Watts Water Technologies, Inc. (NYSE:) reported second-quarter 2017 adjusted earnings of 83 cents per share, up 11% year over year, primarily on the back of operational improvement, driven by productivity and restructuring initiatives. Earnings also surpassed the Zacks Consensus Estimate of 80 cents.

On a reported basis, including special items, Watts Water’s earnings were 79 cents per share in the quarter, down 5% year over year from 83 cents recorded in the year-ago quarter.

Total revenue was up 2% year over year to $378.5 million in the quarter. It came in line with the Zacks Consensus Estimate of $379 million. Organic sales remained flat year over year.

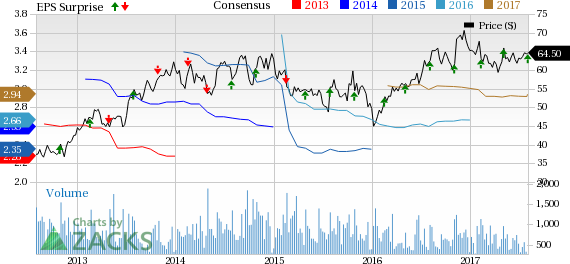

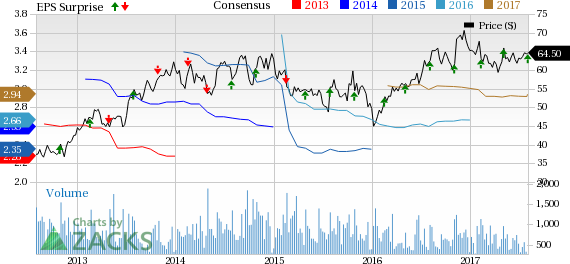

Watts Water Technologies, Inc. Price, Consensus and EPS Surprise

Watts Water Technologies, Inc. Price, Consensus and EPS Surprise | Watts Water Technologies, Inc. Quote

Regionally, organic sales dipped 1% in the Americas. It was flat in Europe and improved 2% in APMEA. The Americas sales were affected by lower heating and hot water product sales, and headwinds in the retail sector and specialty sectors. In Europe, growth in drains and electronics products was offset by a decline in water and plumbing products. APMEA’s improvement was driven by growth in China.

Cost and Margins

Cost of sales edged down 0.6% year over year to $221.8 million. Gross profit increased 4% to $156.7 million. Gross margin in the reported quarter expanded 80 basis points (bps) to 41.4%. Selling, general and administrative expenses went down to $110.2 million from $110.5 million in the prior-year quarter.

Adjusted operating profit went up 7.3% to $47.3 million in the reported quarter. Adjusted operating margin advanced 60 bps to 12.5%.

Segment Performance

Americas: Net sales climbed 4.6% to $250.5 million in the reported quarter. Adjusted operating profit increased 4.8% to $41.4 million.

Europe: Net sales declined 3% year over year to $110.7 million. The segment reported adjusted operating profit of $13 million compared to $12.8 million recorded in the year-ago quarter.

APMEA: Net sales remained flat year over year at $17.3 million. Adjusted operating profit surged 37.5% to $2.2 million from $1.6 million in the prior-year quarter.

Financial Performance

Watts Water had cash and cash equivalents of $217.5 million at the end of second-quarter 2017 compared with $338.4 million at the end of 2016. The company recorded cash from operations of $9 million for the six-month period ended Jul 2, 2017, compared with $7.8 million recorded in the comparable period last year.

Watts Water repurchased 73,000 shares of Class A common stock for $4.5 million during the quarter.

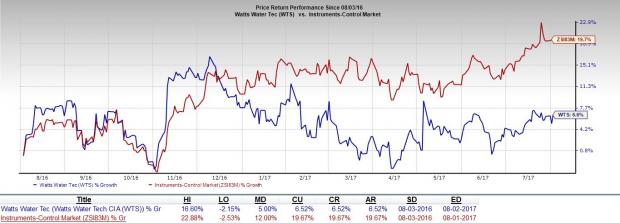

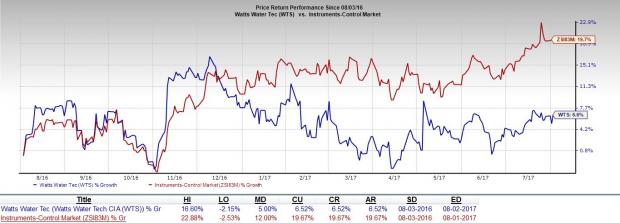

Share Price Performance

In the last one year, Watts Water has underperformed the industry with respect to price performance. The stock gained around 6.52%, while the industry recorded growth of 19.67% over the same time frame.

Zacks Rank and Key Picks

Watts Water currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same sector are Applied Optoelectronics, Inc. (NASDAQ:) , Changyou.com Limited (NASDAQ:) and Entegris, Inc. (NASDAQ:) . All three stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Optoelectronics has expected long-term growth rate of 18.75%.

Changyou.com has expected long-term growth rate of 20.32%.

Entegris has expected long-term growth rate of 10.00%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>