A litany of central bank meetings lies ahead in the first half of December. The ball will get rolling with the Reserve Bank of Australia and the Bank of Canada next week, both of which are expected to raise interest rates, albeit at a slower pace. Meanwhile in America, business surveys and producer prices will shape expectations around Fed policy, helping investors decide whether the dollar’s best days are behind it.

RBA shifts into lower gear

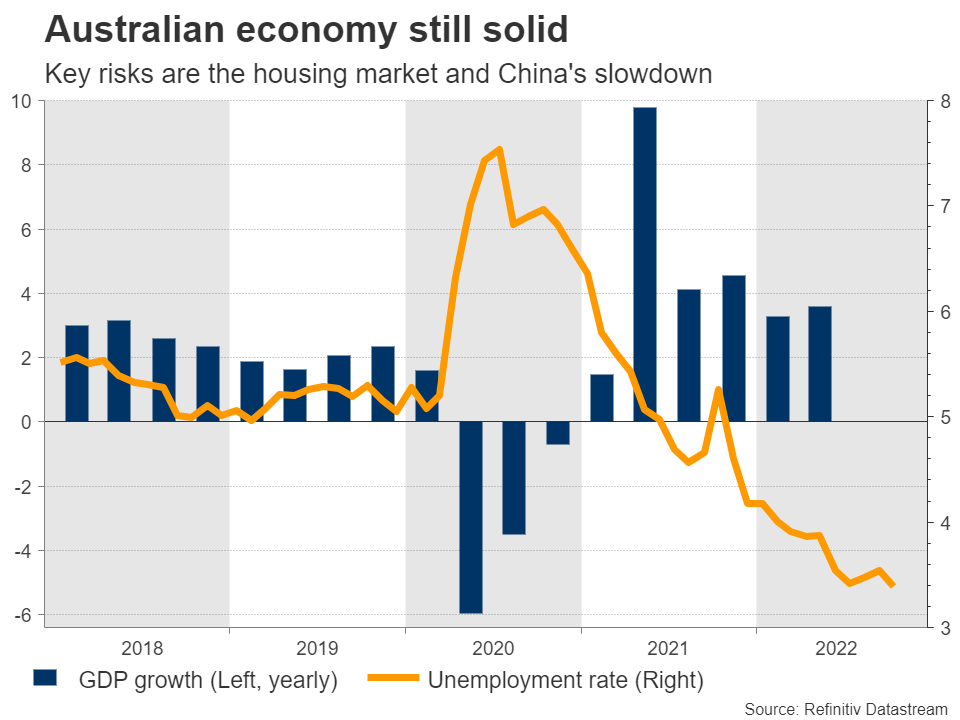

The Australian economy continues to fire on most cylinders, setting the stage for another rate increase when the Reserve Bank concludes its meeting early on Tuesday. Markets currently assign a 75% probability for a quarter-point rate hike and a 25% chance for no change at all.

Economic developments since the RBA last met have been favorable. The labor market remains extremely tight, with the unemployment rate having fallen back to a half-century low. Meanwhile, wage growth fired up last quarter, which is usually a sign that inflationary forces are becoming entrenched.

Yet, investors are saying the tightening cycle could come to a pause this month already. That's mainly because inflation unexpectedly cooled in October, fueling hopes that the worst has passed. With house prices also on the decline and external risks intensifying as the Chinese economy loses steam, there’s a solid case for the RBA to slow down.

