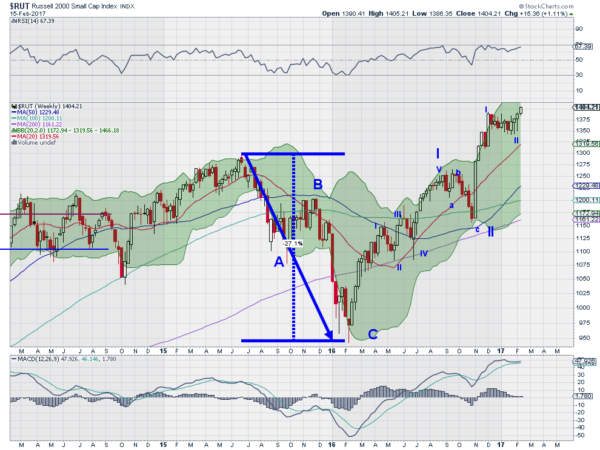

There has been a lot of talk about how long this bull market can go on. It has been a long run since the bottom in 2009. But that is not the beginning of the latest bull market. My friend Michael Batnick points out that there have been many bear market corrections including some massive ones in 2016 here. Notice that one is the Russell 2000 that dropped over 27% from June 2015 into February 2016. Since that bottom things have gotten a lot better for the Russell.

The chart below shows that A-B-C correction to the low and now the run higher. Using Elliott Wave Principles it would appear that the young move in the Russell may just be getting started. Elliott Wave Principles would give a 5 Wave pattern tot the upside and it is not even midway through the third wave. With Wave I moving roughly 300 points it would suggest that Wave III end at 1500, at least. The dynamics within Wave III suggest that will be breached by the minor wave III to at least 1570. That gives Wave III a possibility of moving much higher.

Elliott Wave will not give a target without the wave IV pullback, but it you use 1570 as a wave III target and then look to a 61.8% retracement of wave III, a deep pullback, it would give an upside target to at least 1650 for minor wave V. And that still leaves Wave V to come! No one knows what will play out until it happens. But it is important to understand that the bull run in the Russell 2000 is really only 12 months in. History has shown it can continue for a long time.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.