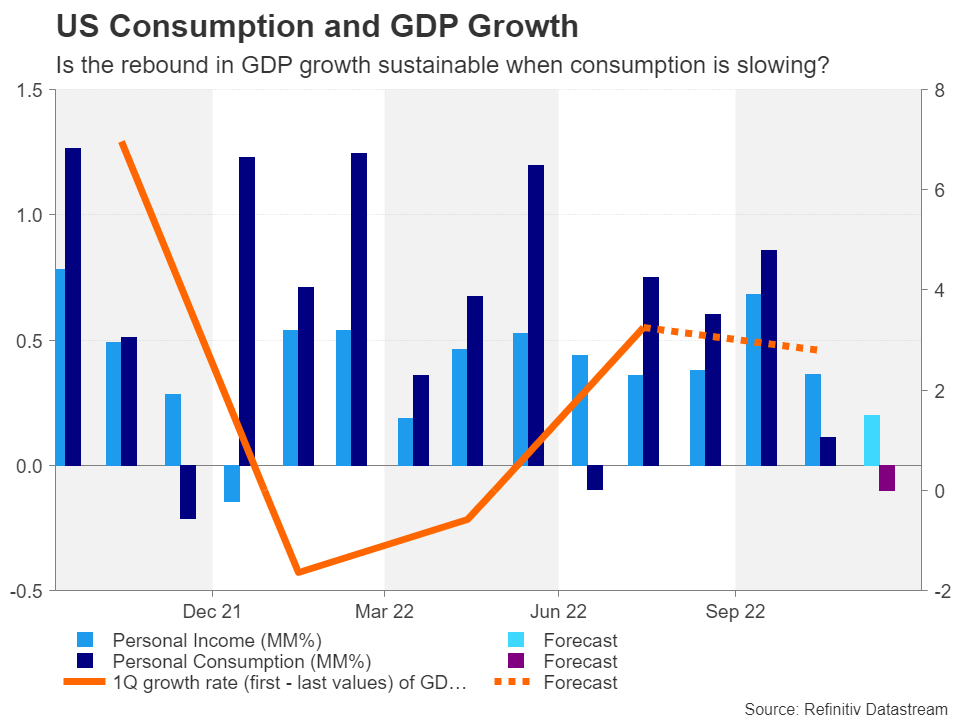

Just south of the border, the Fed is far from done with rate hikes and investors are getting more and more jittery about an impending recession. Inflation in America is well and truly on the way down, but so is pretty much everything else as cracks are appearing across the economy. The hot labour market is fast becoming the sole bright spot. But with payrolls being a lagging indicator, markets are increasingly out of lockstep with the Fed as they are not convinced it will be able to stick to its rate hike path where the terminal rate is somewhere above 5%.

The US dollar has been a big casualty of this divergence and next week’s releases could potentially stir even more confusion. Data on durable goods orders and the initial estimate of Q4 GDP are expected to be upbeat, with the former seen rising by 2.5% m/m in December and the latter by an annualized 2.8% q/q. Both are due on Thursday.

However, the flash S&P Global PMI readings out on Tuesday could point to another contraction in business activity in the early parts of January, while Friday’s personal income and spending numbers for December could be soft again. More importantly, the core PCE price index – the Fed’s preferred inflation gauge – could make further progress towards the 2% target.

There could be support for the dollar if the US indicators overall aren’t as dire as some of the more recent ones, such as the ISM non-manufacturing PMI and retail sales. But for Wall Street, traders might shrug off the data and focus on the Q4 earnings season as tech favourites Microsoft (NASDAQ:MSFT) and Tesla (NASDAQ:TSLA) will be among the many reporting their latest financial results.

