Watsco (NYSE:WSO), Inc. WSO has been benefiting from strong sales growth, a better sales mix of high-efficiency systems, improved selling margins and operating efficiencies. Also, the company’s e-commerce business is gaining strength amid the pandemic

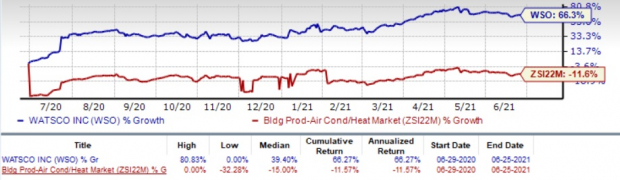

Notably, shares of Watsco have gained 66.3% over the past year against the Building Products - Air Conditioner and Heating industry’s 11.6% fall. Apart from the above-mentioned tailwinds, the price performance was backed by a solid earnings surprise history. Watsco’s earnings surpassed the Zacks Consensus Estimate in four of the trailing five quarters. Earnings estimates for 2021 have moved up 4.5% in the past 60 days. This positive trend signifies bullish analyst sentiments and justifies the company’s Zacks Rank #2 (Buy), indicating robust fundamentals and expectation of outperformance in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Major Growth Drivers

Focus on Technology

Watsco is consistently focused on investing in modern technologies to enhance customer experience. With the progress of the digital era, the need of speed, productivity and efficiency will increase. Consequently, the company is investing to improve customer experience through e-commerce. Watsco is deploying technology that improves order fill rates with speed and accuracy. It has the industry’s largest database of digitized product information, with more than 875,000 SKUs in 2020, showing an increase of 20% over 2019 levels. Driven by various technology platforms, the current run rate of e-commerce sales stands at 18% in first-quarter 2021 versus the year-ago period. E-commerce transactions in the quarter grew 30% from a year ago.

To serve customers and employees with better technologies, Watsco is continuously leveraging its technology platforms. The company launched “contactless” sales and servicing capabilities amid the current environment. Notably, average weekly users of its mobile apps surged 11% from a year ago in the first quarter.

Watsco’s digital sales platform for HVAC/R contractors — OnCall Air — generated $105 million in gross merchandise value for customers in the first quarter, reflecting an 111% year-over-year increase. Also, its companion financing platform — CreditForComfort — processed more than 1000 financing applications, up 31% from last year.

Accretive Acquisitions

Watsco — which shares space with AAON, Inc. AAON, Comfort Systems (NYSE:FIX) USA, Inc. FIX and The AZEK Company Inc. AZEK — depends largely on acquisition of assets and businesses for solidifying its product portfolio and leveraging new business opportunities in a bid to increase customer base and profitability. On Mar 16, 2021, Watsco and Carrier Global (NYSE:CARR) Corporation formed a joint venture to acquire the largest Carrier distributor in the Midwest — Temperature Equipment Corporation (TEC). However, the terms of the transaction have been kept under wraps. With this buyout, Watsco will foray into the U.S. Midwest market.

Since 1989, Watsco has taken over 63 businesses, as of 2020. The company focuses on partnering with great businesses focused on the HVAC/R industry. Watsco’s revenues in HVAC/R distribution grew to $5.1 billion in 2020 from $64.1 million in 1989, mainly buoyed by strategic acquisition of companies with established market positions.

Rewarding Shareholder

Watsco significantly rewards shareholders on a timely basis through share repurchases and dividends. The company has been paying cash dividends for 47 consecutive years. It has increased dividends in 19 out of the last 20 years. In February 2021, the board of directors raised annual dividend by 10% to $7.80 per share. This approach has helped the company gain investors’ trust.

Superior ROE

Watsco’s superior return on equity (ROE) is also indicative of its growth potential. The company’s ROE currently stands at 16.1%. This compares favorably with ROE of 13.4% for the industry it belongs to. This indicates efficiency in using its shareholders’ funds and Watsco’s ability to generate profit with minimum capital usage.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO): Free Stock Analysis Report

AAON, Inc. (AAON): Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX): Free Stock Analysis Report

The AZEK Company Inc. (AZEK): Free Stock Analysis Report

To read this article on Zacks.com click here.