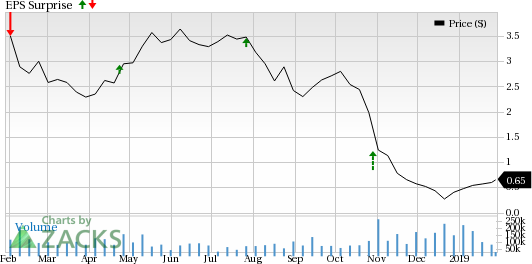

Weatherford International Ltd. (NYSE:WFT) is expected to report fourth-quarter 2018 earnings on Feb 1.

Notably, the leading oilfield services company beat the Zacks Consensus Estimate thrice in the trailing four quarters.

Factors Likely to Influence the Upcoming Quarterly Results

Cost inflation triggered by increased labor and raw material pricing is likely to dampen investor confidence. Rising overhead costs increase the expense associated with the servicing of a well and put upward pressure on the cost of contractors like Weatherford.

With the divestment of pressure-pumping business to Schlumberger (NYSE:SLB), Weatherford has significantly lowered its footprint in prolific shale resources of North America. This will likely lower the company’s possibilities of getting lucrative oilfield services contracts and in turn hurt the top line.

Product and Service Line Revenues:

The Zacks Consensus Estimate for revenues from Well Construction is pegged at $391 million, lower than the last reported quarter’s $401 million and the year-ago level of $394 million.

The Zacks Consensus Estimate for revenues from Production is pegged at $380 million, lower than the last reported quarter’s $383 million and the year-ago figure of $408 million.

The Zacks Consensus Estimate for revenues from Completion is $297 million, lower than the last reported quarter’s $303 million and the year-ago period’s $339 million.

Segment Revenues:

The company operates through two business segments: Western Hemisphere and Eastern Hemisphere.

The Western Hemisphere segment includes the company's operations in North America and Latin America. Activities related to land drilling rigs in Mexico and Colombia are also included in the segment. The Zacks Consensus Estimate for the segment’s revenues is pegged at $750 million, lower than the last reported quarter’s $762 million and the year-ago level of $759 million.

The Eastern Hemisphere segment comprises the previous Middle East/North Africa/Asia Pacific segment and Europe/SSA/Russia segment, as well as land drilling rig operations in the Eastern Hemisphere region. The Zacks Consensus Estimate for revenues from the segment is pegged at $694 million, lower than the year-ago figure of $731 million.

Earnings Whispers

Our proven model does not conclusively show that Weatherford is likely to beat on earnings in the to-be-reported quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here, as you will see below.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, is -17.56%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Weatherford’s Zacks Rank #4 (Sell) further decreases the predictive power of ESP, making us less confident of an earnings surprise call.

As it is, we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Energy Stocks With Favorable Combination

Here are some companies from the energy sector, which, according to our model, have the right combination of elements to post an earnings beat in the to-be-reported quarter:

Houston, TX-based Enterprise Products Partners L.P. (NYSE:EPD) has a Zacks Rank #3 and an Earnings ESP of +5.26%. The company is slated to report fourth-quarter earnings on Jan 31. You can see the complete list of today’s Zacks #1 Rank stocks here.

Pittsburgh, PA-based EQT Corporation (NYSE:EQT) holds a Zacks Rank #3 and has an Earnings ESP of +1.48%. The company is scheduled to report fourth-quarter earnings on Feb 21.

Oklahoma City, OK-based Chaparral Energy, Inc. (NYSE:CHAP) carries a Zacks Rank #3 and has an Earnings ESP of +11.63%. The company is anticipated to report quarterly results on Feb 12.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

EQT Corporation (EQT): Get Free Report

Enterprise Products Partners L.P. (EPD): Get Free Report

Weatherford International PLC (WFT): Free Stock Analysis Report

Chaparral Energy, Inc. (CHAP): Get Free Report

Original post

Zacks Investment Research