Medivation (NASDAQ: MDVN) is best known for developing therapies to treat serious diseases. Earlier in 2014 the biopharmaceutical company received FDA approval to expand the use of Xtandi, a prescription medicine used to treat men with prostate cancer.

Since the expansion of the drug was approved Medivation’s (NASDAQ:MDVN)) stock has increased about 60%. In addition, the company raked in $200 million in revenue during their most recent quarter.

On January 22nd, Medivation and partner Astellas Pharmaceuticals reported data collected from a TERRAIN study, which evaluated Xtandi (enzalutamide) in comparison to Casodex (bicalutamide), a direct competitor of the treatment in metastatic prostate cancer. The study achieved its goal showing a statistically considerable increase in the lives of patients with metastatic prostate cancer when using Xtandi over Casdodex. In addition, the study also revealed a delay in tumor growth in patients using Xtandi.

Neal Shore, MD, co-principal investigator of the TERRAIN study and Medical Director, Carolina Urologic Research Center said of the data, "The results of this study showed that enzalutamide provides a longer duration of disease control in the studied patient population compared to bicalutamide…This robust data set adds to an impressive and consistent body of data for enzalutamide across multiple studies and stages of prostate cancer."

Medivation is scheduled to announce its fourth quarter 2014 earnings report on February 25th.

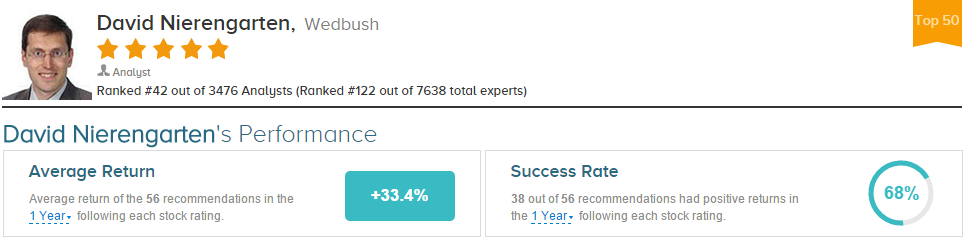

Analyst David Nierengarten of Wedsbush weighed in on Medivation on February 2nd, reiterating an Outperform rating on the stock with a $118 price target. Nierengarten reasoned his bullish rating to sales of Xtandi coming in ahead of his estimates, which were $218.3 million. “Astellas reported US Xtandi sales of $230.2 [million].” The analyst believes, “[full year 2014] US sales will now reach approximately $680M, ahead of our previous estimate of $667M and consensus of $645M.” He concluded, “After the EU label expansion of Xtandi to use in pre-chemotherapy patients back in December, we expect stronger growth to be reflected in Q1:15; as previously noted, Zytiga sells more ex-US than US, indicating significant market.”

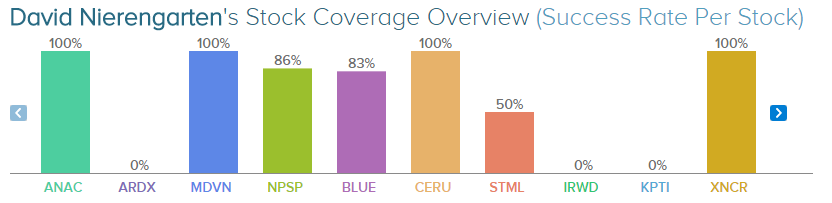

David Nierengarten has rated Medivation 5 times since September 2012, earning a 100% success rate recommending the stock and a +20.6% average return per recommendation.

Nierengarten often rates stocks in the biopharmaceutical industry, such as Bluebird Bio (NASDAQ: BLUE) and NPS Pharmaceutcals (NASDAQ: NPSP), helping him earn an overall success rate of 68% recommending stocks and a +33.4% average return per recommendation.

The analyst has rated Bluebird Bio 6 times since July of 2013, earning an 83% success rate recommending the company and an impressive +103.7% average return per recommendation. Likewise, Nierengarten has rated NPS Pharmaceuticals 9 times since March of 2013, earning an 86% success rate recommending the company and a +65.9% average return per recommendation.

However, Neirengarten is not always as accurate with his recommendations. The analyst has rated Stemline (NASDAQ: STML) twice since September 2013 with only a 50% success rate and a -30.8% average loss per recommendation.

Disclosure: All recommendations from David Neirengarten, sourced from TipRanks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Wedbush Weighs In On Medivation Following Phase II TERRAIN Results

Published 02/03/2015, 05:14 AM

Updated 05/14/2017, 06:45 AM

Wedbush Weighs In On Medivation Following Phase II TERRAIN Results

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.