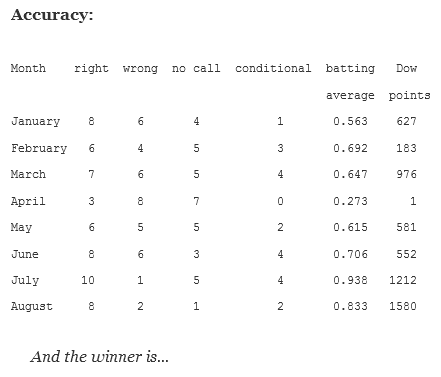

The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher.

- ES pivot 1893.75 holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias lower.

- Single stock trader: VZ now a swing trade buy.

Recap

Well it was another wild day on Wall Street Tuesday as the Dow opened up big as I had expected only to see all those gains evaporate after 3 o'clock when, apparently, the Chicoms decided to lower their interest rates again. That led to a 205 point loss for the Dow which makes four 200 point plus moves in a row and is, apparently, the only time in its entire history that that has happened.

So just what the heck is going on here? The market's crashing, the market's not crashing. The Fed is going to raise rates in September, the Fed is going to raise rates next March. We're in a correction, we're not in a correction. The economy is fundamentally fine, the economy is fundamentally flawed. Just who are you supposed to believe? Personally, the only thing I believe is the charts - so let's get right over there and see if we can make any sense at all out of this craziness.

The technicals

The Dow: The Dow just continues to get jerked around by the Chicoms. On Monday we got a tall hammer, which is a good reversal sign, and on Tuesday we ended up with a tall inverted hammer, also a good bullish reversal sign. And this one was accompanied by a bullish stochastic crossover and highly oversold indicators (RSI is now 3.48). The losing streak is now 6 in a row and, as we've mentioned, four in a row for 200 point plus moves lower, so there has to come a point where the selling is exhausted. Technically this chart looks like its going higher, but with the VIX still nearly 40 there's just no telling.

The VIX: Last night I said the VIX looked ready to move lower and indeed that's just what happened on Tuesday with an 11.59% decline - although it was on a green spinning top. Still that candle is in a bearish harami position and the indicators have now peaked at overbought and are proceeding lower. Also the stochastic just gave us the bearish crossover and it's at a very high level, which means that it's more likely for the VIX to move lower than higher from here.

Even more interesting, and this is a chart I haven't seen anyone mention lately, is the VVIX, which basically measures the volatility of the VIX. Just take a look at this. The long term historical mean of the VVIX is 86. On Monday it hit an astonishing high of 212. Then on Tuesday it gapped down hard to end at a still breathtaking 192 on a small green spinning top. Those three most recent candles put together constitute a good evening star and that's a bearish pattern. We also have a bearish stochastic crossover and indicators that are still overbought but now starting to move lower. That all portends a lower VIX. And that means that the market is likely to move higher real soon now.

Market index futures: Tonight, all three futures are higher at 1:04 AM EDT with ES up 1.32%, On Tuesday ES put in what ended up being a super tall long-legged doji star sitting at the bottom of Monday's candle. With RSI now at an extraordinarily low 0.63 and the stochastic lying flat on the floor one would think that there's a lot more upside potential here than downside risk. But the volatility just keeps on coming in the overnight .

ES daily pivot: Tonight the ES daily pivot ticks up from 1889.00 to 1893.75. An overnight rally in ES has now put it back above its new pivot so this indicator is once again bullish.

Dollar index: After a big gap down on Monday the dollar gapped right back up again retracing 50% of those losses on Tuesday. Monday's 1.27% gain was enough to form a bullish stochastic crossover and send the indicators higher although they are still oversold. We're also still in a descending RTC but nearing the right-hand edge. All in all this chart looks like it might have possibilities to move higher again on Wednesday.

Euro: Meanwhile volume continue to be extraordinarily high in the euro trade on Tuesday and after a tall green candle on Monday, the euro fell right back down again on Tuesday with a red inside harami to close at 1.1429. The overnight is gapping up higher once again so with the current muddled state of affairs who knows where this one is going on Wednesday.

Transportation: Despite an exponential run down in the trans, there seems to be no stopping this headlong rush to oblivion. I extrapolated the descending RTC and if the trend continues falling at the current rate they will hit zero by November 8th of this year. That's right, absolute zero. The losing streak is now six days and despite massively oversold indicators the stochastic has yet to form a bullish crossover. In fact its lines are now falling off the bottom of my chart - I can't even see them anymore. So I still can't call a reversal here yet.

I'm probably taking my life in my hands by saying this, but purely technically we now have two very good reversal candles: a giant hammer followed by a giant inverted hammer. And all the charts remain crazy overextended in all sorts of directions so the only logical call is for Wednesday higher. But Lord knows, the market has been anything but logical recently. All it will take to derail this is one peep out of the Peeple's Bank of Communist China or some inopportune sound bite from a Fed head given that the VIX is still up there in outer space somewhere. Either way, should make for an interesting session.

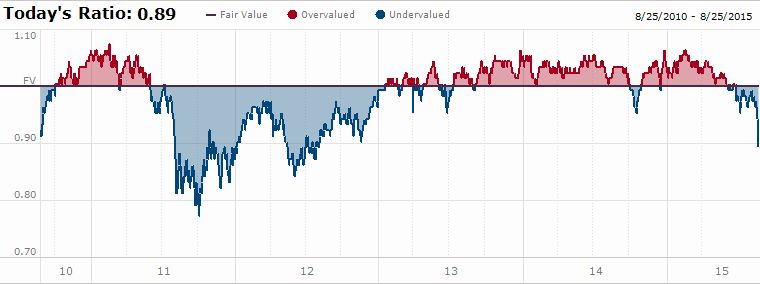

In closing, there is an interesting chart I would like to show you:

Now it's interesting to note that if you look at the Dow in 2011 both August and September were truly crummy months. But once September was over October took off and we went on a 7 month winning streak. If history is any guide, this would imply that we have another month of downward pressure before seeing a significant rally into the end of the year. Just sayin'. I grabbed this chart from Morningstar's great website. This is their market fair value indicator that tells whether the market as a whole is overbought (the red areas) or oversold (the blue areas). Today this indicator hit 0.89. The last time we were at this level following an extended period of being overbought was back on August 4th, 2011. Notice the similarities between the situation we have now and what was going on back in 2011. You have an extended period of being overbought after which we hit the break-even level then we have a double bottom of oversold conditions followed by a big crash. In 2011 we ended up hitting 0.79 on October 4th.

Single Stock Trader

Last night Verizon Communications (NYSE:VZ) looked like a good buy. And on Tuesday it indeed opened way higher and then continued upwards only to give it all back in the end. Leaving us right where we started. However the indicators are still way oversold and the stochastic is just microns away from a bullish crossover so I still have to think that this chart has possibilities. The fact that support at 40.47 held is encouraging.