Market movers today

- A busy day ahead of us as we have PMI's for the US, euro area, Japan and Germany plus central bank events. We expect PMI's in all countries to deteriorate from their current levels on the back of the slowing global growth and geopolitical risks. In the US, we expect PMI manufacturing to drop below the 50 mark. That said, our forecast was made before the release of the strong regional PMIs last week, which means there are upside risks to our estimate. In the euro area we expect the manufacturing PMI to decline from the already 6.5 year low level of 46.5 to 46.2 driven by the still very fragile German manufacturing sector.

- On global monetary policy, we have ECB July meeting minutes as well of a lot of monetary policy discussions from the Fed's Jackson Hole conference. The theme is "Challenges for Monetary Policy", which suggests it will focus on the same things as in the FOMC review of the current monetary policy framework. The ECB minutes will be scrutinised for any news regarding new policy measures.

- In the Nordics, we get Swedish unemployment figures and Norwegian Oil investment survey.

- UK Prime Minister Boris Johnson meets with French President Emmanuel Macron after his visit to Germany yesterday. EU has continuously rejected PM Johnson's call for a removal of the backstop of the withdrawal agreement.

Selected market news

As expected, there was not much news in the FOMC minutes released last night. The minutes revealed that while the committee was much divided, the initial cut should be seen as a mid-cycle adjustment and not the start of an aggressive easing cycle. Also, the Fed stressed it wanted flexibility/optionality and that monetary policy was not on a pre-set course. All in line with Fed chair Powell's message at the press conference that left market participants a bit disappointed. We want to emphasise that one should not put too much weight on the minutes given that much has happened since the meeting. The trade war has escalated further and we no longer expect a trade deal on this side of the US presidential election. The economic indicators from Europe and China have been weaker than anticipated. The US 2s10s yield spread inverted briefly last week and inflation expectations have dropped further. Hence we still expect the Fed to deliver more cuts.

The reaction in the Asian equity markets this morning has been modestly negative as the FOMC minutes did not bring much news to change the view on the Fed as discussed above. President Trump kept up his attack on the Federal Reserve for not delivering more on monetary policy. Hence, there will be significant focus on the speech by Fed President Powell on Friday.

In the EU, the Brexit talks continue although it looks difficult to reach a new agreement.

Scandi markets

The Swedish labour market has turned the corner. Unemployment is slowly rising, overtime work declines fast and private businesses’ hiring plans are cooling off. Still data released today ought to show a correction down in terms of unemployment. June data popped both in seasonally adjusted and unadjusted terms. Higher unadjusted unemployment in June is in itself quite normal but the 0.2 pp rise in adjusted unemployment was more than we had expected, so that’s why we look for lower numbers this time around. We expect adjusted unemployment to ease to 6.2% (unadjusted 5.7%). Higher figures would suggest that the softening of labour market conditions accelerates.

In Norway, much of the reason why the economy seems to have coped so well with the global downturn to date is the strong contribution to demand from oil investments. The Q2 investment survey back in May indicated growth of around 15% this year after allowing for the surge in late 2018. The outlook for 2020 is naturally much more uncertain, but the May survey at the very least did not signal a marked drop in investment next year and actually pointed to further growth. We do not anticipate any major changes to this picture in the Q3 survey, which should therefore confirm that oil investment will continue to boost the economy for the rest of this year and have a moderate positive effect next year too.

Fixed income markets

The Italian government bond market continues to “ignore” the political uncertainty after the Italian PM Conte resigned as prime minister. Spreads to core-EU continued to tighten although we now enter a period with uncertainty; there are both rating events and a budget for 2020 that must be sent to the EU for approval by October 15.

There has been significant focus on the lack of demand at 30Y German bond auction yesterday. However, looking at the widening of ASW-spread and the price action in the secondary market, we do not see a lack of demand for ultra-long bonds. We continue to recommend buying the new 30Y German bond against swaps as the 30Y segment is the only segment on the German curve that gives a modest positive carry.

