The Hoot

Actionable ideas for the busy trader delivered daily right up front

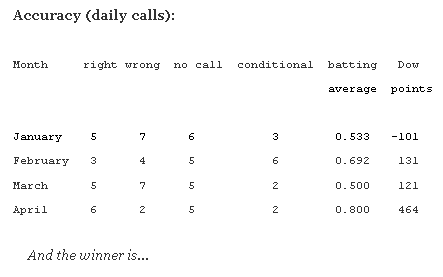

- Wednesday higher, medium confidence.

- ES pivot 1553.25. Holding above is bullish.

- Rest of week bias higher technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

And this, folks is why I never use stop orders on either my ESFT ES fantasy trading account or in my real trading account. I'll bet there's a lot of people kicking themselves tonight who got stopped out of trades or investments they should have hung onto. And this is just the disgraceful sort of thing that makes people think the market is rigged. I think the SEC should investigate and that Twitter should reimburse people for their losses. Of course, one might argue that anyone who makes their trading decisions from a Twitter news stream deserves what they get. I wonder if any trades are going to be busted as a result of this hack. And I really wish that they catch whoever was behind this and put them away for a long long time.

I find it interesting though that this mini-crash stopped at the 200 period MA on the dot (the dashed orange line). Don't tell me this number isn't heavily programmed into all the bots.

So aside from some more market shenanigans, overall Tuesday played out quite nicely. The technicals played out well and the housing news that I'd been afraid of last night didn't hinder another positive day that saw the Dow close up 152. So is this the end or is there a rally in store? We head right back to the table and figure out where to plunk down out hard-earned cash on Wednesday.

The technicals (daily)

The Dow: Today's big green marubozu provided a descending RTC exit for a bullish setup, though I'd just about call this one a trigger in its own right. Add in an RSI that has now bottomed at oversold and a newly completed bullish stochastic crossover and it looks like there's definitely more room to run here on Wednesday.

The VIX: Last night I wrote "it's certainly possible we might see another [red candle] on Tuesday." And sure enough, the VIX went down again, this time losing another 6.32%. The candle is a tall inverted hammer, but that's only due to that Twitter nonsense, so I completely discount that. Removing that spike leaves just an ordinary red candle. And with no nearby support, indicators continuing to decline, and a steep descending RTC now established, it looks like the VIX could go lower still on Wednesday.

Market index futures: Tonight all three futures are higher at 12:27 AM EDT with ES up by 0.11%. This chart now has a lot going for it. On Tuesday we got a bullish three white soldiers pattern, a descending RTC exit for a bullish trigger, a new rising RTC, all the indicators rising smoothly off oversold, an upper BB still 13 points away, and positive follow-through in the overnight. What's not to like?

ES daily pivot: Tonight the pivot jumps from 1553.25 to 1566.42. But even with that, ES remains above the new pivot by nearly 10 points, so that's a bullish sign.

Dollar index: The dollar gapped up 0.44% on Tuesday for a stubby hanging man and a stochastic that's flattening out for a bearish crossover. But we remain solidly in a rising RTC and are still under the upper BB so it's premature to call the dollar lower just yet. Maybe by the end of the week though.

Euro: After a few complicated days, the euro took a decided drop on Tuesday to close at 1.2995, its lowest level since April 8th. But this move wasn't enough to call a new trend and the indicators continue to lack direction, so I'm taking a second pass in a row on this chart. We might see a small move higher on Wednesday, but that's just idle speculation.

Transportation: Monday was the bullish RTC trigger and Tuesday was the payoff, with a 0.28% gain for the trans. This gives us a new rising RTC rising indicators, and no nearby resistance so I'd say we could move higher again on Wednesday.

Things are still looking reasonably bullish tonight and I'm still not seeing any bearish reversal signs. And it doesn't look like we're really all that over-extended yet, so I'm just going to vote for another close higher Wednesday.

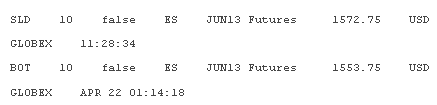

ES Fantasy Trader

Today we booked a decent profit on Sunday night's long. In this case, patience definitely paid off. I was briefly considering bailing out around mid-day Monday when I had a few thousand in profit, and then began to doubt myself when that all evaporated and the trade went in the hole. But we bounced nicely on Tuesday for a handy 19 point gain.

Portfolio stats: the account now rises to $107,750 after 11 trades (9 for 11 total, 4 for 4 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside, because while I am expecting more upside, I think we've already caught the majority of this move which makes the risk/reward of going for the rest of it unacceptable in my book.