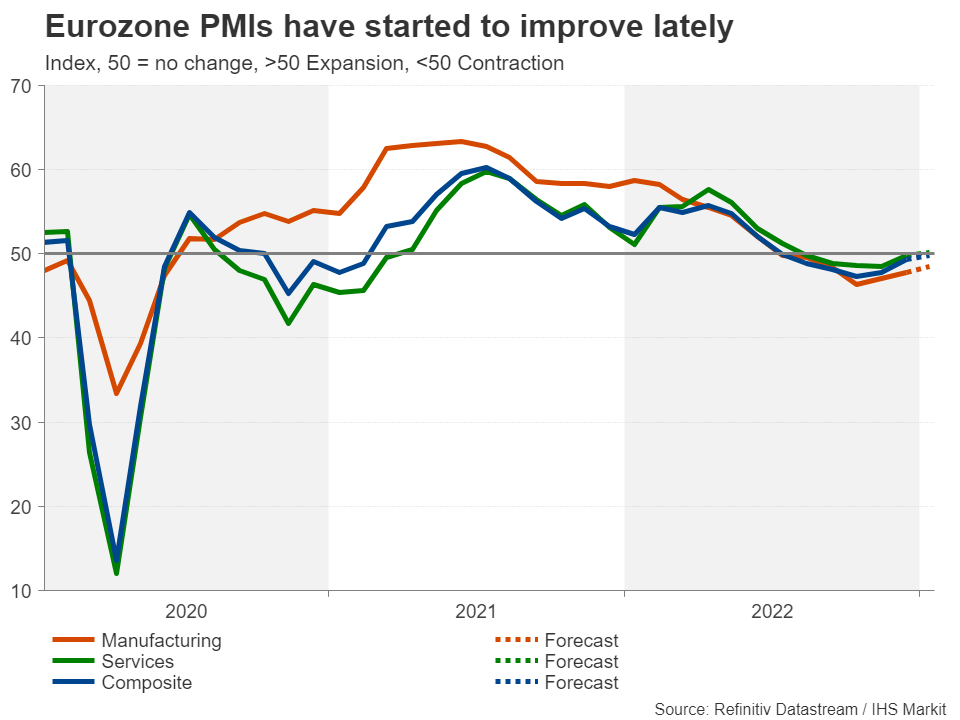

Not as bad as feared for the euro area

In Europe, the flash PMIs will be taking a more prominent role when released on Tuesday. Although the PMI numbers since the summer have been mostly knocking the euro down, lately, the picture from the surveys has been improving and this could be repeated in January. The manufacturing PMI is forecast to edge up from 47.8 to 48.5, while the services sector is expected to return to growth, with the PMI increasing to 50.2 from 49.8.

The current shift in the economic backdrops on either side of the Atlantic whereby there are growing signs that any recession in Europe will be a mild one but that the much-hoped soft landing in the US might not be possible after all has been a game changer for the euro.

The single currency is trying to establish a foothold above the $1.08 level and its prospects for 2023 look promising as the European Central Bank has reiterated its pledge for several more 50-bps rate hikes in the coming meetings.

If the PMIs provide further evidence that the worst is over for the continent from last year’s energy crisis, the euro’s uptrend could have further to go.

