A month ago I declared the weakness in the Japanese yen had ended. At the time, the U.S. dollar versus Japanese yen currency pair, USD/JPY or the inverse ratio in the Rydex CurrencyShares Japanese Yen Trust (FXY), had slipped for three days in a row. I turned out to be about a week too early as a fresh bout of weakness swept over the yen and USD/JPY rushed to fresh 11-month highs. The end of that rally coincided with a major breakout of the S&P 500 (SPY) to fresh multi-year highs. Since then, the S&P 500 has gone nowhere and the yen’s weakness has also turned into a consolidation phase with a slight bias toward a stronger yen.

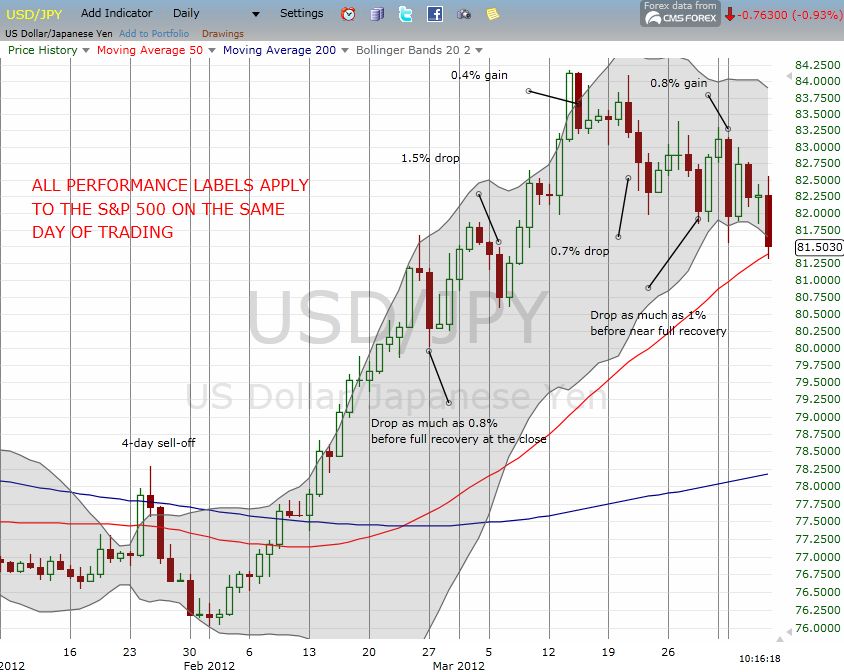

The chart below shows USD/JPY with labels showing the performance of the S&P 500 on key days of yen strength and weakness. The correlation has recently weakened a bit, but it seems that strength in the yen TENDS to correspond to weakness in the stock market on a day-to-day basis and more-so on a week-to-week basis. The performance over the last three weeks suggests that a lack of further weakness in the yen is correlating with a lack in further upside in the stock market (I am not ready to attribute causation just yet!). I imagine that if the stock market were open today, it would be selling off. USD/JPY CHART" title="USD/JPY CHART" width="2278" height="1495">

USD/JPY CHART" title="USD/JPY CHART" width="2278" height="1495">

Note that USD/JPY is now facing a major test at the presumed support of the 50-day moving average (DMA). This sets up for a VERY interesting (and tense?) week next week.

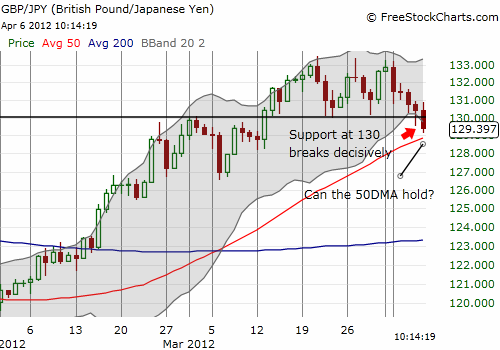

During this transition period to the next big move in the yen, I have remained positioned short GBP/JPY (the British pound vs yen currency pair). I have used bouts of yen strength to buy other yen currency pairs in relatively small amounts and then selling those at the next profit opportunity. It is a hedged strategy that has worked relatively well so far. With today’s unexpectedly weak U.S. nonfarm payrolls number sending traders scurrying to the yen, I believe we have growing evidence that the yen will not weaken much further from here for a while. GBP/JPY finally cracked support at 130 and looks ready to head much lower from here. It remains to be seen whether the stock market can regain its momentum despite the increasing weight of the yen. GBP/JPY CHART" title="GBP/JPY CHART" width="500" height="350">

GBP/JPY CHART" title="GBP/JPY CHART" width="500" height="350">

Be careful out there!

Full disclosure: long USD/JPY, EUR/JPY, AUD/JPY, sort GBP/JPY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weakness In The Japanese Yen Is Over For Now, Part Two

Published 04/08/2012, 04:52 AM

Weakness In The Japanese Yen Is Over For Now, Part Two

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.