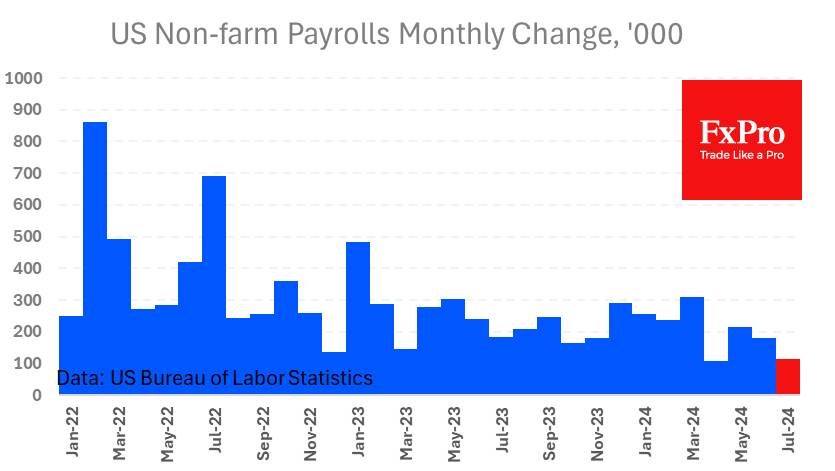

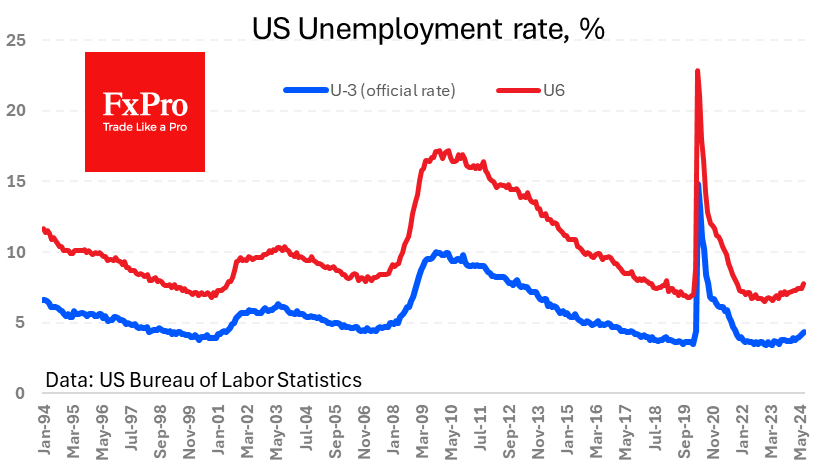

The US economy added 114K jobs in July, well below expectations. The private sector added 97K jobs, the smallest increase since March last year. The market's knee-jerk reaction was also exacerbated by a rise in the unemployment rate from 4.1% to 4.3% (no change was expected).

Wage growth also missed expectations, coming in at 0.2% m/m and 3.6% y/y, down from 0.3% and 3.8% (revised from 3.9%) the previous month. The year-over-year wage growth is the lowest in more than three years.

