We’re Back On!:

Just some light Monday morning reading to ease you back into your trading week.

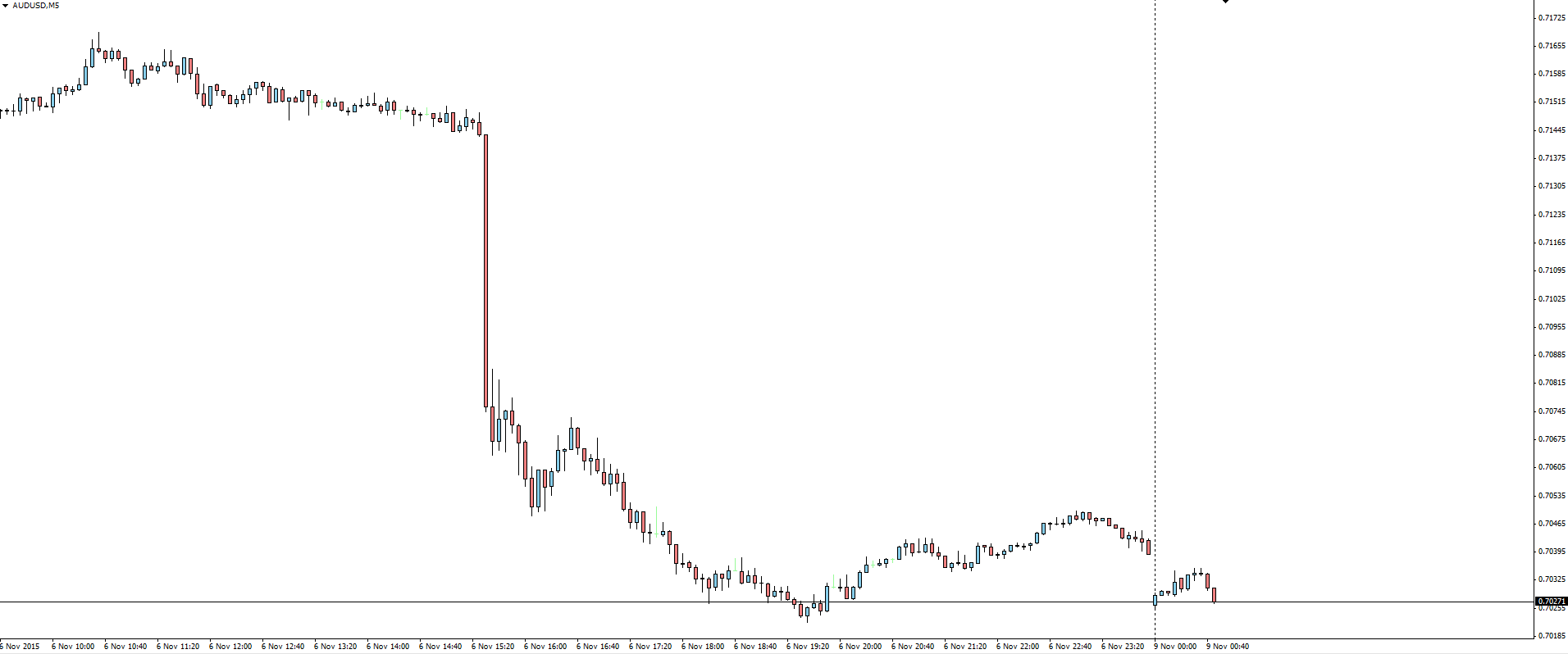

After Friday night’s NFP carnage, the majors have this morning opened with slight gaps down that they are quickly racing to fill. The following AUD/USD 5 minute chart shows the carnage and the open quite well:

AUD/USD Daily:

The October US Non-Farm Payrolls report on Friday night came in at 271K compared to the 181K expected and a revised 137K previously. This 271K jobs gained was the strongest hiring pace this calendar year, adding fuel to the fire that lift-off in December is all but a formality.

These stellar numbers were backed up by comments from San Francisco Fed President John Williams who was speaking on Saturday at an education event in Tempe, Arizona. Williams spoke about why The Fed inserted a reference to its next meeting in its last release and tried to smooth market sentiment again.

“To my mind, the decision was a close call, in part reflecting the crosscurrents we’re navigating.”

