While the economic calendar remains light this week our fundamental analysis focuses predominantly on movements in EURUSD and GBPUSD. Both currencies appear to be showing signs of being overbought on long term horizons which mean a reversal may be not be too far away.

Even though the majority of analysts turned bearish on EURUSD at the start of the year, EURUSD has had a good couple of months, battling through the 1.38 barrier and hitting a fresh two year high just last week.

Euro strength has come in the form of ECB resilience as the central bank has failed to give into trader’s demands for looser policy action.

Looking at open position data, however, reveals a very one-sided market developing and this is often the precursor to a change in trend.

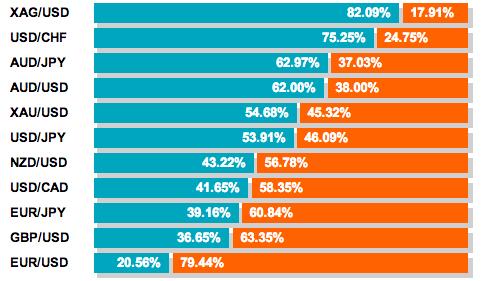

According to data from forex broker Oanda, only 20% of current open positions are long trades, making EURUSD the most one-sided market out of all the major currency pairs at present. This situation is unlikely to last long and the most likely scenario is for a decent pullback in EURUSD, which will allow more longs back into the market.

The British pound has been similarly resilient so far this year and that has seen cable hit 4 year highs.

Just like the ECB, the BOE remained committed to current policy measures in last month’s meeting and also indicated that rate rises would be on the cards sooner than most traders had expected. As a result, the trend for GBPUSD has clearly been up so far this year.

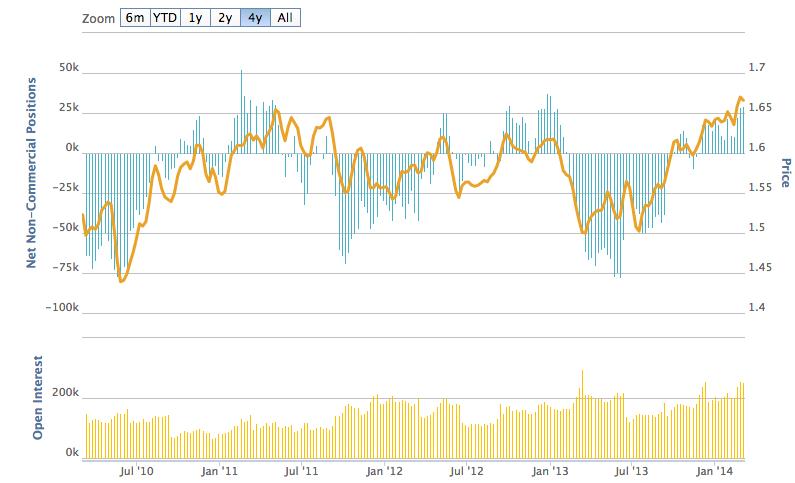

It is never wise to bet against the prevailing trend, but Commitment of Traders (COT) report data does indicate that a correction may be on the way.

Taking a long term horizon, the COT chart (below) shows how net non-commercial positions have hit the 25,000 mark on several occasions over the last 4 years. And on nearly every occasion, it turned out to be a great time to short the currency. This was the case in May 2011, May 2012, October 2012 and January 2013.

Going forward, it is impossible to say whether history will repeat itself again but a short correction would seem to be a likely outcome. GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">