I am an optimist. I see the glass as half full and start looking for ways to fill it and make a bigger glass. I also am a technician first in terms of analyzing stocks. That means that the only truth for me is found in the actual price action. I no longer watch or read any news other than what I get from Twitter (NYSE:TWTR). It may make me a boring guy at a cocktail party but it works for me.

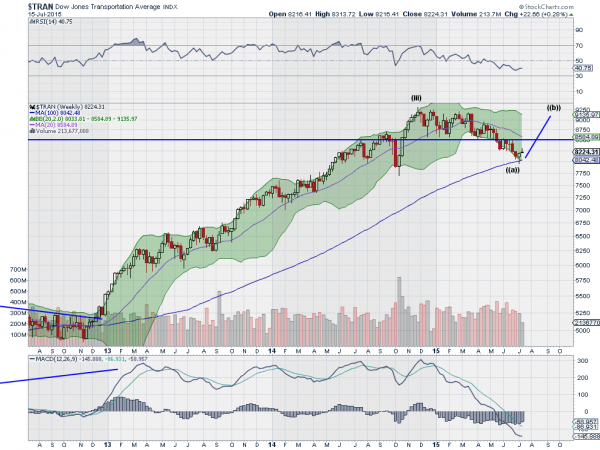

Three weeks ago, when the Transportation were one of the flavors of the day for talking heads, I wrote something that would have comforted long term investors and driven out short term traders. There may have been a third group that just got scared when they saw the words “Elliott Wave”. Basically I wrote about the pullback leading to another strong leg higher. Now it looks like the transport train may be stopping to pick up riders.

The pullback can happen in sections though and the current chart above suggests that the first of 3 legs may be over. Digging into the Elliott Wave again, the price is moving in Wave (iv) of Wave III, or pulling back. Wave (iv) would have 3 legs: down, up down, before completing.

The weekly candlestick from last week, a Hammer, can signal a reversal. It needs confirmation by a higher close this week. That is the signal I am waiting on. That Hammer also touched the 100 week SMA for the first time in 3 years. There is nothing magical about the 100 week SMA, other than many traders will use SMA’s as a bullish/bearish barometer. So if it were to reverse here it would be a sign that many determined the downtrend is over for now.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.