Investing.com’s stocks of the week

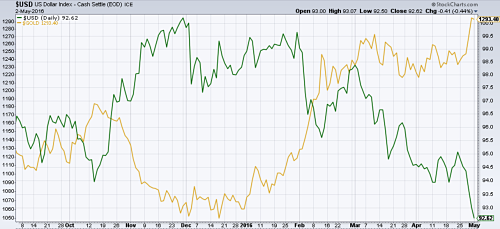

The U.S. dollar index, which tracks the buck against a basket of international currencies, hit a 15-month low this week.

The fact that traders are not supporting the dollar above these levels is quite bearish for the currency.

There are three major factors that explain the weakness in the dollar:

- Japan was expected to implement a fresh round of stimulus to weaken the yen to combat low inflation. However, the Bank of Japan kept interest rates unchanged last Thursday.

- Federal Reserve officials left interest rates unchanged at their meeting last week and remained ambiguous about raising rates in June. The Fed showed intentions at the end of last year to raise rates four times in 2016; that changed early this year, and the prediction is now just two rate hikes. Recent weak U.S. growth data isn’t encouraging at all for the prospect of increased interest rates.

- The rebound in commodity prices hurts the dollar, too. As commodity prices rise, the currencies of commodity exporting countries appreciate against the US dollar.

Gold Surges on Dollar Weakness

The dollar weakens on higher commodity prices and commodity prices rise on a weaker dollar - the effect is reciprocal.

One asset that is really enjoying the dollar’s weakness is gold. The yellow metal hit a new 15-month high this week as the dollar index hit a 15-month low. The correlation, gold-to-dollar, is way more reliable that any physical demand indicator of gold.

Not only gold, but all precious metals are rising as the dollar weakness. Silver also hit a 15-month high this week, while platinum and palladium rose to their highest levels in 10 and six months, respectively.

Industrial Metals Gain Traction

Now, with a falling dollar and the demand side of the equation looking brighter thanks to China’s stimulus measures (at least until their effect lasts), industrial metals are enjoying a tailwind.

It’s a great time for metal buyers to minimize their price risk exposure.