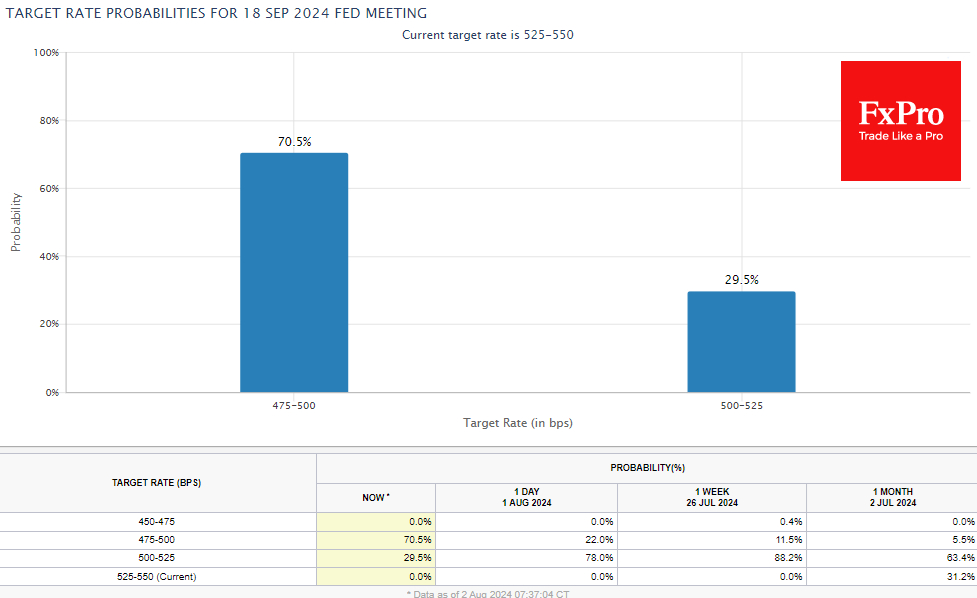

The market's reaction to the statistic wasn't trivial, selling off the dollar and equities simultaneously. The dollar's decline can easily be attributed to the consolidation of expectations for a rate cut from September and the growing confidence that more than 75 basis points will cut the rate by the end of the year.

Expectations of a dovish Fed have been the fuel for most of the equity rally since the beginning of the year. Expectations now include more fear of deteriorating macroeconomic conditions than enthusiasm for monetary easing. Surprisingly, within minutes of the release, interest rate futures were pricing in an 80% chance of a 50-point rate cut in September, up from a bold 20% a day earlier.

It must be said that the fresh data isn't bad enough to suggest an economic catastrophe (yet). If expectations of three or more declines before the end of the year become entrenched, it may not be such bad news for the equity market and, at the same time, a big negative for the dollar.

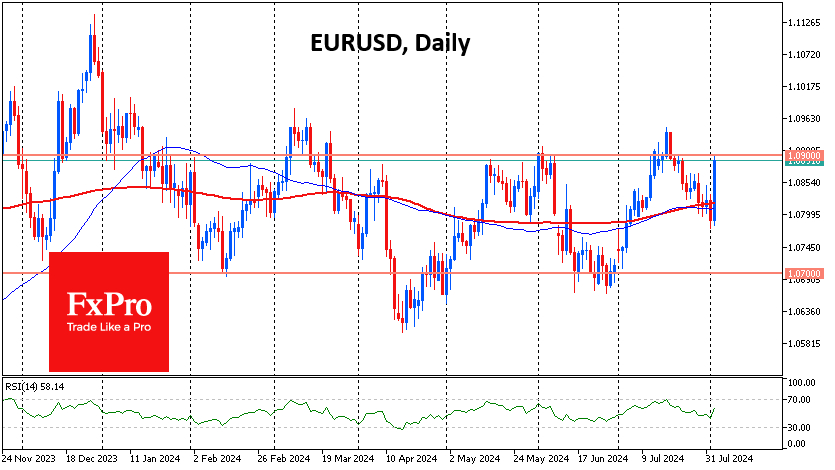

The US dollar reacted in textbook fashion immediately after the report, falling sharply on the weak economic data as a direct result of the impressive shift in rate expectations. Markets now expect the Fed to taper more than the ECB or the Bank of England, which explains why the EURUSD and GBPUSD jumped more than 0.5% after the release.

Short-term market reactions can be deceptive, as the increase in risk-taking in equity markets, if sustained for a few days, tends to be toxic, eventually leading to a wave of dollar gains as marginal risky positions are liquidated. In practice, this could mean that if the EURUSD fails to consolidate above 1.09 (the upper boundary of the range since February), be prepared for a plunge to the lower boundary at 1.07 and on to 1.05.

The FxPro Analyst Team