• Sterling spikes after BoE inflation report

• Gains particularly strong against EUR, CHF

• AUDUSD possibly set to test 0.920/50

Today’s big mover was sterling, as the Bank of England’s Quarterly Inflation Report sent the currency on a moonshot against the struggling euro and Swiss Franc. Elsewhere, NOK was a big mover and the Scandie picture is interesting in general heading into critical event risks.

Looking ahead, in addition to the Scandie central bank policy risks tomorrow, note that we have an Australian employment report up tonight and US Retail Sales and Yellen’s second round of testimony tomorrow. AUD is particularly interesting after the break above 0.9000 in AUDUSD and we look for whether the squeeze will continue toward 0.9200/50 or pivot lower on a weak jobs report.

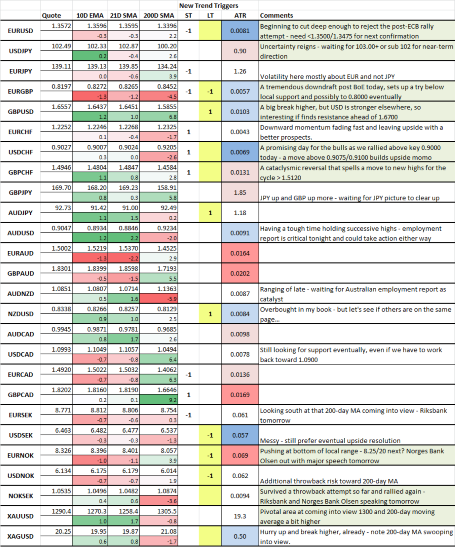

Today’s FX Board (beta)

EUR/GBP and GBP/CHF were the biggest movers today on the BoE inflation report as EUR/GBP crushed all the way lower to the ultimate local support all in one fell swoop. The momentum is now overwhelming on this move and we could test to new lows for the cycle and even on to new multi-year lows.

EUR/GBP" title=" EUR/GBP" align="bottom" border="0" height="343" width="455">

EUR/GBP" title=" EUR/GBP" align="bottom" border="0" height="343" width="455">

The rally today engulfed all most of the previous range trading as we focus on whether the pair can sustain a rally beyond 1.5120 in the days ahead.

GBP/CHF" title="GBP/CHF" align="bottom" border="0" height="343" width="455">

GBP/CHF" title="GBP/CHF" align="bottom" border="0" height="343" width="455">

A key Scandie battleground tomorrow in NOK/SEK, as the pair pulled back above 1.0500 today after a threat below on the mixed Norway GDP data. Tomorrow we have the Riksbank rate decision and Swedish employment report and the Norges Bank’s Olsen out making an annual policy speech.

NOK/SEK" title="NOK/SEK" align="bottom" border="0" height="343" width="455">

NOK/SEK" title="NOK/SEK" align="bottom" border="0" height="343" width="455">

Gold is pushing at key levels here. In the bigger picture, it’s time for the rally to get serious or find a more volatile rejection than it has seen thus far.

XAU/USD" title="XAU/USD" align="bottom" border="0" height="343" width="455">

XAU/USD" title="XAU/USD" align="bottom" border="0" height="343" width="455">

AUD/USD is nearing the highs for the year and will trigger off tonight's employment report possibly sending it toward the 200-day moving average in the days ahead on strong Aussie numbers and support from commodity markets or pivoting back lower on a weak number. Strategically, it is still looking for bear market resumption — it's a question of local entry levels at this point.  AUD/USD" title="AUD/USD" align="bottom" border="0" height="343" width="455">

AUD/USD" title="AUD/USD" align="bottom" border="0" height="343" width="455">