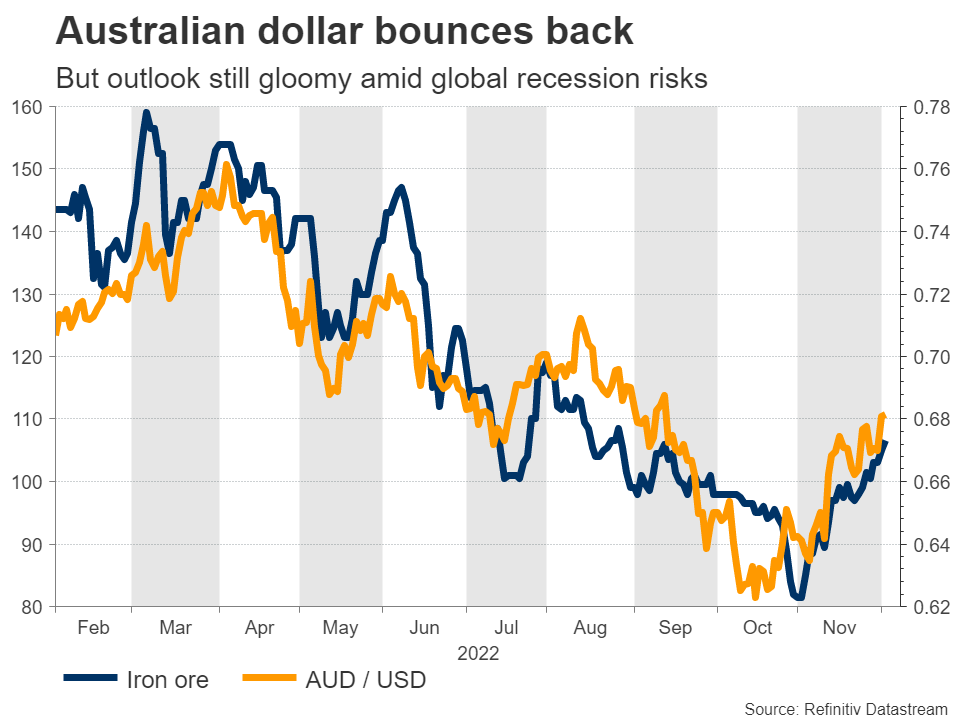

One way to balance everything is to raise rates but softly open the door for a pause next year, buying some time to monitor the effects of all its previous actions and how the global economy will evolve. In the markets, this could translate into a positive FX reaction initially, which might then reverse fairly quickly as the terminal rate gets calibrated lower.

Overall, the outlook for the aussie remains gloomy, despite the latest relief rally. The coming year will likely feature recessions in several economies, and even if Australia dodges one, it might still suffer collateral damage from reduced trade flows and commodity demand. With China slowing down and stock market valuations looking unrealistic too, it’s tough to be optimistic on a risk-sensitive currency like the Australian dollar.

On the data front, Australia’s GDP stats for Q3 will be released on Wednesday. A few hours later, China’s trade stats for November will hit the markets ahead of the nation’s inflation stats on Friday, both of which could be important for the aussie.

BoC - Almost there

Over in Canada, there’s a sense that the tightening cycle is about to conclude. Markets have fully priced in a quarter-point rate increase for Wednesday, which is expected to be repeated next month, before the Bank of Canada takes the sidelines for good.

The economy is doing fine, at least on the surface. Growth exceeded expectations last quarter, the labor market is still in good shape, and inflation is running at more than three times the BoC’s target, all of which argues for further rate increases.

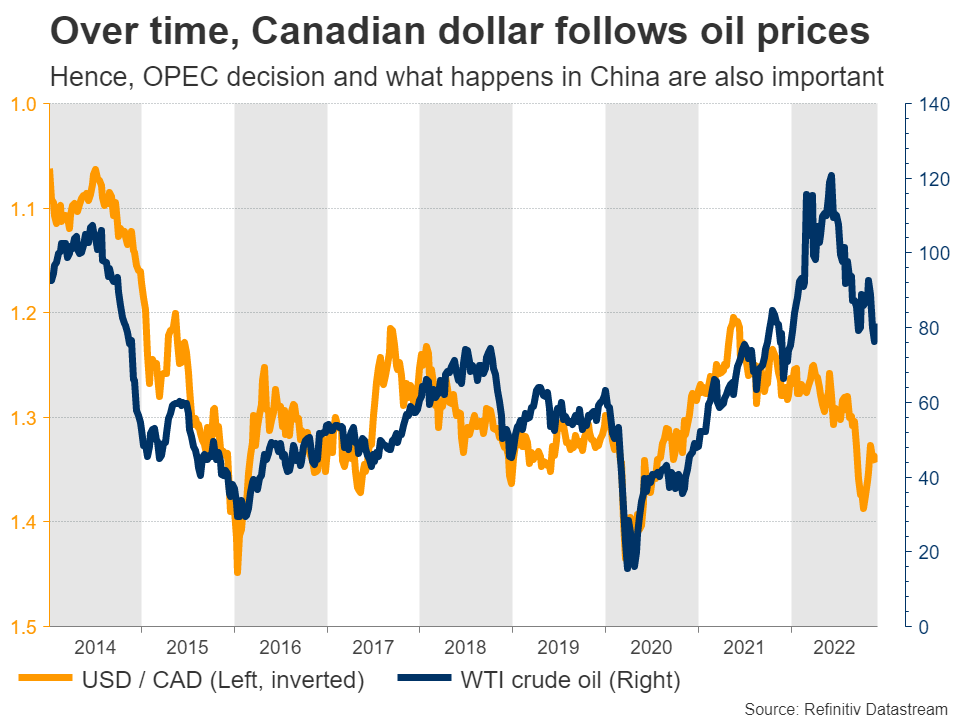

What’s making the BoC cautious is the notion of policy lags, as the full impact of the rate increases that have already been rolled out hasn’t been felt yet. Coupled with a housing bubble that has started to pop and extremely high private debt levels, the officials are concerned that if they keep pressing ahead, they could spark a financial ‘accident’.

