According to our earnings preview report, construction companies are scheduled to post an 8.9% year-over-year increase in earnings in the second quarter of 2016, lower than the 27.5% increase recorded in the first quarter. On the other hand, the revenue projections are fairly optimistic with sales likely to increase 5.2% year over year, better than the 3.9% increase reported in the preceding quarter.

Despite volatility in the U.S. stock market, uncertainty surrounding the Fed rate hike, panic in the global financial markets triggered by the unexpected Brexit vote and volatile gasoline prices, the homebuilding market remained stable. More importantly, the departure of U.K. from the European Union is believed to have no major impact on the sector.

Last month, homebuilders Lennar Corporation (NYSE:LEN) and KB Home (NYSE:KBH) reported better-than-expected second-quarter results, beating estimates for both earnings and sales. Despite a slower sales trend in the Houston market, both companies recorded a double-digit increase in home deliveries and new home orders in a successful spring selling season.

In fact, stronger job data for June is encouraging. The month reported an addition of 287,000 jobs in the market, which represents the highest in eight months. With improved job prospects and historically low mortgage rates, more young adults will opt to purchase their own homes, which will eventually drive the top line in the homebuilding space. In addition, the home remodeling market is also picking up pace. These factors eventually lead to higher demand for building products.

On Jul 12, two of the building product companies are scheduled to report their quarterly results. Let us steal a peek into how the companies are placed ahead of the release.

Fastenal Company (NASDAQ:FAST)

Based in Winona, MN, Fastenal Company is a national wholesale distributor of industrial and construction supplies. The company is set to report results before the market opens.

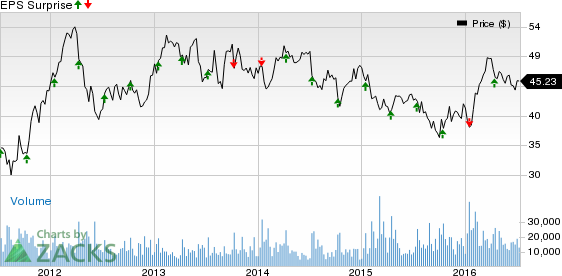

Last quarter, Fastenal posted in-line results. Meanwhile, the company has posted two positive earnings surprises in the past four quarters. However, it has an average four-quarter negative surprise of 0.45%.

The company has an Earnings ESP of -2.08% and a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for the quarter is pegged at 48 cents.

Fastenal’s revenues are being hurt by lower sales to customers in the oil & gas industry, softness in the Canadian business and overall weakness in the industrial economy. These trends are likely to impact results in the soon-to-be reported quarter.

Moreover, lack of price inflation, an unfavorable product mix and pricing and competitive pressure are hurting gross margins.

Gypsum Management and Supply, Inc. (NYSE:GMS)

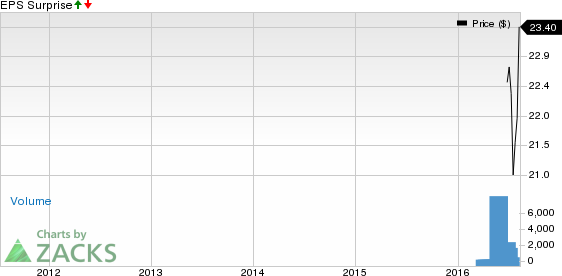

Based in Tucker, GA, Gypsum Management and Supply is a North American distributor of wallboard and suspended ceilings systems. The company initiated its initial public offering on May 25. The company is set to report fourth-quarter results before the market opens.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is pegged at 42 cents.

FASTENAL (FAST): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

GMS INC (GMS): Free Stock Analysis Report

Original post