A batch of negative eurozone economic indicators, including a worse-than-expected manufacturing PMI, drove the EUR/USD to its lowest level in over a week during trading yesterday. The news also resulted in the euro dropping over 140 pips against the yen during the European session.

Turning to today, European news is forecasted to generate significant market volatility. Traders will want to pay attention to the results of a Spanish debt auction, as well as to the ECB Press Conference at 12:30 GMT. Should any of the news signal further troubles regarding the euro-zone economic recovery, the common currency could drop further before markets close for the week.

Economic News

ADP Employment Figure Leads To Dollar LossesThe US dollar fell vs. the safe-haven JPY throughout European trading yesterday, as a batch of worse-than-expected international data led to an increase in risk aversion. Specifically, a worse-than-expected eurozone manufacturing PMI followed by a disappointing US ADP Nonfarm Employment Change figure resulted in the USD/JPY tumbling over 50 pips over the course of the day. The pair dropped as low as 80.04 before staging a slight upward correction. The eurozone news resulted in the EUR/USD dropping over 90 pips to reach its lowest level in close to a week and a half. The pair eventually stabilized around the 1.3130 level during the afternoon session.

Turning to today, dollar traders will want to pay attention to the weekly US Unemployment Claims figure scheduled to be released at 12:30 GMT, followed by the ISM Non-Manufacturing PMI at 14:00. Yesterday's employment news led to increased doubts among investors regarding the pace of the US economic recovery. Should today's news come in below analyst expectations, the dollar may continue to slide against currencies like the yen and Swiss franc.

ECB News Set To Impact Euro Today

The euro tumbled against virtually all of its main currency rivals yesterday following a worse-than-expected German Unemployment Change and eurozone Manufacturing PMI. German unemployment unexpectedly rose by 19K last month. Analysts had been predicting the figure to decrease by 9K. Meanwhile, the manufacturing PMI dropped to 45.9, its lowest level since June 2009. In addition to taking losses against the USD and JPY, the euro dropped close to 80 pips against the CAD and 75 pips against the AUD during morning trading. Both the EUR/CAD and EUR/AUD staged slight upward corrections later in the day.

Turning to today, significant euro volatility is expected following the Minimum Bid Rate and ECB Press Conference, scheduled for 11:45 and 12:30 GMT. While the ECB is not forecasted to adjust eurozone interest rates, the press conference is likely to provide clues as to the current state of the region's economic situation. Any indication that further trouble is still to come in the eurozone could result in losses for the common currency today. Additionally, a Spanish debt auction may signal just how far Spain still needs to go toward economic recovery after its recent credit downgrade. Should the debt auction disappoint investors, the euro could extend its losses further.

Risk Aversion Leads To Aussie Losses

The AUD took losses against both the Japanese yen and US dollar throughout trading yesterday, following disappointing eurozone and US indicators that led to increased risk aversion in the marketplace. The AUD/JPY, which earlier in the week saw substantial upward movement, fell over 80 pips during the European session. Against the USD, the aussie extended its bearish trend, falling an additional 60 pips. The AUD/USD eventually found support at the 1.0285 level.

Turning to today, the direction the aussie takes will largely be determined by a batch of eurozone indicators. With political and economic uncertainty dominating the news in Europe, investors may decide to continue shifting their funds to safe-haven assets, which could lead to further aussie losses. That being said, should any of the news today come in above expectations, the AUD may be able to rebound before markets close for the week.

US Inventories Figure Causes Oil To Drop

A combination of poor global economic data and a higher than expected US Crude Oil Inventories figure caused the price of oil to fall during yesterday's trading session. Oil typically falls when US inventories rise unexpectedly, as it is taken as a sign of decreased demand in the world's largest oil consuming country. Oil fell from a morning high of $106.01 a barrel to $105.24 during the afternoon session.

Turning to today, the direction oil takes will largely be determined by eurozone news. Should the results of the ECB Press Conference and Spanish debt auction convince investors that they need to shift their funds to safe-have assets, the price of crude oil could fall further ahead of Friday's all-important US nonfarm payrolls figure.

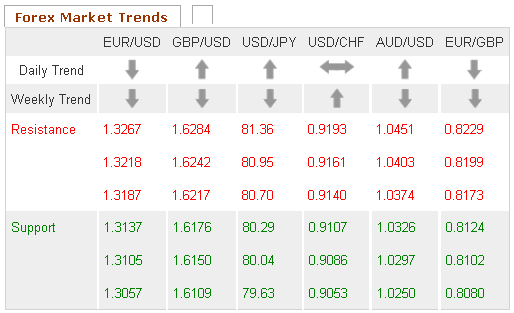

Technical News

EUR/USDThe MACD/OsMA on the daily chart appears close to forming a bearish cross, indicating that this pair could see upward movement in the near future. Additionally, the Williams Percent Range on the same chart is moving down at the moment and could soon cross into oversold territory. Traders will want to keep an eye on these indicators, as they may signal an impending upward correction.

GBP/USD

The Williams Percent Range on the weekly chart is in overbought territory, meaning that this pair could see downward movement in the near future. Furthermore, the MACD/OsMA on the daily chart appears to be forming a bearish cross. Going short may be the preferred strategy for this pair.

USD/JPY

A bullish cross on the daily chart's Slow Stochastic points to a possible upward correction. That being said, most other long-term technical indicators show this pair trading in neutral territory, meaning that no defined trend can be predicted. Traders may want to take a wait-and-see approach, as a clearer trend may present itself shortly.

USD/CHF

Most long-term technical indicators show this pair range-trading, meaning that no defined trend can be predicted at this time. That being said, the weekly chart's MACD/OsMA appears close to forming a bearish cross. Traders will want to keep an eye on this indicator. Should the cross form, it may be a sign of impending bearish movement.

The Wild Card

CHF/JPYThe daily chart's Williams Percent Range has dropped into oversold territory, indicating that an upward correction could occur in the near future. Additionally, a bullish cross has formed on the same chart's Slow Stochastic. This may be a good time for forex traders to open long positions ahead of a possible upward breach.