Today, there is a string of EU and US PMI data, which we expect to be weak. This will put focus on both expansionary monetary policy and fiscal policy in the EU. The minutes from the ECB is not expected to bring much new information to the market.

Yesterday, we published our bi-weekly on the Danish fixed income market, where we look at 2% callables ad how much prepayment the 2% segment can sustain. The front end of the Danish curve looks expensive see more here.

FX markets

In the Scandies, we expect both the oil investment survey and the Norges Bank (NB) expectations survey in Norway to support the NB narrative of at least another rate hike to come this year. However, while we still think that Norges Bank will eventually hike rates in September (priced at 7bp), we emphasize that the global environment (USD, inflation expectations, commodities, oil prices etc.) is far more important in driving NOK FX currently. With our fairly downbeat view on the near-term global macro momentum and no trade deal in sight we think the external environment limits the potential for a substantial near-term NOK appreciation. Positioning has been heavily cleared in recent weeks (see chart) which does open a NOK potential, but as long as global risk appetite remains shaky foreign interest in NOK is likely to remain muted. In sum, we prefer to stay side-lined in NOK FX for now and generally play the Norwegian currency as a high-beta asset on the external environment.

In Sweden, we expect a positive surprise in the labour market statistics today as our estimate for unemployment (see Scandi section) is below consensus. This should lend some support to the krona. At least temporarily. But labour market data has started to show signs of weakness and may soon become a headwind for the economy and thus the krona.

In majors, FOMC minutes did not move markets (see front page for details). The market has now about priced out the possibility of a 50bp rate cut by Fed in September, which has led to a recovery in USD over the past week. It means there is room for front-end USD rates to fall back and the market to sell USD, e.g. if PMIs disappoint further today. We see a stronger scope for USD/JPY to fall back towards 105 level in the short-term than for EUR/USD to bounce higher.

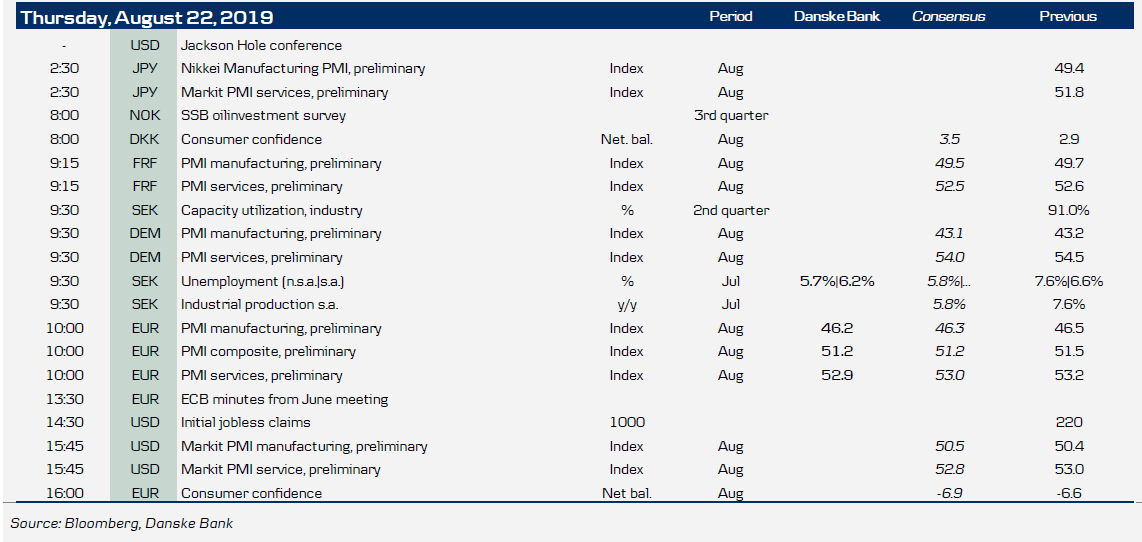

Key figures and events