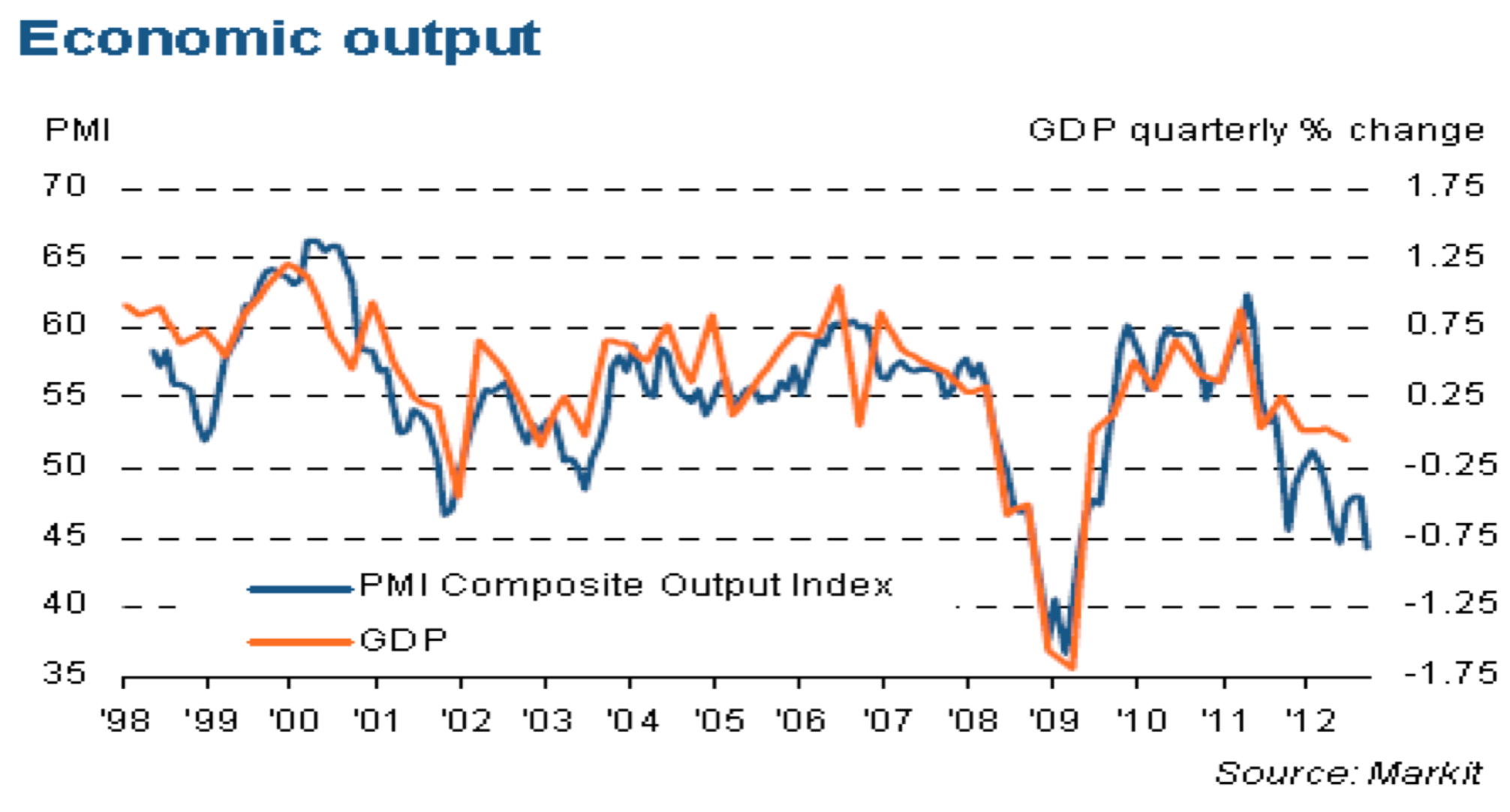

We are seeing further evidence of the Euro-zone-wide recession that is more entrenched than numerous economists have been projecting. The slowdown in Germany (discussed here) demonstrates that the core states are not immune. Today's MarkIt flash PMI numbers, particularly from France, also show ongoing economic weakness. French composite PMI hit a new post-09 low and as the chart below shows, GDP (which is reported on a lag) is sure to follow.

MarkIt: September, falling at the steepest rate in nearly three-and-a-half years. All the more concerning was the fact that new business and employment also showed accelerated declines, while service providers’ future expectations slipped into negativity for the first time since early 2009. GDP may have stagnated for three successive quarters up to Q2, but yet more weak PMI data points firmly towards a contraction in Q3.

