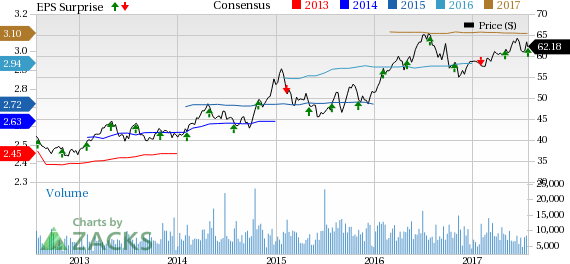

WEC Energy Group (NYSE:WEC) reported second-quarter 2017 adjusted earnings of 63 cents per share, beating the Zacks Consensus Estimate of 59 cents by 6.8% and the year-ago figure of 57 cents by 10.5%.

Revenues

WEC Energy’s total revenue amounted to $1,631.5 million, beating the Zacks Consensus Estimate of $1,592 million by 2.5%. Reported revenues also surpassed the year-ago figure of $1,602 million by 1.8%.

Highlights of the Release

Residential consumption of electricity in the first half of 2017 was down 1.1% year over year. Electricity utilized by small commercial and industrial customers also dropped 1% year over year. Electricity used by large commercial and industrial customers, excluding the iron ore mines in Michigan's Upper Peninsula, declined 0.5%.

Total operating expenses in the quarter under review was $1,269.3 million compared with $1,269.9 million.

Operating income in the reported quarter was $ 362.2 million, up 9.1% from $332.1 million a year ago.

The company’s interest expenses in the second quarter increased 1.8% year over year to $101.9 million.

WEC Energy's utilities expanded the customer base in the reported quarter. At the end of second-quarter 2017, the company had an additional 9,000 electric and 13,000 natural gas customers compared with the year-ago quarter.

Financial Position

As of Jun 30, 2017, WEC Energy had cash and cash equivalents of $36.5 million compared with $37.5 million as of Dec 31, 2016.

As of Jun 30, 2017, WEC Energy’s long-term debts of $8.8 billion, decreased almost 3.9% from the 2016-end level.

In the first half of 2016, cash flow from operating activities was $1,268.0 million, marginally higher than $1,224.1 million in the year-ago period.

WEC Energy’s capital expenditure in the first half of 2016 was $790.0 million, 26.1% higher than the comparable year-ago period.

Guidance

The company reaffirmed its 2017 earnings guidance in the range of $3.06 to $3.12, with the expectation of closing the year in the upper end of the range.

Zacks Rank

WEC Energy currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Here are a few companies in the utility sector that have the right combination of elements to post an earnings beat this quarter.

Allete, Inc. (NYSE:ALE) has an Earnings ESP of +5.36% and holds a Zacks Rank #2. It is slated to report second-quarter 2017 results on Aug 2.

Pattern Energy Group Inc. (NASDAQ:PEGI) has an Earnings ESP of +23.08% and carries a Zacks Rank #2. It is slated to report second-quarter 2017 results on Aug 4.

The AES Corporation (NYSE:AES) has an Earnings ESP of +20.00% and holds a Zacks Rank #2. It is slated to report second-quarter 2017 results on Aug 8.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

Allete, Inc. (ALE): Free Stock Analysis Report

Pattern Energy Group Inc. (PEGI): Free Stock Analysis Report

Original post

Zacks Investment Research