Investing.com’s stocks of the week

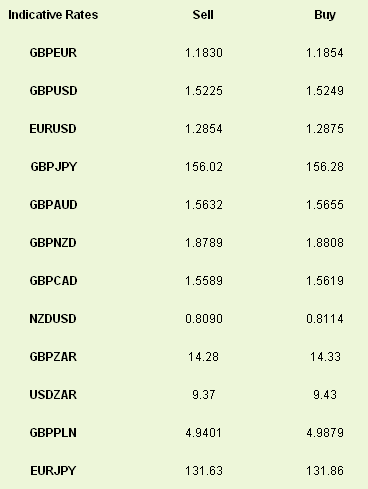

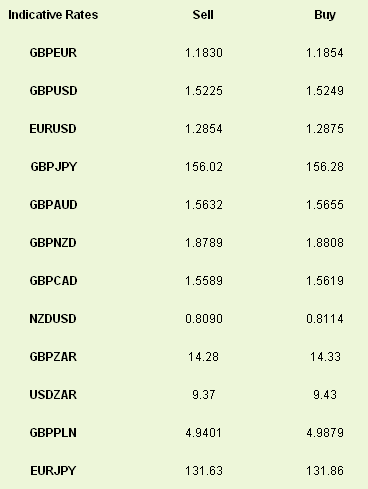

Though we have had a more positive tone to recent data in the UK and an improving picture painted by the inflation report, we still see GBPUSD around 4 cents lower than a week ago. We have been discussing US dollar strength, but even with softer US data yesterday and a minor bounce, we find sterling on the back foot again this morning. There is no data out of the UK today and only consumer sentiment from the US, so we would expect to see GBPUSD fairly range bound with the potential for some profit taking into the weekend likely to keep sterling supported.

We saw Eurozone CPI numbers come in line with expectations leaving EURUSD trading in a fairly tight range around the 1.2880 level. The Eurozone trade numbers showed a big first quarter surplus, adding around 0.5% to GDP, and emphasising how weak domestic demand has been. Since relatively strong growth elsewhere is not really leading to higher yields, it means there is no naturally offset of capital to the better trade balance. This could lead to near term support for the euro against the US dollar and consequently is likely to leave GBPEUR continuing its sideways path, at least for today.

Higher US jobless claims, weaker housing starts and a weaker Philadelphia Fed survey yesterday all helped to dampen the recent market enthusiasm for the USD. It doesn’t suggest any sort of major change from recent trends just yet, but the bigger news was speculation about an end to quantitative easing (QE3) as early as the end of the year, with the potential to reduce purchases through the summer. There is very little on the calendar today, but the strength of the USD in the last week suggests potential for some USD weakness this afternoon on profit taking, particularly if the Michigan sentiment data disappoints.

We saw Eurozone CPI numbers come in line with expectations leaving EURUSD trading in a fairly tight range around the 1.2880 level. The Eurozone trade numbers showed a big first quarter surplus, adding around 0.5% to GDP, and emphasising how weak domestic demand has been. Since relatively strong growth elsewhere is not really leading to higher yields, it means there is no naturally offset of capital to the better trade balance. This could lead to near term support for the euro against the US dollar and consequently is likely to leave GBPEUR continuing its sideways path, at least for today.

Higher US jobless claims, weaker housing starts and a weaker Philadelphia Fed survey yesterday all helped to dampen the recent market enthusiasm for the USD. It doesn’t suggest any sort of major change from recent trends just yet, but the bigger news was speculation about an end to quantitative easing (QE3) as early as the end of the year, with the potential to reduce purchases through the summer. There is very little on the calendar today, but the strength of the USD in the last week suggests potential for some USD weakness this afternoon on profit taking, particularly if the Michigan sentiment data disappoints.