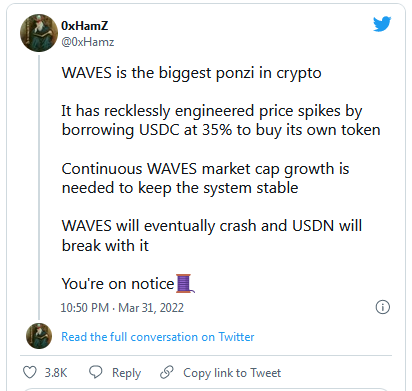

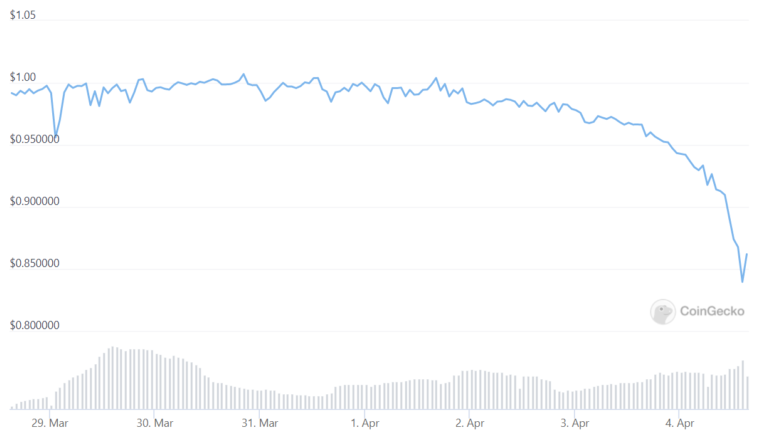

Waves’ flagship stablecoin Neutrino USD is currently trading at $0.86, far below its targeted $1 peg. After almost doubling its market capitalization in a few weeks, Waves’ Neutrino USD stablecoin has lost its peg, signaling a potential “death spiral” event for the ecosystem’s native token. Neutrino USD, the flagship stablecoin of the Waves ecosystem, is seeing its peg challenged amid short-selling pressure on the ecosystem’s native token, WAVES. Neutrino USD is meant to roughly follow the price of the U.S. dollar, but it’s currently worth around $0.86. USDN lost its desired $1 peg last Friday after a scathing post by the pseudonymous crypto investor 0xHamZ began making rounds on Twitter. 0xHamZ called WAVES, the native token of the Waves network, the “biggest ponzi in crypto,” and claimed that the project’s founders had been artificially pumping the token’s value using leverage. Waves began making headlines in March after seeing its market capitalization surge almost sixfold in just over a month amid otherwise relatively shaky market conditions. Its principal use case is to mint and support USDN, which has likewise seen it's market capitalization surge from around $500 million to an all-time high of over $960 million over the same period before losing around $130 million in value today. USDN’s mechanism works similarly to MakerDAO‘s DAI, only it is overcollateralized and can only be minted using the WAVES token. The surging demand for USDN could be attributed to the large staking yields offered for the stablecoin on various DeFi platforms in the project’s ecosystem. However, 0xHamZ said that the high USDN staking yields were heavily dependent on the continuous growth of the collateral token, WAVES and that the team had been “folding leverage” to engineer a supply squeeze to pump WAVES’ price artificially. They also shared on-chain data to substantiate their claim, showing that the Waves team had been depositing USDN on the Waves-native money market protocol Vires Finance to borrow USDC, transferring the USDC to Binance to buy WAVES, and converting WAVES to USDN. The data showed that they repeated this process multiple times. Soon after the rumor of Waves using leverage to prop up the value of their token broke out, USDN began sliding below its targeted $1 peg. Although it is overcollateralized by WAVES, USDN is currently trading around the $0.86 price range, showing little signs of recovery. The WAVES token has also erased over 30% or $1.8 billion in value, raising concerns of a potential “death spiral” event that could see the value of the WAVES collateral on the Neutrino protocol fall below the market capitalization of the USDN stablecoin. That would mean the system has become insolvent. In response to the rumors, Waves founder Sasha Ivanov blamed the renowned cryptocurrency trading firm Alameda Research for orchestrating an anti-Waves “FUD” campaign. “Get your popcorn ready: @AlamedaResearch manipulates $waves price and organizes FUD campaigns to trigger panic selling. I hope I caught your attention,” Ivanov said in a Sunday tweetstorm. Ivanov claimed that Alameda had borrowed WAVES on Vires Finance to short the asset and orchestrated the campaign on Twitter to trigger a sell-off and turn its trade profitable. “So what do we have here: They were the first to push the price on FTX, but after the position was closed with profit the subsequent short trade they opened failed because the price kept going up,” “Borrowing and FUD had to bring the price down and make the short profitable.” Alameda founder and former CEO Sam Bankman-Fried dismissed Ivanov’s claims as a “bullshit conspiracy theory” without providing further details about the trading firm’s involvement with the incident. Ivanov also posted a proposal to the Vires Finance DAO to “temporarily reduce the liquidation threshold for Waves and USDN borrowing to 0.1%” and limit the maximum borrow APR to 40%. The idea behind the proposal is to liquidate Alameda’s supposed short position and protect Waves’ long position by capping the borrowing rates for USDC and USDT. Setting higher borrow rates would mean that the team would have to make higher interest payments on its stablecoin loans, which it uses to support the price of WAVES. The Waves team allegedly controls around 30% of the circulating supply of VIRES, meaning that it could heavily influence—if not singlehandedly decide—the outcome of the vote. However, if Ivanov’s proposal gets rejected, it could force the Waves team to unwind its leveraged long position on the Vires money market platform to service their debt. Following 0xHamZ’s warning post on Friday, the borrow APRs for the USDC and USDT pools on Vires jumped from around 34% to 80%, effectively more than doubling the interest Waves must pay on its loan, which is reportedly worth north of $400 million at press time. Key Takeaways

Neutrino USD Depeg Spells Trouble for Waves

Founder Blames Alameda Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Waves Stablecoin Crash Sparks Death Spiral Fears

Published 04/05/2022, 01:33 AM

Waves Stablecoin Crash Sparks Death Spiral Fears

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.