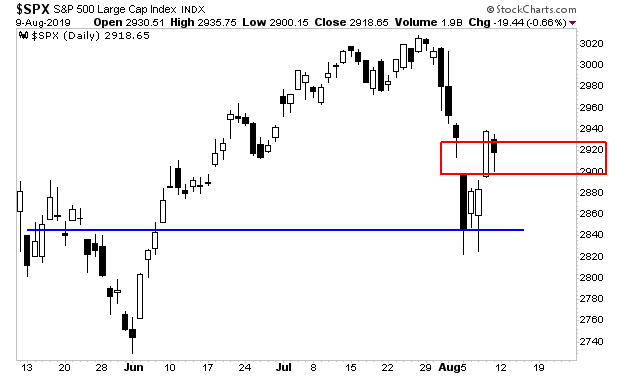

Stocks closed the gap I mentioned on Thursday (the red rectangle), they are now consolidating before their next move.

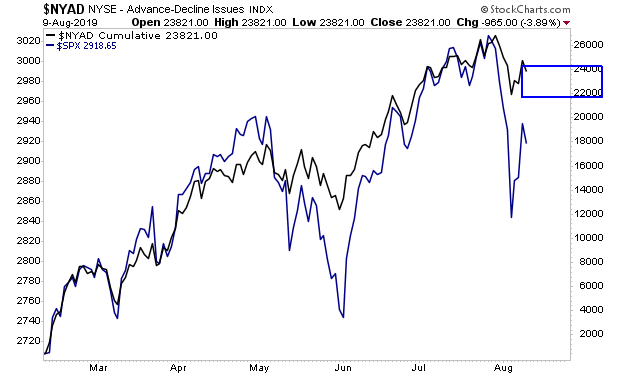

Breadth which leads stocks, suggests it will be a move higher, probably to the 2,800-3,000 range on the S&P 500 (blue rectangle).

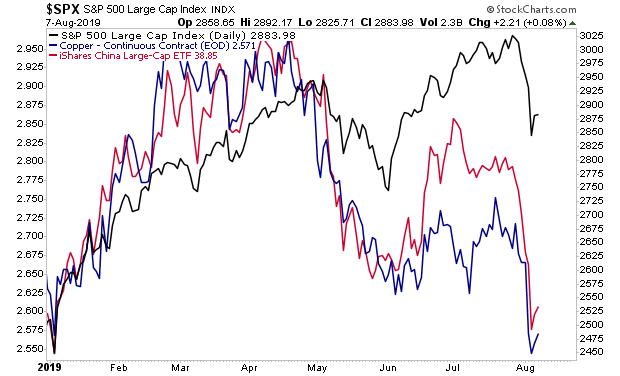

After that comes the BIG drop…. Not because the US is in trouble necessarily, but because China is in REALLY BIG trouble.

At the end of the day, the US economy might hold up, but there is no way China can implode without hurting US stocks in a significant way. Copper and China’s stock market tell us that reality is much lower than most expect.

On that note, we are already preparing our clients for this with a 21-page investment report titled the Stock Market Crash Survival Guide.

In it, we outline the coming collapse will unfold…which investments will perform best… and how to take out “crash” insurance trades that will pay out huge returns during a market collapse.