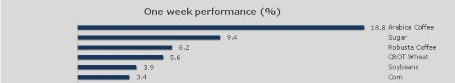

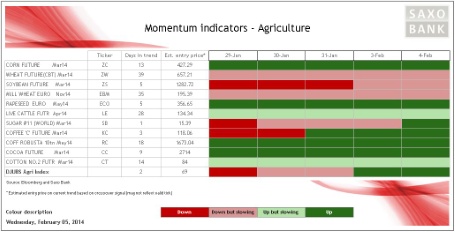

Weather-related issues continue to drive most of the gains within the commodity sector. A cold winter in North America and very dry conditions in South America have been the main drivers behind the top five performing commodities over the past week. As a result, positive momentum as seen through the DJ-UBS Agriculture index has now returned to the agriculture sector for the first time since early December.

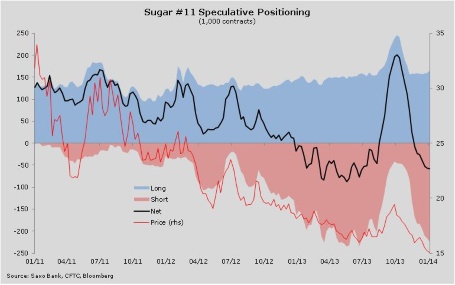

Both Arabica coffee (KCH4) and sugar (SBH4) received a strong boost from the very dry weather conditions in Brazil. Sugar reached 16.38 cents/lb yesterday after posting the longest rally in four months on the back of worries that crop yields in Brazil could be reduced as a result of the current heatwave. Bloomberg has reported that Brazil had the hottest January ever and the least rain in 20 years. At the same time, India has delayed plans to export upwards of four million tonnes to reduce brimming domestic inventory levels. Hedge funds have been a significant driver behind the rally after changing their position from a net long of 200,000 contracts in October to a net short of 58,657 on January 28.

CBOT soybeans (ZSH4) rose back above USD 13/bushel on the back of strong export demand for soymeal (ZMH4), which yesterday reached a contract high. This rally has been driven by reduced exports from Argentina, the world's largest soymeal producer, after farmers there started to hold back supplies of dollar-denominated soymeal to maintain a hedge against rising inflation and a tumbling currency.

CBOT wheat (ZWH4) rose by almost 4 percent yesterday, which was the biggest one-day gain since last April. The rally was driven by concerns that freezing weather in the US may damage winter crops in the southern US plains. The driver was a monthly state crop report from the US Department of Agriculture, which showed a drop in wheat condition ratings in places like Kansas, Oklahoma and Texas. With global supplies still expected to reach a record during this 2013/14 season, the rally has so far been driven by technical buying and short covering from hedge funds and money managers who held a net-short position of 62,501 contracts as of January 28.

CBOT corn (ZCH4) received an additional boost from the support coming from wheat and soybeans. Hedge funds were short of 52,117 contracts as of January 28 and with positive momentum now entering its 13th day, a break above the December high at USD 4.41/bushel may trigger some additional short covering and further confirm that a low has now been made during this cycle.