Therefore, from a risk management perspective, it’s prudent for the BoC to play some defense here with just a quarter-point rate hike. Since the market is pricing in around a 15% chance for an even bigger, half-point rate increase, this could come as a minor disappointment for the Canadian dollar.

Ahead of the BoC decision, there’s an OPEC meeting on Sunday that could also prove crucial for the loonie, given its sensitivity to oil prices.

Dollar awaits key US data

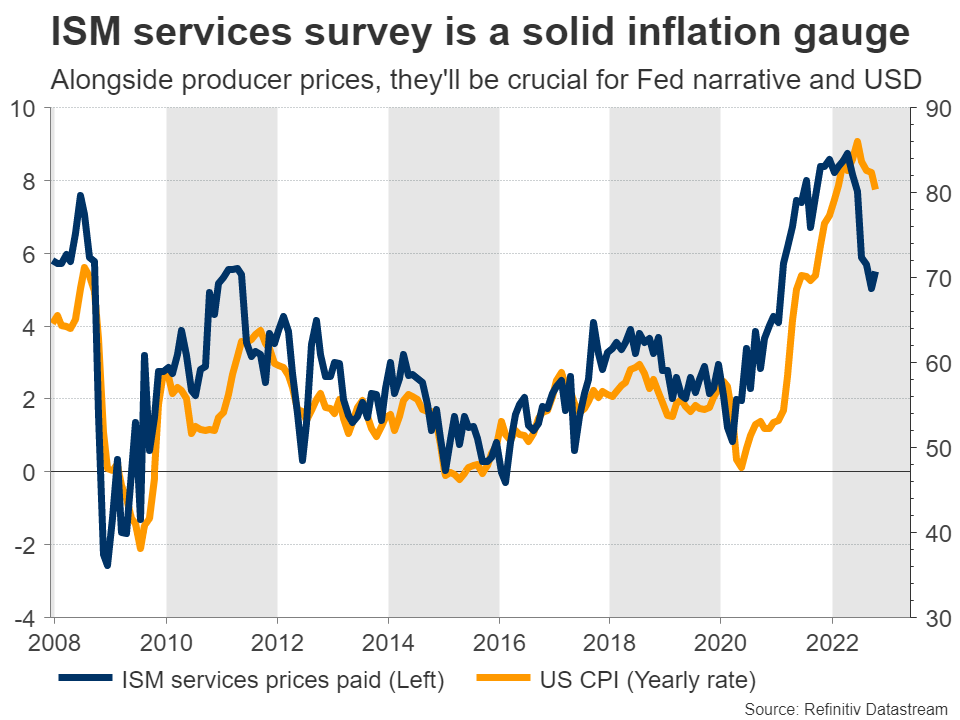

In America, the spotlight will fall on the ISM services survey on Monday, ahead of the latest batch of producer prices on Friday. Both will be crucial pieces of the puzzle as investors mull how high the Fed will raise rates and how long it will keep them there.

Market pricing currently implies a half-point rate increase this month, followed by a similar move early next year that pushes rates to 4.85%. At that point, the Fed is expected to stay on hold for several months, before cutting rates a notch towards the end of the year.

Economic data validate this narrative. Even though official US data remains solid with consumption and the labor market still in good shape, forward-looking indicators warn of trouble ahead. Hence, the Fed has to keep going for now, especially since inflation is still running hot, but is likely to encounter growth problems by the middle of next year.

As for the dollar, all this suggests that it’s too early to call for a bearish trend reversal just yet as the outlook for other major economies is even worse, but the rally is likely in its final chapters. A softer Fed profile is usually not enough to turn the tide in the dollar - it also requires an improving economic outlook in the rest of the world to draw capital outside the US, which is currently not the case.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Week Ahead: Australia and Canada Kick Off Central Bank Bonanza

ByXM Group

AuthorTrading Point

Published 12/02/2022, 07:21 AM

Updated 05/01/2024, 03:15 AM

Week Ahead: Australia and Canada Kick Off Central Bank Bonanza

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.