The Bank of England releases the minutes of the MPC’s July meeting on Wednesday next week. The decision to keep the rate at 0.50% and the stock of asset purchases at GBP 375 bn was probably made unanimously. The most hawkish member of the Committee, Martin Weale, had signaled earlier that he would not support an immediate hike. Bank of England governor Mark Carney has hinted that interest rates might rise sooner than had been expected in his Mansion House speech. However, the minutes will likely dampen rate hike expectations by indicating a number of sources of uncertainty, mainly regarding the weak growth rate of wages and prices. The MPC would not have known that inflation jumped in June to 1.9% yoy. Dovish minutes can be a good opportunity to go long on GBP/USD. In our opinion the first rate hike is most likely in November and next-month meeting will bring us a split vote.

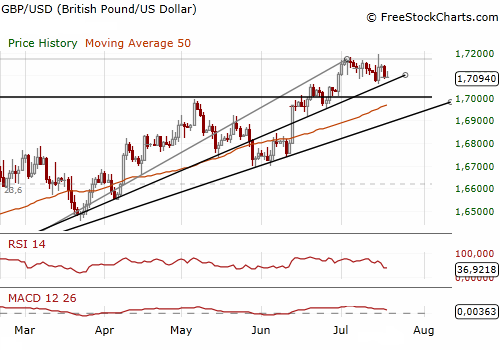

The nearest support levels are at 1.7059 (Tuesday low before June’s higher-than-expected CPI inflation release) and 1.7009 (lows from the end of June). A key resistance level is situated at 1.7191.

What do the econometrics say?

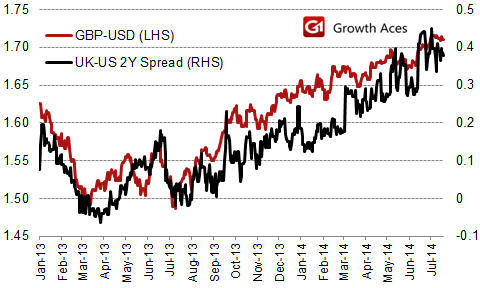

GBP/USD has had a very tight correlation with the spread between the UK and the US bonds since the beginning of 2013. The correlation ratio in the period of January 2013 – July 2014 amounted to 91%. After regressing GBP-USD on the 2Y rate differential between UK and US bonds we reached a fairly stable relationship and a conclusion that the coefficient on the spread suggests that its widening by 1 bps is associated with a 0.005 gain in the GBP/USD rate.

In the January 2013 – July 2014 period the rate differential has explained more than 80% of the variation of the GBP/USD rate. In line with the econometric model the fair value for the GBP/USD is currently at 1.73. Widening of the spread between UK 2-Year and U.S. 2-Year rates (likely scenario) will push this value up. The model says that bullish strategy on GBP/USD is justified.

- Short-term outlook: mixed

- Medium-term outlook: mixed

- Long-term outlook: mixed with bullish bias