My clan, the accountants, must be in high demand with the Fortune 500 companies who report their earnings every quarter. Because despite a weak economy and bad quarter, companies are beating the projected EPS. Even when the top line is down or costs are high or demands are slow, they will miraculously meet or exceed the EPS even if by a penny.

If this is not creative accounting, what else is it? It’s a shame that an accountant never gets nor will ever get a Nobel Prize in creative imagination. They get prize for writing stories, why not a prize for the best accountant creating profit when it is not there. How did they manage to show profit in JP Morgan Chase (JPM) after over $ 4 billion loss? If the banks had such a great quarter how come most of them are planning layoffs? Of course the US Government. gives very generous helping hand by tweaking the FASB rules or even allowing the Banks to mark securities to books or by not following IFRS. But manipulation is now accepted fact of life and you cannot wake up who is already awake but is pretending to be asleep.

For two days in a row, while SPX has gone up, XLF , the ETF for financials has closed in red. Normally financials lead the market. The weakness of the financials do not bode well for the market as a whole. If these TBTF guys can’t beat the market in their own game, what hope the momo chasing investor has in picking up the nickel before the steamroller? At some point of time, things go out of hand. Now it seems is the time for LIBOR to catch up. The reserve for legal trouble will not be enough but they have the Fed to bail them out.

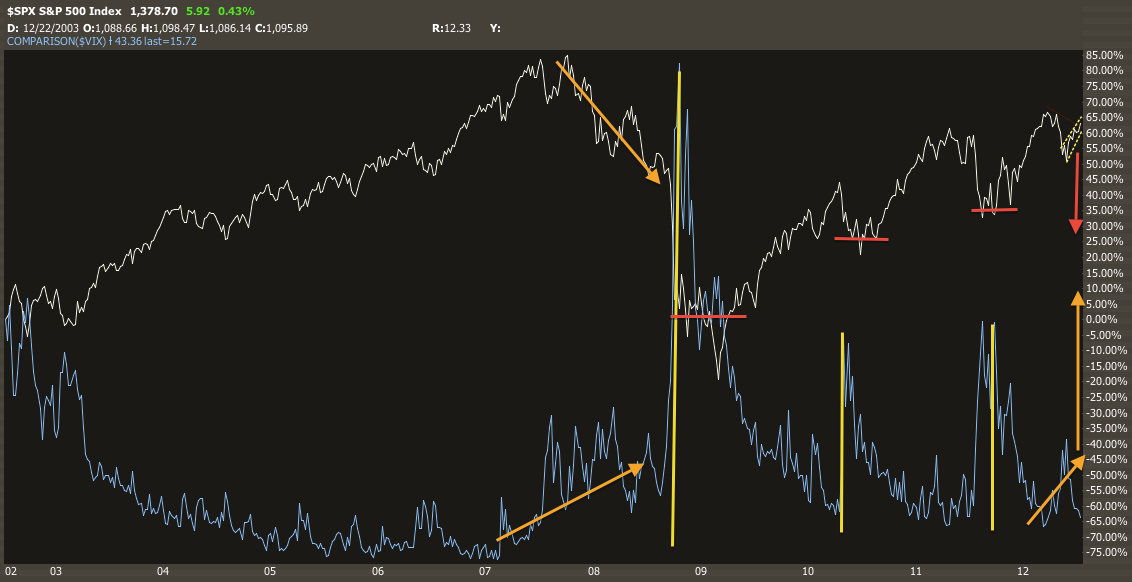

I remember last year, around the same time, asking the same question, how low VIX can go. Here is a graph to explain what I am talking about.

(Hat Tip: NJB Deflator)

I am not so much worried about how the market will play out tomorrow or day after. The hope driven rally is showing signs of topping but the earning season is keeping it going. But very soon the ugly head of realty will rear its head. Do I think that we are coming to an all time top? Yes and no. No because there will be another attempt by the central bankers to re-inflate the balloon. When that happens will we cross the all time of high of 2007 is the question. I expect that test to happen by November. Before that a test of the fall is around the corner. To those who think that SPX will cross 1400, I have one question. Assuming that SPX does reach 1400, that is around 25 points away. After that what? But we will cross the bridge when we come to it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weakness Of Financials Doesn't Bode Well For Overall Market

Published 07/20/2012, 06:18 AM

Updated 07/09/2023, 06:31 AM

Weakness Of Financials Doesn't Bode Well For Overall Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.