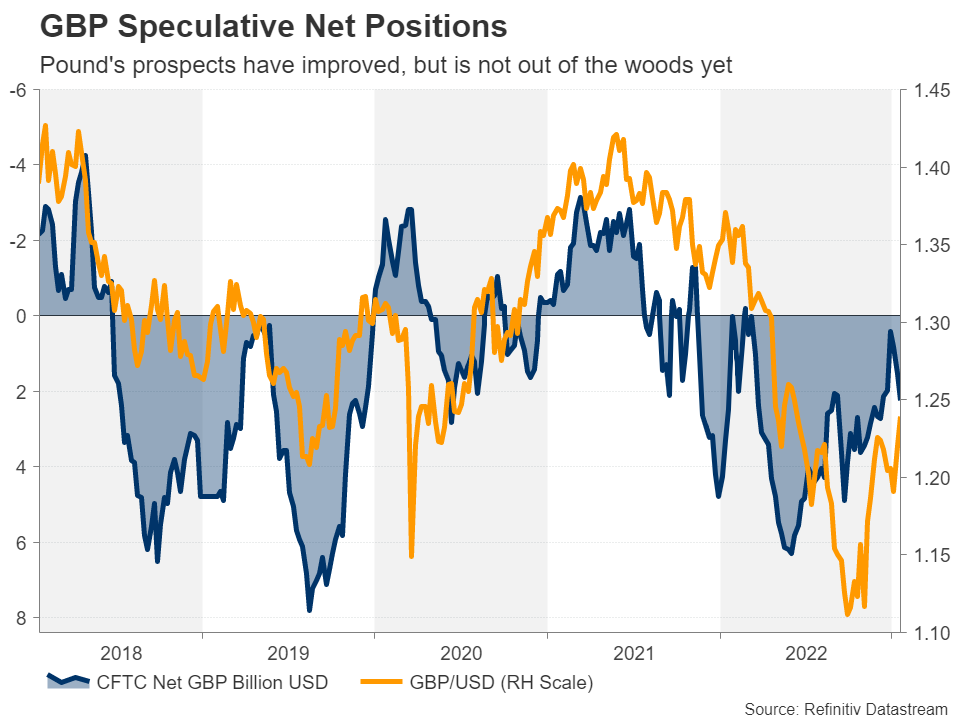

Sterling eyes new highs with UK PMIs

It could be said that the United Kingdom is in a very similar boat as the Eurozone but not quite. The odds of the British economy dodging a recession are somewhat lower and even if some of the gloom around the UK and sterling has been overdone, Brexit and the political chaos have seriously dented the outlook for the country.

Still, with the dollar on the backfoot, further positive surprises in UK data could help the pound surpass its December peak of $1.2445.

The flash January PMIs are due on Tuesday and investors will be looking out for an uptick in both the services and manufacturing prints. On Thursday, the producer price index for December might also attract some attention.

Aussie and kiwi on inflation watch

The coming week will be relatively quieter in Asia as Chinese markets will be closed for the Lunar New Year celebrations. But for the antipodean currencies, there should be plenty of excitement from the incoming CPI data.

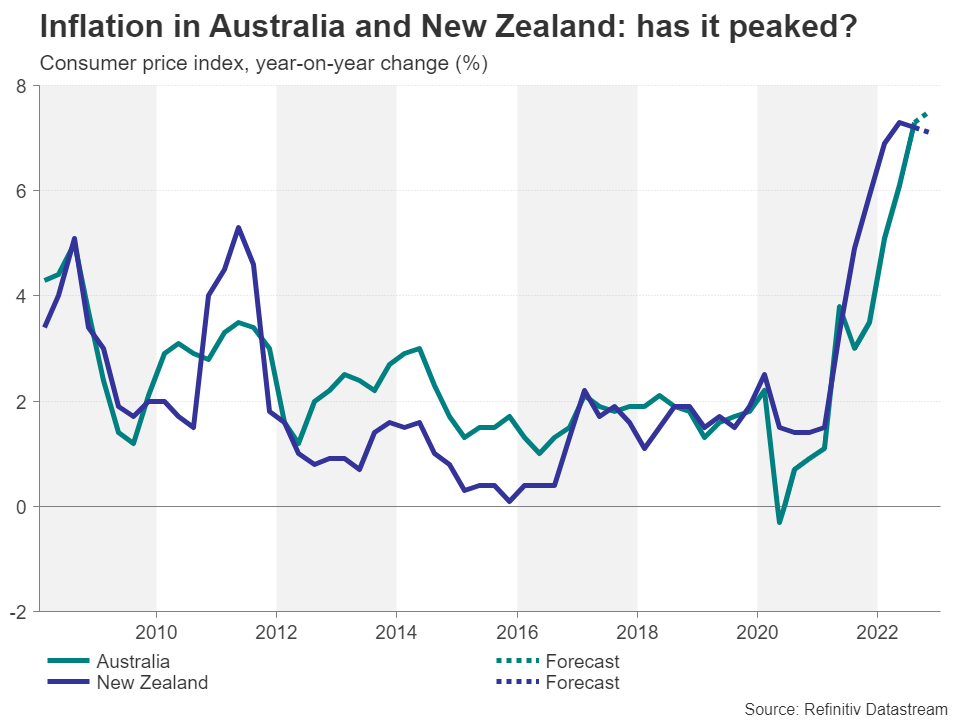

Both Australia and New Zealand will publish quarterly readings on the consumer price index on Wednesday. The Reserve Bank of Australia’s fight against inflation suffered a setback recently after the annual CPI rate crept back up to 7.3% in November. If there is a further deterioration in December and for the fourth quarter as a whole, investors are likely to increase their bets of a 25-bps rate rise at the February meeting from the current odds showing it’s a coin toss between a hike and keeping rates unchanged.

The aussie will also be keeping an eye on the flash PMIs and business confidence figures on Tuesday.

As for the kiwi, it’s likely to benefit more substantially from stronger-than-expected CPI prints as investors have priced in about a 25% chance of a bigger 75-bps rate increase by the Reserve Bank of New Zealand at its February gathering. The RBNZ’s cash rate is seen peaking well above 5% and at the current level of 4.25%, the bank could be hiking long after its peers have paused, so any upside surprises are likely to boost the local dollar.