Actionable ideas for the busy trader delivered daily right up front

- Wednesday uncertain.

- ES pivot 1689.92. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader remains short at 1643.00.

We got our first down day on the SPX in a week, just barely, though the Dow did manage a modest 22 point gain on Tuesday. Still, this sort of action has to make me wonder once again if we're not due for a move lower soon. But instead of merely guessing, let's analyze the charts - and then guess :-)

The technicals (daily)

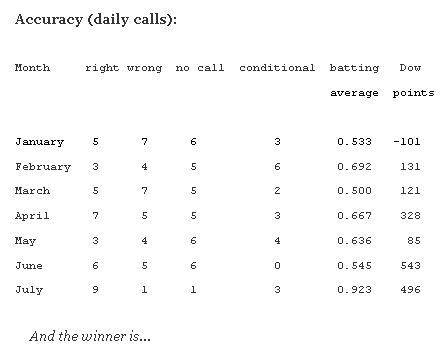

The Dow: It seems to be just one reversal warning after another on the Dow. Last three days: hanging man, star, and today inverted hammer. And none of them have come to anything as we continue to grind slowly higher, up another 0.14% on Monday. (And BTW, if you're following my daily call accuracy list below, it's based on the results of the Dow, so Tuesday was a hit). The chart appears to be sagging a bit but we remain in a rising RTC so I still can't really call this chart lower just yet.

The VIX: And what of the all-important VIX? Well here's something interesting - after being down three of the last four the VIX finally posted a non-trivial 3.01% gain on Tuesday with a classical bullish piercing pattern. And VVIX put in a bullish engulfing pattern. So despite remaining in a descending RTC, this is the perkiest news I've seen for the VIX lately. I'd not be surprised to see th3e VIX move higher on Wednesday. Oh, and Tuesday;'s low was right at support of 12.09, and that held up nicely. And I note that VVIX put in a bullish engulfing pattern too.

Market index futures: Tonight all three futures are decidedly mixed at 1:00 AM EDT with YM up by all of one tick, ES down one tick and NQ marching to its own drum, up a healthy 0.45%. After putting in a star on Monday, ES confirmed it as it moved lower on Tuesday with a red spinning top that just broke out of the rising RTC for a bearish setup. And despite a rally attempt right after Tuesday's close, ES is fading in the overnight. This is all a type of action we've not been seeing during the rally that began Jun 25th. Indicators continue to come off overbought too so I'm thinking now that this chart may be headed lower on Wednesday.

ES daily pivot: Tonight the pivot barely moves from 1690.00 to 1689.92. After threading about the old number all day long on Tuesday, it looks like ES has now decided to remain below the new level so this indicator becomes bearish.

Dollar index: On Tuesday the dollar posted its fourth consecutive loss, down another 0.34% and rapidly closing in on the 200 day MA at 55.97 on the $USDUPX. (a number that coincides with the lower BB). So with a steep downtrend in place, I see no signs of a reversal for the dollar on Wednesday.

Euro: The euro managed to make it three in a row on Tuesday for a bullish three white soldier pattern. However, the overnight is sinking to a greater degree than we've seen at this hour of the night lately, down 0.19% at this point. So it's possible we could see a pullback here on Wednesday, though this is far from certain.

Transportation: If you believe in Dow Theory (and I do), then Tuesday's action is somewhat concerning, as the trans dropped a significant 0.95% on a day the Dow gained 0.14%. This dropped them out of the latest rising RTC for a bearish trigger. It also completed a bearish stochastic crossover. With indicators remaining overbought, it looks like the stars are aligning for lower here on Wednesday.

I began noticing a few bearish signs a couple of days ago. They're becoming a bit more pronounced tonight, though not by much. But I do note that the market New High-New Low ratio hit 91:9 on Tuesday, and that's getting pretty overextended. Dr. Brett Steenbarger often made note of this one. Unfortunately, the pattern recently has been a "sneeze market". It starts going "ahh... ahhh" and everyone's waiting for the "choo!" only it never comes. So while it looks like the current advance has stalled out a bit, it's also not a sure bet to go lower, from what I can see tonight. Therefore, the only logical call is for Wednesday uncertain.

ES Fantasy Trader

Portfolio stats: the account remains at $115,000 even after 14 trades (11 for 14 total, 6 for 6 longs, 5 for 8 short) starting from $100,000 on 1/1/13. Tonight we remain short at 1643.00. Nothing new here.