“On one hand, the U.S. economy continues to grow and is closing in on full employment. On the other, in large part due to developments abroad, inflation has remained lower than we’d like.”

We’re back on!

On the Calendar Friday:

A quiet start to the week in terms of tier 1 data releases but we did get a juicy set of trade numbers out of China over the weekend which we can take a look at.

CNY Trade Balance (393B v 367B expected)

With Chinese imports again being smashed and a record trade surplus of $61.6 billion, the Chinese government has again had more pressure put on it to keep easing. The major contributing factor was again weaker than expected demand for commodities.

Chart of the Day:

A post-NFP look at one of the more important majors in today’s chart of the day.

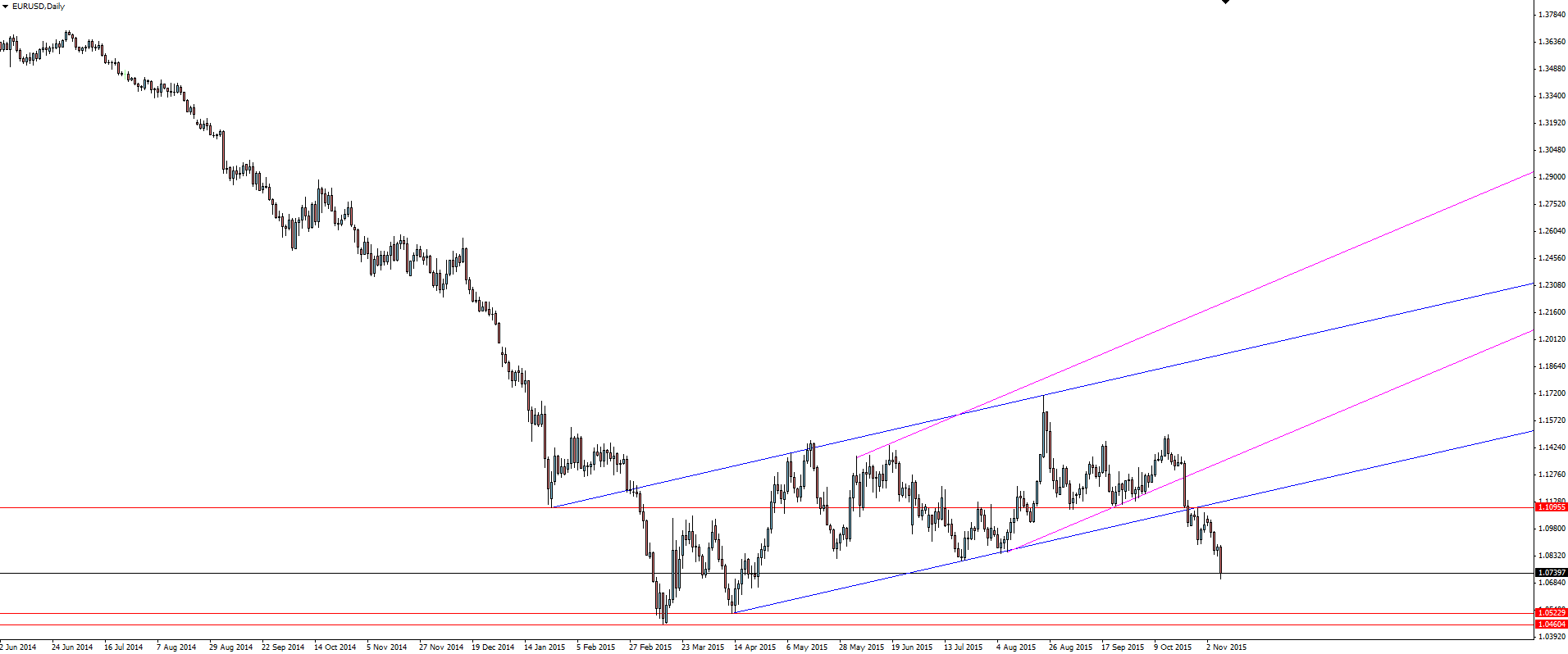

EUR/USD Daily:

After the NFP induced drop, price looks to have held that clean re-test of broken channel support. Is price going to reach the next level of support and look to make a new push toward parity?