EUR/USD has been flirting with the green support zone recently, yet strongly rebounded yesterday. Was it a surprise? Not if you’re reading our analysis. Enough tooting our horn, what’s next in store for the pair?

These were our yesterday’s observations:

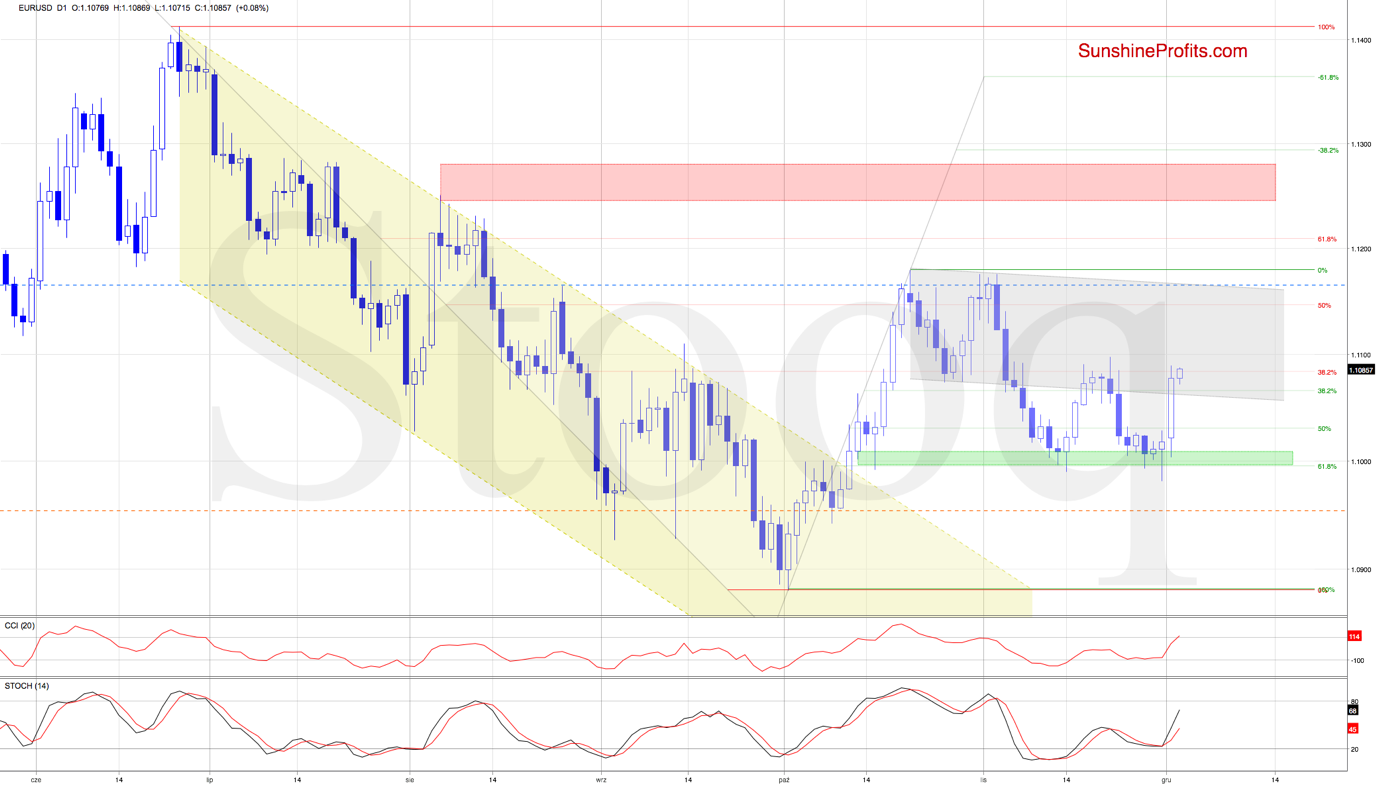

(…) While EUR/USD slightly decline on Friday, the green support zone coupled with the 61.8% Fibonacci retracement stopped the sellers. A rebound followed, and the pair finished the day above the said support. This way, the tiny intraday breakdown below it has been invalidated.

In mid-November, we have seen similar price action, which suggests that reversal followed by higher values of the exchange rate may be just around the corner. This is especially so when we factor in the position of the daily indicators. Both the CCI and the Stochastic Oscillator have generated their buy signals just as they did in mid-November, which increases the likelihood of further improvement this week.

The situation developed in line with expectations and the exchange rate moved sharply higher during yesterday’s session. This upswing brought the pair back above the previously broken lower border of the declining grey trend channel, and the earlier breakdown was invalidated this way.

Additionally, both the CCI and the Stochastic Oscillator generated their buy signals, lending more support to the bulls.

Earlier today, we saw another attempt to move higher. It’s our opinion that further rally will be more likely and reliable only if the exchange rate breaks above the late-November peaks.

Should the bulls prove strong enough and overcome that 1.1100 mark, the way to the upper border of the grey trend channel would be open.