Although this is bound to cause delight amongst a few folks, the past three weeks have been utter torture for me. There have been many reasons for this, but one of them, of course, has been the brutal counter-trend rally which seems to have strength drawn from another dimension.

Of course, what’s maddening is that it wasn’t a secret that things were badly oversold on February 11th. Indeed, I took the time yesterday to read every post from 2/11 to see what people were saying. I figured everyone would be screaming at me to get out. Nope. Everyone – – both authors of posts (Springheel Jack, for instance) as well as the commenters were all jumping up and down about the next leg down, be it 1750 (conservatively) or the 1500s. So the atmosphere was definitely “bearish now and bearish to stay.” Of course, the oversold state of the market is plain as the nose on my face now:

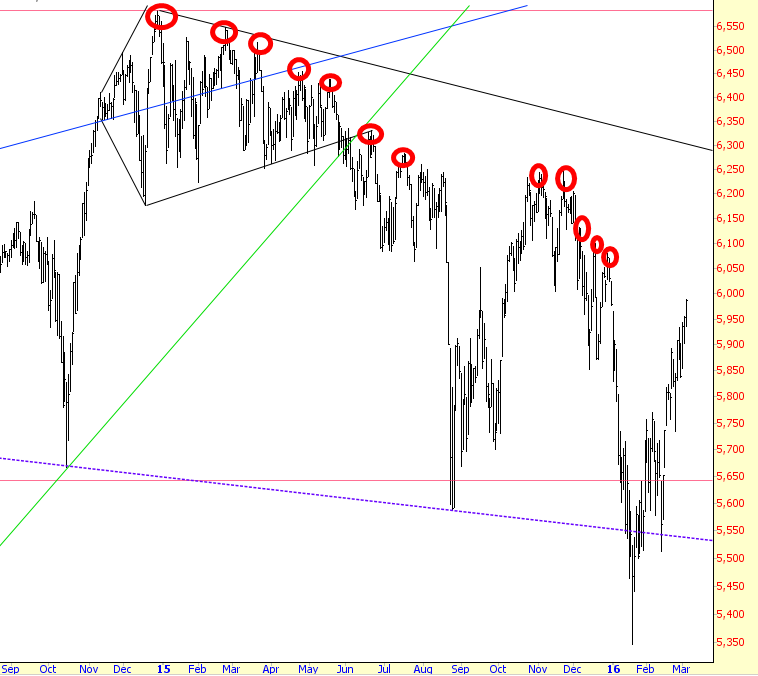

But I knew it was badly oversold, and I did cover some positions, but truly, I expected a meaningful leg lower after a small bounce. Look at the circles below. That 4th circle I’ve drawn represents the bounce that I totally and completely expected. What I did NOT expect at all was that roaring ascent that I’ve tinted in magenta. It’s been horrible, and horribly surprising, too.

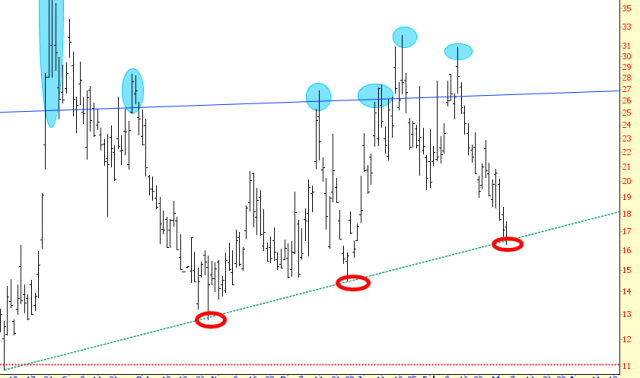

I guess the most compelling piece of evidence I can offer is the VIX, which says to me that there’s a decent chance that this countertrend rally could be over soon. We are at a trendline that we haven’t been at since Christmas Eve (and most of us remember how I, who has a knack for regretting things in both directions, felt so terrible that last week of December not positioning myself for the market’s fall).

At this point, it’s all up to the jobs report. Since I’m feeling so demoralized (and that’s an understatement), I half-expect the report to create some kind of hyper-accelerated rally, just to extend the torture. Of course, if we fall, I’ll just gripe that I wasn’t positioned more aggressively, since I’m so scared at this point that I don’t have the gonads to really get in there with some strong positions. So I can’t win!

Anyway, as long as we don’t violate the most recent “lower high” on the Dow Jones Composite, the bears still have a fighting chance. If we do violate it, it’s time to take that Aluminum Siding Course that’s been looking so tempting.