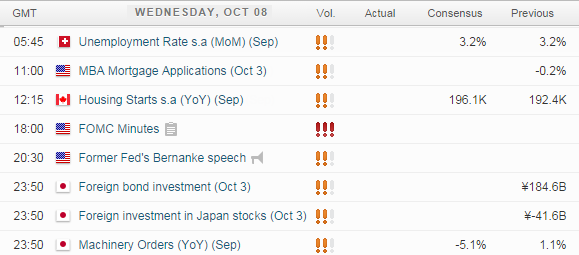

UP NEXT:

CAD: Housing Perm its unexpectedly plunged by 27.3% in August so will be interested to see if Housing Starts also mirrors this. Wityh USD/CAD lookig heavy belw resistance then any strength from US housing may provide short swing trades leading up to the FOMC minutes.

USD: FED minutes tonight will no doubt hog the headlines tomorrow. To get up to speed you can read the summary of the previous statement we wrote last month. Along with the usual clues traders will be seeking, it will also be interesting to see how string the arguments were from each voting memeber in regards to rate timings. There does still seem to be contrasting views within the FED with Traders buying the Greenback on any hint of hawkishness. With the USD hovering near 4-year highs and with so much anticipation of interest rates to be raised then this does leave room for dissapointment and an eventual deep correction for the USD.

TECHNICAL ANALYSIS:

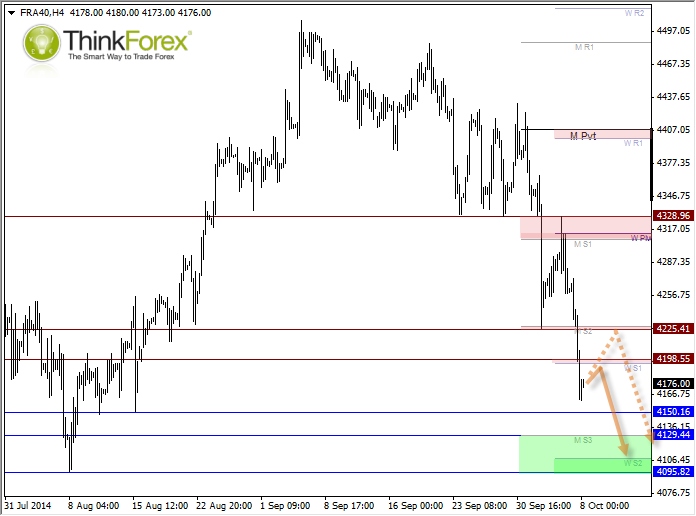

CAC 40: Targeting August lows

To follow on from yesterday's idea, we can see FRA 40 didn't hang around before plummeting to new lows. I would prefer to see a mild bounce into resistance before taking a further short position. However also be on the guard for a deeper retracement as you can see that historically the retracements can be quite deep before the follow-through occurs.

USD/CAD: Swing trade below 1.12

With FOMC minutes and CAD data then we should at least see a directional move on USDCAD tonight. Price is below 1.12 handle and the Weekly Pivot so bearish setups could be considered here prior to the events.

Due to being against the trend I would prefer to have smaller targets, with 1.109 providing a likely bed of support.

A Dovish FOMC statement may be required to break it below this zone which could then target the bullish trendline.