Whilst the EUR might be failing to make any solid gains on the USD, it could be about to shine against its Australian counterpart. Specifically, the current rally is the outcome of a corrective ABC pattern which is likely to see the pair surge higher again. However, the rally could also be part of a larger Gartley formation which could be heralding even greater upwards mobility for the EUR/AUD in the coming weeks.

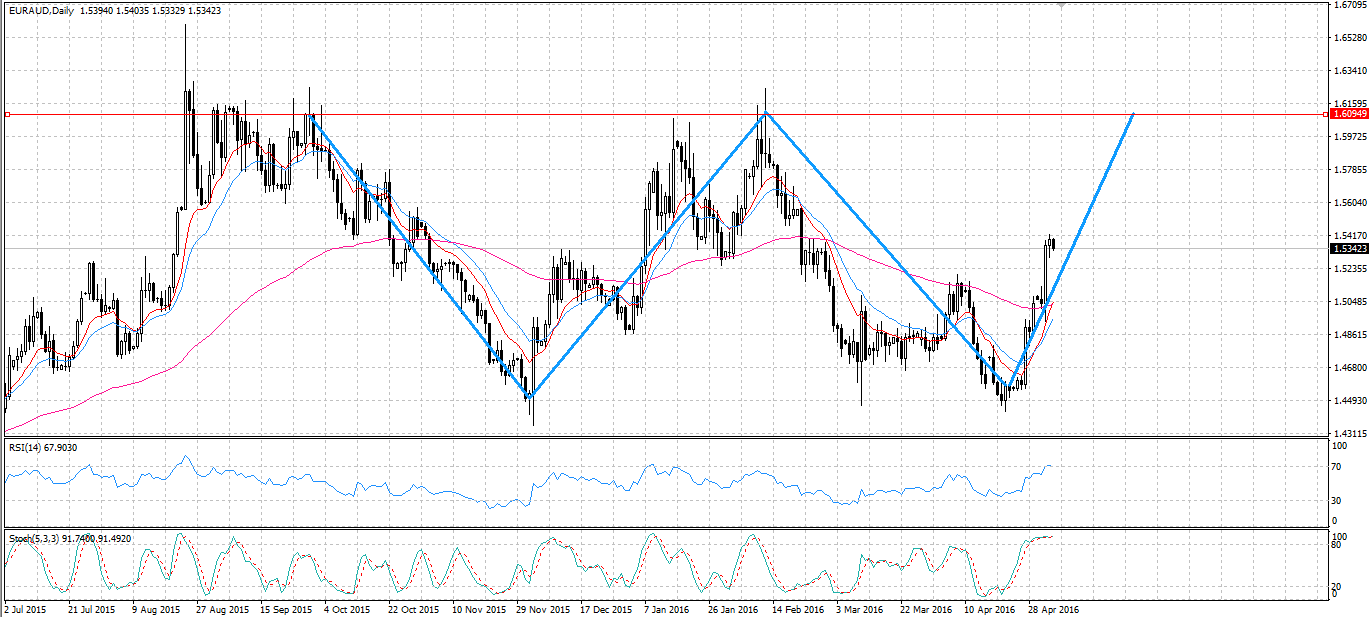

As seen on the daily chart, the EUR/AUD is currently in the process of completing a flat ABC pattern. After finishing leg ‘C’ around the 20th of April, the pair began the characteristic climb higher. Consequently, the pair should retrace back to around the 1.6094 zone of resistance where the ‘A’ and ‘C’ legs of the flat ABC pattern began.

