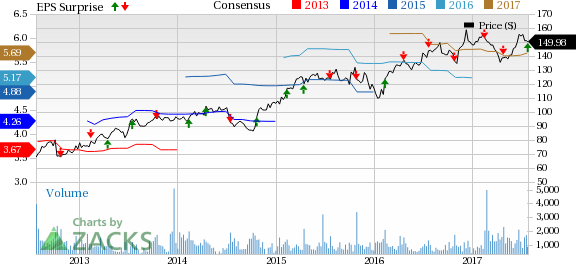

Watsco, Inc. (NYSE:WSO) reported record earnings per share of $2.07 in second-quarter 2017, which improved 14% year over year and also surpassed the Zacks Consensus Estimate of $2.02. The year-over-year improvement was driven by sales growth, improved selling margins, as well as operating efficiencies. Also, continued investment in a variety of technologies to modify customer experience, enhance productivity and additional investments in products to grow and develop market share for supplier partners, continue to aid results.

Total revenue in the quarter increased 5% year over year to a record $1,276 million, but marginally fell short of the Zacks Consensus Estimate of $1,284 million. Sales of HVAC (heating, ventilating and air conditioning) increased 7%, commercial refrigeration products climbed 3% and other HVAC products went up 2%.

Cost and Margins

Cost of sales went up 4.7% to $965.6 million from $922.6 million in the year-ago quarter. Gross profit advanced 6.3% year over year to $310.3 million. Gross profit margin expanded 30 basis points (bps) year over year to 24.3%.

Selling, general and administrative expenses rose 3.8% year over year to $180.9 million. Operating income increased 10% year over year to another record of $129 million. Operating margin improved 40 bps from the prior-year quarter to 10%.

Financial Operations

Watsco had cash and cash equivalents of $51 million as of Jun 30, 2017, compared with $56 million at 2016 end. The company delivered $32.2 million of operating cash flow during the six-month period ended Jun 30, 2017, compared with $41.9 million in the comparable period last year.

In Apr 2017, Watsco raised its annual dividend rate by 19% to $5.00 per share. In Jun 2017, Watsco’s Carrier Enterprise business unit acquired 35% ownership of Russell Sigler, Inc., for around $63.6 million. The move is in sync with Watsco’s strategic efforts to collaborate with well-established businesses and will strengthen its presence in the significant Western U.S. markets.

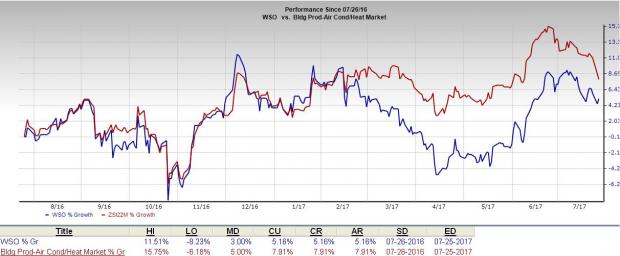

Share Price Performance

In the last one year, Watsco has underperformed its industry with respect to price performance. The stock gained around 5.16%, while the industry recorded growth of 7.91% over the same time frame.

Our View

Watsco is actively transforming its business into the digital age by investing in scalable platforms for mobile apps, e-commerce, business intelligence and supply chain optimization. Its continuous focus on strategic goals will accelerate sales and profit growth, as well as extend the company’s reach into new geographies and sales channels. Moreover, Watsco continues to actively seek acquisitions, and investments to grow its network and leverage investments.

Zacks Rank & Other Key Picks

Currently, Watsco carries a Zacks Rank #2 (Buy).

Other top-ranked companies in the same sector are D.R. Horton, Inc. (NYSE:DHI) , KB Home (NYSE:KBH) and NCI Building Systems, Inc. (NYSE:NCS) , all three sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

D.R. Horton has expected long-term growth rate of 11.64%.

KB Home has expected long-term growth rate of 16.66%.

NCI Building has expected long-term growth rate of 10.00%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

NCI Building Systems, Inc. (NCS): Free Stock Analysis Report

Watsco, Inc. (WSO): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

Original post

Zacks Investment Research