Since last week Eurozone inflation has been rising again. Further ECB easing measures cannot be expected. Therefore speculators position themselves against the Swiss franc again. This resulted in a considerable weakening of CHF in particular against the euro.

In December 2015, the seven year Joseph cycle ended with a Fed rate hike. These lean years of the Joseph cycle started in December 2008 when the Fed lowered rates to the current level. We think that in the next seven year cycle, even the risk-averse Swiss investors will buy more foreign assets, not only the central bank and speculators. All three types of crisis have passed, the U.S. subprime, the euro crisis and the Emerging Markets crisis. The last one culminated in the Russia crisis and the end of the peg in January 2015.

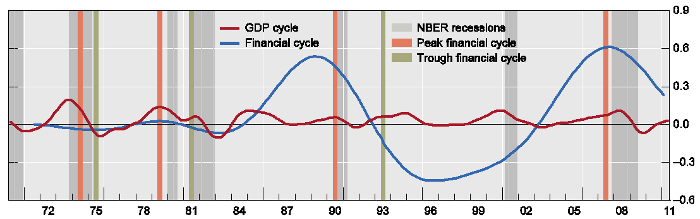

Official NBER Recessions and Joseph Cycles

The following graph shows the years of the “official NBER recessions” in the United States:

2008, 2000/2001, 1990, 1982/1983,1973/1974 and 1969/1970.

For an official recession, two subsequent quarters of negative GDP growth are needed.

A pattern of more or less seven can be identified.

But we should not follow the lead of the United States anymore, the US economy tends more strongly to boom-bust, often caused by Fed interventions and adjustments of the savings rate.

Nowadays we have three blocks of GDP valued in purchasing power (PPP):

- China with 19.5 billion USD

- Europe with 19.2 bln. USD

- The United States with 18 bln. USD

The global economy is less dependent on the U.S. than it was before.

Recessions in other countries happen less often. According to the Handelsblatt, a recession in Germany took place in 1967, in 1975, in 1982, in 1993, in 2001/2002 and 2009. The seven year pattern is also visible.

If we take a look on longer-term movements of around 14 years then it makes sense to divide the cycles into two parts.

- One part during which stock prices were rising and unemployment was higher than in the second phase.

- The second phase with lower unemployment and rising salaries of employees, but bad performance of stock markets. Sometimes the second phase was associated with a recession, because the Fed raised in interest rates and investment and GDP slumped.

Clearly we have just exited the phase1 with rising stocks and relatively high unemployment rates. Applying this pattern to Germany, we see:

1967-1975: A phase of stronger

1975-1982: Weak stock market performance, low unemployment, high inflation

1982-1993: High unemployment, recovering stock market, reduction in inflation

1993-2001: Low unemployment, high inflation, (initially) weak stock markets

2001-2008: (initially) High unemployment,

The fat years of the Joseph cycle are based on higher debt, a lot of it in cheap CHF, on money that the Swiss lend to foreign countries. These outflows in form of debt – direct lending or Swiss buying European bonds) will finally be able to neutralize the strong Swiss trade surplus. Investors will be in search of yield, hence the low yielding CHF will slowly depreciate against the euro, the carry trade will be back on vogue. High yielding currencies in Emerging Markets have become cheap enough (with the exception of the Chinese yuan).

When the CHF debt is suddenly paid and flows invert again during next global recession around the year 2022, the franc should appreciate strongly again. We gave our number of EUR/CHF 0.90 in 2022 and explained why. We also explained why weak growth in China is negative for the Swiss franc. See CHF is no safe haven but a safe proxy for global growth.