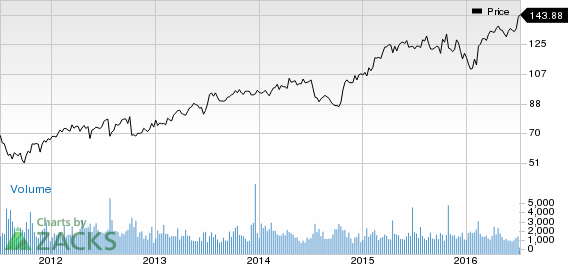

Shares of Watsco Inc. (NYSE:WSO) reached a fresh 52-week high of $144.69 on Jul 6 and eventually closed trade a notch lower at $143.88. This new high came on the back of expected benefits from growth potential in the replacement market.

The distributor of air conditioning and heating equipment and related parts has a market cap of $4.7 billion. Watsco’s shares witnessed a solid one-year return of over 17.6% and year-to-date return of 22.8%. The average volume of shares traded over the last three months was roughly 180K.

Growth Drivers

Watsco set records for earnings per share, net income, operating profit and sales during first-quarter 2016, driven by consistent growth in both residential and commercial markets, and continued investment in technology. The company expects this momentum to continue in 2016. Also, Watsco has immense growth potential in the replacement market, given an aging stock of air conditioners and heating systems in the U.S.

The company will benefit from the expansion of its product offering as well as logistic and productivity improvements. Watsco aims to reduce infrastructure costs which will provide opportunity to increase operating margins.

Further, Watsco is actively transforming its business into the digital age by investing in innovative platforms for mobile apps, eCommerce, business intelligence and supply chain optimization. The company’s strategic goals will help to further strengthen its leadership position, accelerate sales and profit growth, increase the speed and convenience of customer service, and extend its reach to new geographies and sales channels.

Moreover, Watsco will gain from investments in new technologies, dividend hikes and share repurchases.

Watsco currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Better-ranked stocks in the sector include TopBuild Corp. (NYSE:BLD) , Dycom Industries Inc. (NYSE:DY) and Louisiana-Pacific Corp. (NYSE:LPX) . All these stocks sport a Zacks Rank #1 (Strong Buy).

WATSCO INC (WSO): Free Stock Analysis Report

LOUISIANA PAC (LPX): Free Stock Analysis Report

DYCOM INDS (DY): Free Stock Analysis Report

TOPBUILD CORP (BLD): Free Stock Analysis Report

Original post

Zacks Investment Research