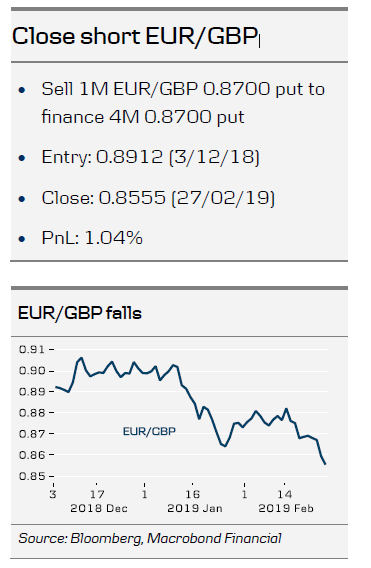

We take profit on our short position in EUR/GBP via options at 0.8555. The trade yielded a return of 1.03%.

After Theresa May's U-turn on Brexit by promising three key votes in mid-March (vote on deal, vote on no deal and vote on Article 50 extension), Labour's support for a second EU referendum and the EU's willingness to extend Article 50, EUR/GBP has moved lower, as investors think the probability of the UK crashing out of the EU has declined.

EUR/GBP is now trading at 0.855 and will probably not move much further in the short term as we are unlikely to get much news over the next two weeks. May's promise has postponed the Brexit fights by another two weeks and it is difficult to see the EU and the UK reaching an agreement until just before the first vote on 12 March (media reporting that the strategy is to reach an agreement on 11 March).

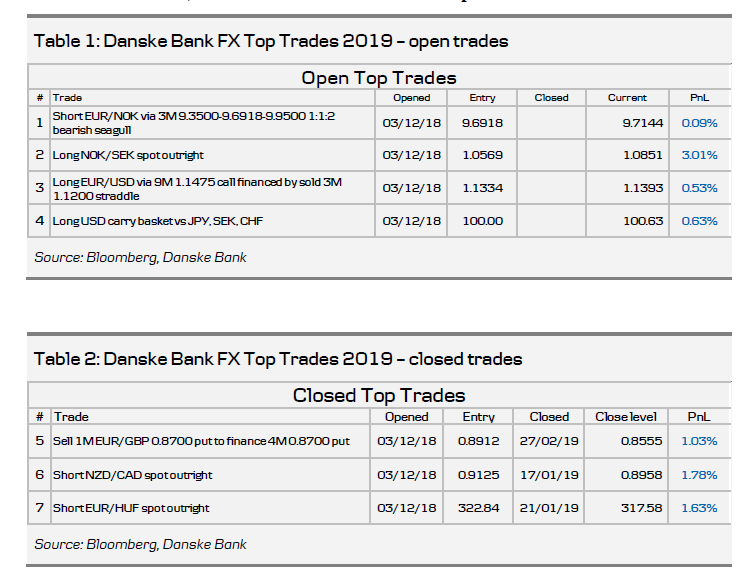

So far, we have closed three trades with a cumulative return of 3.41%. Overall, our FX top trades have so far yielded a total return of 7.67%.

See FX Top Trades 2019: Our guide on how to position for the coming year, 4 December 2018, for further details on our FX top trades.