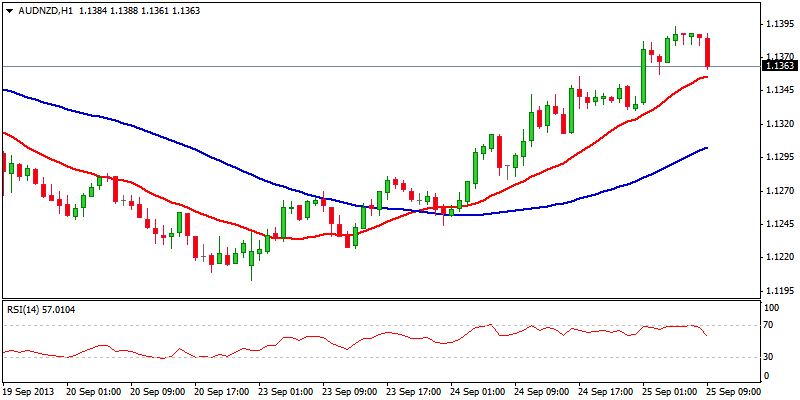

The cross remains supported and extends near-term corrective phase off 1.1203 low, with over 38.2% of 1.1655/1.1203 fall being retraced on a rally to 1.1393 so far. Approaching initial 1.1400 barrier, broken bull trendline off 1.1197 and 1.1430, 50% retracement, keeps focus at the upside, with clearance of these hurdles required to confirm near-term base and allow for stronger correction. Positive near-term studies support the notion, however, overbought conditions see corrective pullback preceding fresh rally, with 1.1300 support required to contain. On the other side, negative daily studies keep the downside vulnerable, with loss of very strong 1.1200 support, to resume larger bear-phase.

- Res: 1.1393; 1.1400; 1.1430; 1.1468

- Sup: 1.1330; 1.1300; 1.1279; 1.1244

AUD/NZD" title="AUDNZD" width="800" height="400">

AUD/NZD" title="AUDNZD" width="800" height="400">