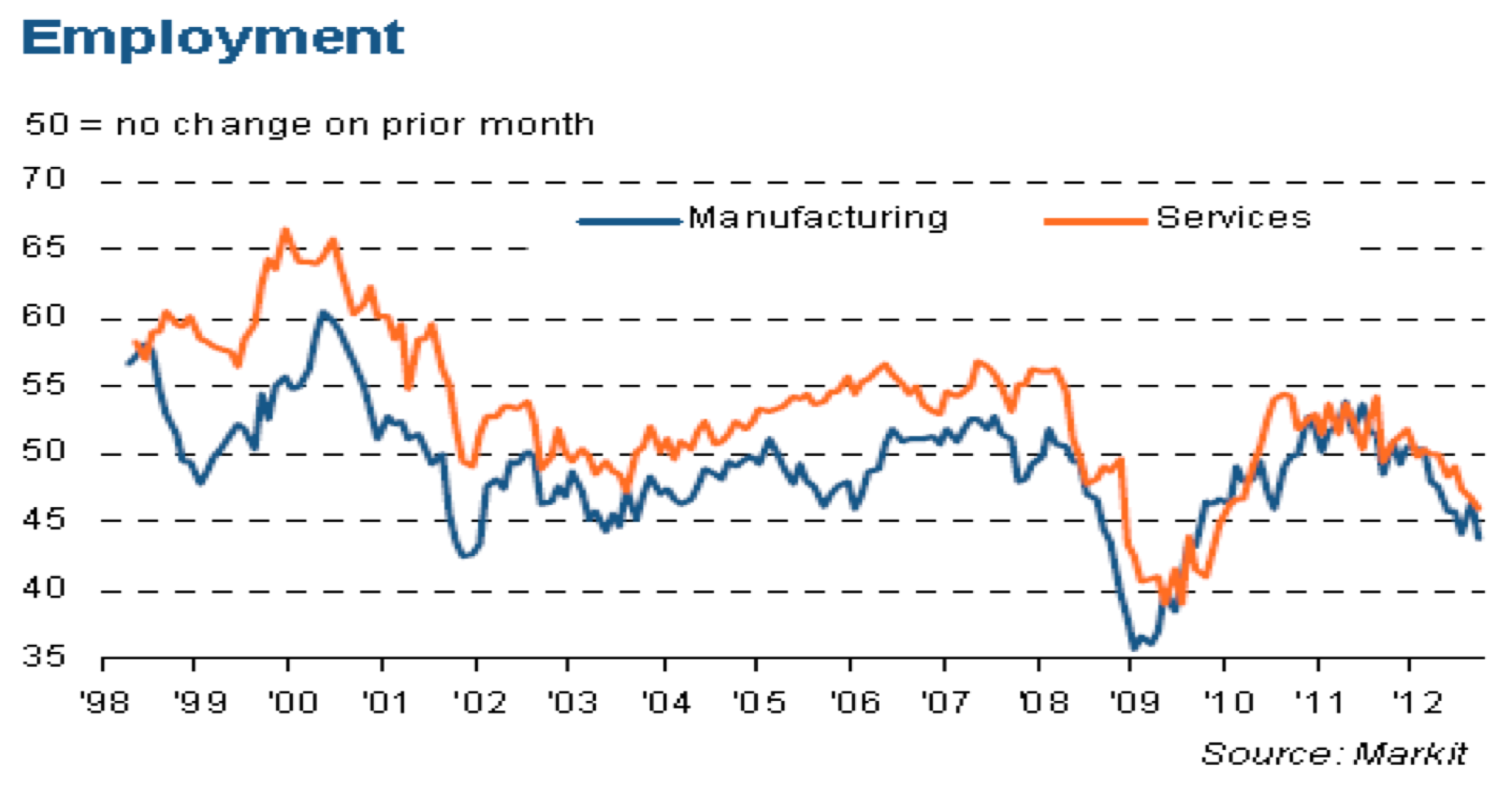

Employment PMI out of France is pointing to weakening labor markets across the board (both manufacturing and services).

One of the major issues for France in general -- and the nation's manufacturing sector in particular -- has been poor labor competitiveness. The recent closure of a Peugeot plant exemplifies that problem. And more factory closures are on the way.

The Economist: The decision by Peugeot-PSA, a loss-making carmaker, to shut its factory at Aulnay, the first closure of a French car plant for 20 years, and to shed 8,000 jobs across the country has rocked France. It has become an emblem both of the country’s competitiveness problem and of the new Socialist government’s relative powerlessness, despite its promises, to stop private-sector restructuring.

...

Over the past 12 years, a competitiveness gap has opened up between France and Germany, its biggest trading partner. This shows both in manufacturing unit-labour costs, which have risen by 28% in France since 2000, but only 8% in Germany, and in France’s declining share of extra-EU exports. A cross-border study of two chemicals firms by Henri Lagarde, a French businessman, points to part of the problem: the German company pays only 17% of its employees’ gross salaries in social charges, next to 38% for its French counterpart. A recent study of competitiveness ranked Germany in sixth place; France came 21st.

Hollande Talks Taboo

Hollande is beginning to talk about an off-limits subject for France's left-leaning politicians -- labor reform. But given the difficulties involved in implementing such reform, especially in France (reforms may make it easier for companies to lay off workers -- a difficult subject in France), it may be years before competitiveness improves and manufacturing returns. In the mean time with the Socialists in power, there are few other government initiatives on the horizon that could help the nation's output grow. Anti-financial-services regulation -- numerous austerity measures and tax increases (75% top tax rate) -- all point to further weakening of economic conditions. And since France generates 21% of the Euro zone's GDP, that does not bode well for the area's economic recovery.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Weak French Data Reflects Troubled Euro Zone Growth

Published 09/20/2012, 03:18 PM

Updated 07/09/2023, 06:31 AM

Weak French Data Reflects Troubled Euro Zone Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.