Swiss retail sales and manufacturing activity declined in February and March respectively. Will the USD/CHF continue rebounding?

The Swiss National Bank decided to keep the target range for the three-month Libor at between minus 1.25% and minus 0.25% at its March 15 meeting. Recent economic data were negative: the manufacturing Purchasing Managers Index (PMI) fell sharply in March to 60.3 points from 65.5 in February, and retail sales contracted 0.2% in February from the same month a year ago, though the decline was smaller than the 0.4% fall in January. Earlier the KOF economic sentiment index fell to 106.0 In March from 108.4 in February. Weak economic data are bearish for Swiss franc.

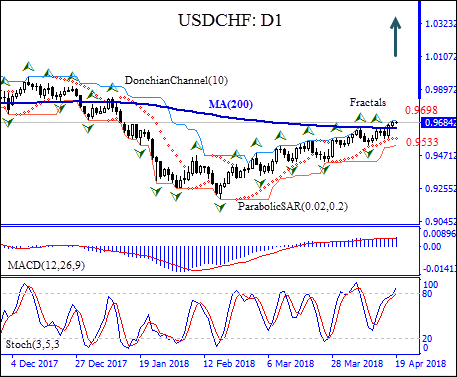

The USD/CHF is rising on the daily chart after hitting thirty thre month low in mid-February. It has closed above the 200-day moving average MA(200).

- The Parabolic indicator gives a buy signal.

- The Donchian channel signals uptrend: it is tilted up.

- The MACD indicator is above the signal and the gap is widening, which is a bullish signal.

- The stochastic oscillator has breached into the overbought zone, it is a bearish signal.

We believe the bullish momentum will continue after the price breaches above the upper Donchian bound at 0.9698. This level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 0.9533. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Buy stop Above 0.9698

Stop loss Below 0.9533