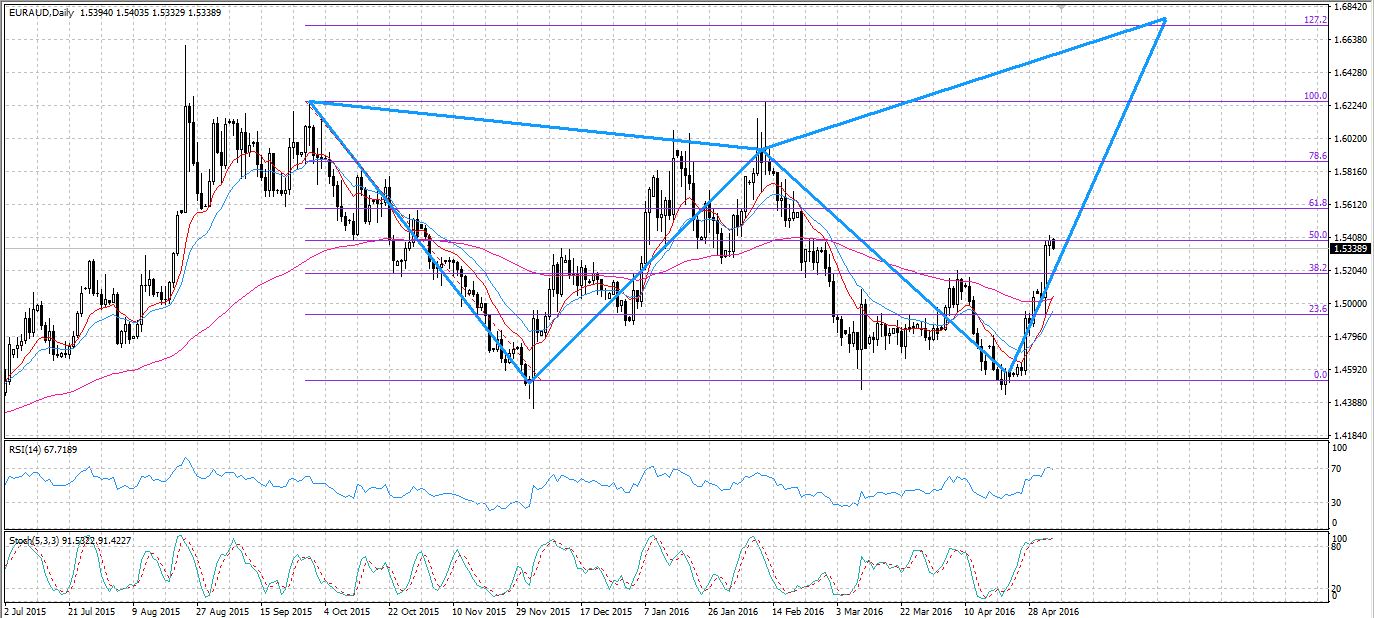

If the pattern does complete, it may continue to post gains and complete the nascent Bearish Butterfly formation. In this event, there is even more upside potential for this pair in the long run. As is typical of this pattern, the EUR/AUD should continue to appreciate until reaching the 127.2% Fibonacci retracement level. At this level, a strong bearish reversal is likely to eventuate and send the pair plummeting.

One roadblock to pattern completion is the strongly overbought RSI and stochastic readings which are currently providing resistance. However, there is still some scope for the pair to range before climbing once again. Furthermore, on the H4 chart, both oscillators have returned to a neutral position. Additionally, the daily and H4 EMA’s are giving strong buy signals which could see the recent rally resume. Specifically, an imminent crossover of the 100 day EMA and the two shorter EMA’s could reignite buying pressures.

Looking at the fundamentals, the AUD is likely to continue weakening as low commodity prices take their toll on the currency. Consequently, the probability of either the flat ABC or bearish butterfly pattern completing is increasing dramatically. In addition to falling commodity prices, recent monetary intervention from the RBA should be taken as a signal that the Aussie is heading lower.

Cumulatively, the evidence suggests that unless a major upset occurs for the EUR, it should continue on the warpath and rally again. Fundamental indicators will likely be the triggers which see a rally resume. However, a crossover of the daily EMA’s could also provide the spark needed to get the pair moving again.