It has been about a month since the last earnings report for Watsco, Inc. (NYSE:WSO) . Shares have lost about 3.3% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Watsco Q2 Earnings Top on Rising Technology Investment

Watsco reported record earnings per share of $2.07 in second-quarter 2017, which improved 14% year over year and also surpassed the Zacks Consensus Estimate of $2.02. The year-over-year improvement was driven by sales growth, improved selling margins, as well as operating efficiencies. Also, continued investment in a variety of technologies to modify customer experience, enhance productivity and additional investments in products to grow and develop market share for supplier partners continue to aid results.

Total revenue in the quarter increased 5% year over year to a record $1,276 million, but marginally fell short of the Zacks Consensus Estimate of $1,284 million. Sales of HVAC (heating, ventilating and air conditioning) increased 7%, commercial refrigeration products climbed 3% and other HVAC products went up 2%.

Cost and Margins

Cost of sales went up 4.7% to $965.6 million from $922.6 million in the year-ago quarter. Gross profit advanced 6.3% year over year to $310.3 million. Gross profit margin expanded 30 basis points (bps) year over year to 24.3%.

Selling, general and administrative expenses rose 3.8% year over year to $180.9 million. Operating income increased 10% year over year to another record of $129 million. Operating margin improved 40 bps from the prior-year quarter to 10%.

Financial Operations

Watsco had cash and cash equivalents of $51 million as of Jun 30, 2017, compared with $56 million at 2016 end. The company delivered $32.2 million of operating cash flow during the six-month period ended Jun 30, 2017, compared with $41.9 million in the comparable period last year.

In Apr 2017, Watsco raised its annual dividend rate by 19% to $5.00 per share. In Jun 2017, Watsco’s Carrier Enterprise business unit acquired 35% ownership of Russell Sigler for around $63.6 million. The move is in sync with Watsco’s strategic efforts to collaborate with well-established businesses and will strengthen its presence in the significant Western U.S. markets.

How Have Estimates Been Moving Since Then?

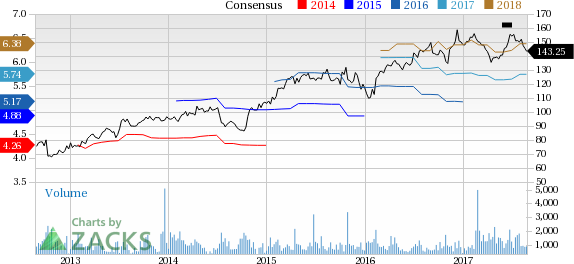

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Watsco's stock has a nice Growth Score of B, a grade with the same score on the momentum front. Following a similar course, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is more suitable for growth and momentum investors than those looking for value.

Outlook

The stock has a Zacks Rank #3 (Hold). We are expecting an inline return from the stock in the next few months.

Watsco, Inc. (WSO): Free Stock Analysis Report

Original post